If you are new to Quickbooks, then it may be a challenge to find Form 941. You can even start to think that the software doesn’t include this form. However, we assure you that it is available in the software, and today, we are going to teach you how to find Form 941 in Quickbooks.

All you need to do is follow these five simple steps to quickly access it! We assume that you have already logged in to your account to follow the following instructions.

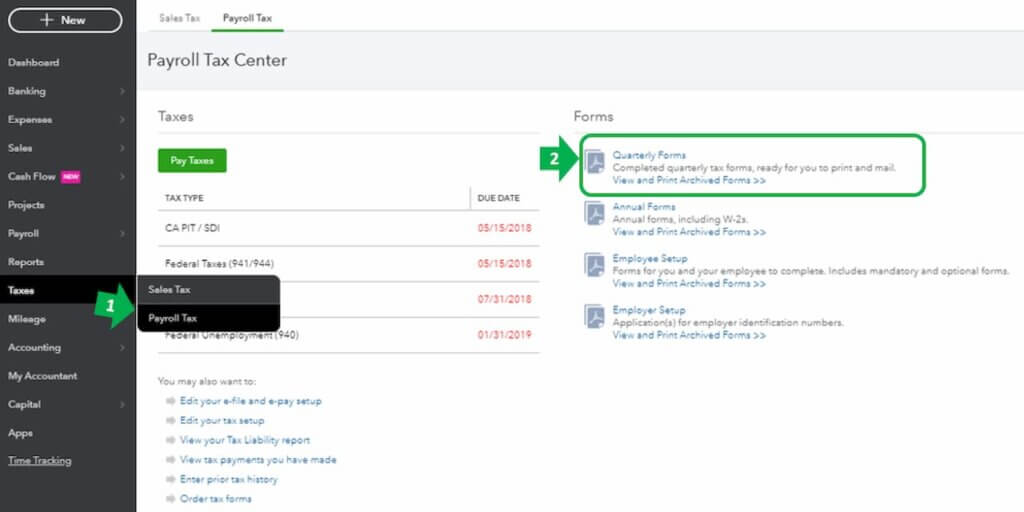

- First, look for the Taxes navigation button on the software. It is located on the left sidebar. Click on it, and you will see two sub-menus, which are Sales Tax and Payroll Tax. You need to click on Payroll Tax to proceed.

- Once you click on this navigation button, the page will refresh, and you will find a list of forms. Here, you need to click on the Quarterly Forms.

- On the new page, you will find two drop-down boxes, and one of them is set to Quarterly Tax Forms as the default. Choose the 941 option in the second drop-down box, which will refresh the page again for you.

- Here, you need to be quick on the only option that will appear. It is called Employer’s Quarterly Tax Return, and when you click on it, you will see a new button at the bottom called View. Once you click on it, a new page will load.

- Here, you are going to find Form 941. If you would like to print this form, all you need to do is click on the print icon located on the top left of your screen.

This is all! We know that it can be quite confusing, especially for first-time users. However, you will get used to finding it over time. Keep in mind that Quickbooks always shares the most recent form released by the IRS. So, you will not have to visit the official IRS page before you start filling out this form.