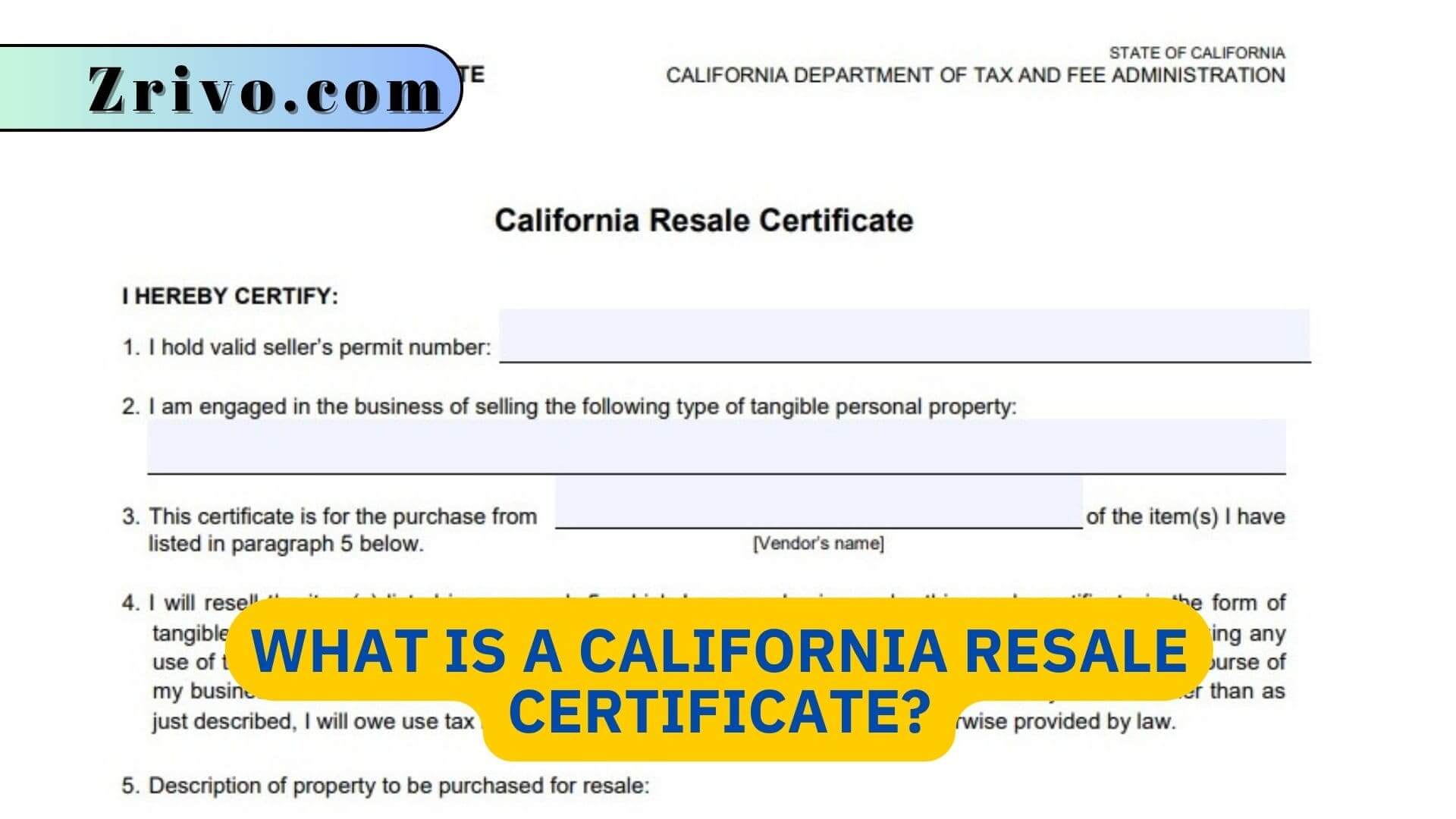

A California Resale Certificate (also known as a sales tax exemption certificate or a seller’s permit) is required for any business that intends to purchase items in the state for resale. The certificate must be signed by the purchaser or someone authorized to act on their behalf. It must also include a valid digital signature and conform to Secretary of State regulations. The resale certificate should clearly state that the item is being purchased for resale. It is against the law to buy and resell items without paying sales tax, and penalties range from repayment to imprisonment.

