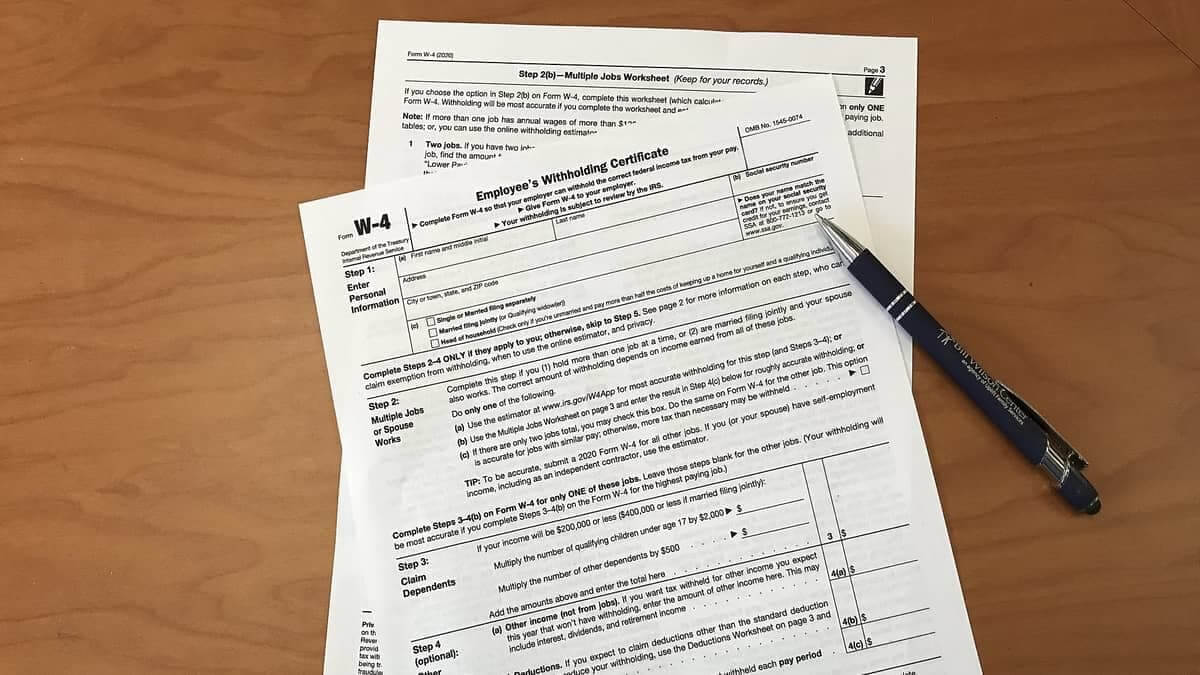

Form W4, Employee’s Withholding Certificate, or formerly known as the Employee’s Withholding Allowance Certificate has been updated for the 2025 tax year.

Employees who started working in any month of 2025 needs to use the updated version of the W4. While the use of Form W4 is simple enough, the IRS renews it every year against changes to the tax code of the United States. For the 2025 tax year, the only change you will spot on Form W4 is the year title located at the top left corner of the form. Cause there weren’t any major changes to the tax law that affects how Form W4 is filed, there wasn’t a need for an update.

That said, you’ll fill out the same form as last year – nevertheless, here is everything you need to know about filling out a Form W4 to let your employer how much tax to withhold from your wages every pay period.

Personal Information – Step 1

On the section of Form W4, you’ll enter your personal information including your name as shown on your tax return, address, Social Security number, and filing status.

Multiple Jobs/Spouse Works – Step 2

If you’re filing a joint return, use the tax withholding estimator to see how it works out with the information you enter on the rest of the steps on Form W4. If you’re holding more than one job at a time where both jobs pay a similar amount, check the box on (c). If the secondary job pays significantly less than your primary job, skip this part.

Claim Dependents – Step 3

Enter the total amount of child tax credit and credit for other dependents you can claim on your next federal income tax return. This will determine a large portion of how much is withheld every pay period.

Other Adjustments – Step 4

While the above is pretty enough for an accurate withholding rate, fill out Step 4 of Form W4 to ensure everything is on track.

On (a), enter the income you expect to earn outside of jobs that’s not subject to federal income tax withholding. Think of income you expect to earn from interests, dividends, and self-employment income.

On (b), enter the total amount of deductions you anticipate to claim other than the standard deduction. You can use the Deduction Worksheet and enter the results.

On (c), enter an extra withholding amount that you want your employer to withhold in extra every pay period. This part is completely optional. Leave it blank if you don’t want to withhold extra income taxes.

Lastly, the W4 and furnish a copy to your employer. You can either print out a paper copy after filling it out on TaxUni PDF filler or save it as a PDF and email it to your employer. Since emailing the W4 is the only option for remote workers, make sure to electronically sign the document before sending it, as it won’t be valid without your signature.

What if there are changes to my tax return?

When there are changes to your anticipated federal income tax return, you should update your W4 ASAP. To adjust the withholding rate, fill out a new W4 and give it to your employer. The federal income tax withholding according to the new W4 will take effect on the next pay period.

Do I need to file W4 with the IRS?

Form W4 is filled out by employees and given to their employers. Since this tax form is for employers to withhold taxes accurately, the IRS doesn’t need it. Don’t send Form W4 to the Internal Revenue Service as the outcome would be the form being sent back to the sender.

When is Form W4 due?

There isn’t a due date on Form W4. You file it as you wish without being bound to deadlines.

What happens if I don’t file Form W4?

In case Form W4 isn’t filed, the employer will withhold tax at the highest single rate. Considering that this would mean a higher withholding rate than necessary, you will reduce your cash flow. Make sure to file a copy of Form W4 and give it to your employer.