The resale certificate should be kept with the vendor’s records. The buyer must present the item to the retailer when purchasing it. Some suppliers may refuse to accept a resale exemption certificate if it does not have all the information required by the state. For example, they may ask for the buyer’s business type, name, address, and contact number. However, this is not common and should not be a deal breaker. Two multi-state resale certificates are available: the Streamlined Sales and Use Tax Exemption Certificate and the Uniform Sales and Use Tax Exemption Certificate.

The cost of a California reseller’s permit varies depending on the type of business and the number of employees. It can also vary by region and county. However, the best way to determine the cost is to contact a local sales tax office for more information.

How to Fill out a California Resale Certificate?

Resale certificates are only valid for the specific purchases they cover. They must clearly state that the purchase is for resale and that you will be reselling it. In addition, resale certificates must be issued by the person in charge of the business that uses them.

To fill out a resale certificate, select the “Billing” section of your Printful dashboard and click “Resale Certificate”. You can then choose categories of products for which you are exempt from sales tax, and we will not charge you any tax for those items. Note that some suppliers are unfamiliar with what types of resale exemption documentation they can accept, and may require you to register for an in-state sales tax permit. We have also seen some sellers who refuse to accept out-of-state resale certificates.

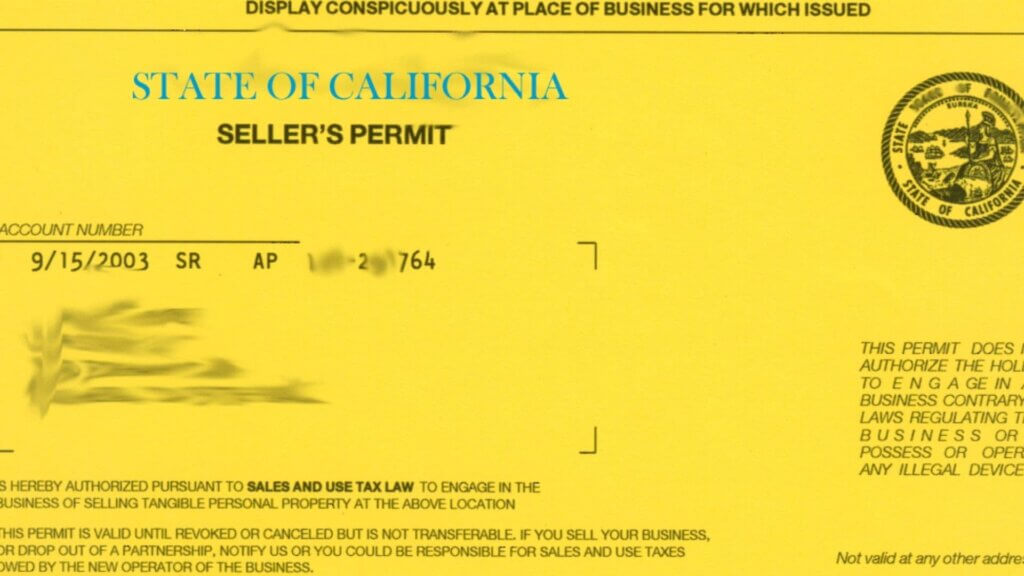

California Seller’s Permit and Resale Certificate

Many businesses confuse the terms seller’s permit and resale certificate. In fact, it’s against the law to issue a resale certificate if you don’t have a seller’s permit. It’s also important to understand that resale certificates are not a substitute for a permit, and you need both in order to be exempt from sales taxes.

A resale certificate is a document submitted by the purchaser to a seller to indicate that an item purchased for resale is exempt from sales and use tax. The certificate must contain the following information:

- The purchaser’s seller’s permit number (unless they are not required to hold one1).

- A description of the property being purchased for resale.

- A signature from the purchaser or someone authorized to act on their behalf.