The W2 Form is used to report how much income tax you have paid to the government. This includes the federal income tax withheld and the state income tax. Form W2 also contains references to Medicare tax and Additional Medicare Tax. The W2 Form deadline for 2025 is January 31. This deadline is the same for all states and the federal government.

W2 Form Updates

There are a few significant changes to the 2025 W2 Form, except for compressing the employee copies into one page. W2 Form 2025 no longer includes the employer Copy D. Another change is the use of placeholders for some dollar amounts in the employee instructions, such as the amount of excess Social Security tax withheld and the number of elective deferrals.

Why Do You File W2 Form?

If you are an employer, you must file the W2 Form for each employee. It is due to the Social Security Administration on January 31, 2023. If you don’t have a computer and don’t have time to fill out a W2 Form, you can contract out the task to someone else. If you hire a third-party company, you must list the address of the company you’re working with. This way, the IRS can contact you if there are any issues.

How to File W2 Form?

Here are the complete step-by-step instructions on how to fill out the W2 Form:

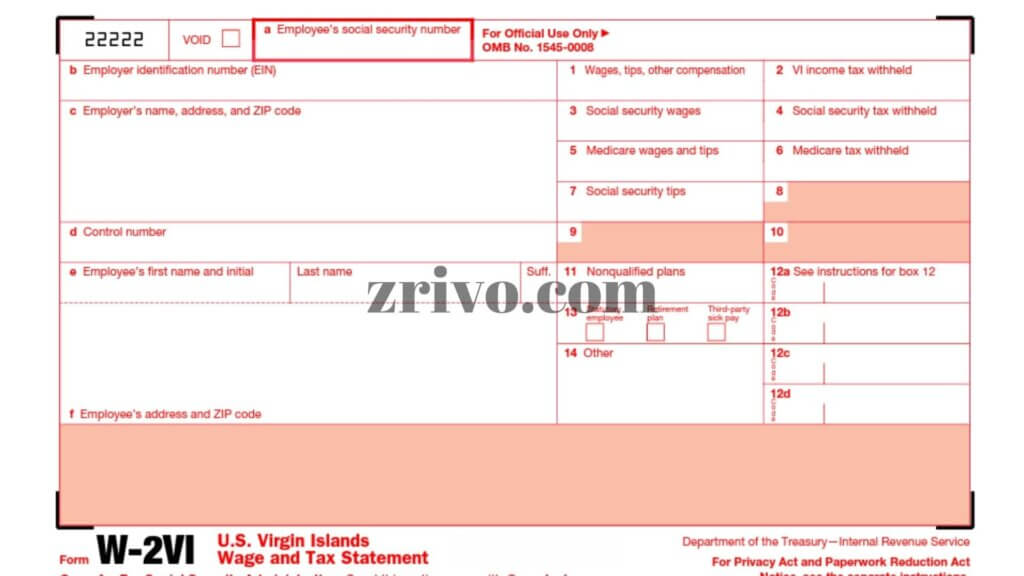

- Box A – Social Security Number

- Box B Employer Identification number (Don’t write your SSN here)

- Box D – Control Number (Optional)

- Box E and Box F – Employee Name and Employee Adress

- Box 1 – Wages, Tips Etc.

- Box 2 Federal tax income withheld.

- Box 3 – Social Security Wages

- Box 4- Social Security Tax Withheld

- Box 5 – Medicare Wages and Tips

- Box 6 – Medicare Tax Withheld

- Box 7 – Social Security Tips

- Box 8 – Allocated Tips

- Box 9 – Leave this section Empty

- Box 10 – Dependent Care Benefits

- Box 11 – Nonqualified Plans (Salary reduction plans etc.)

- Box 12 – Codes

- Box 13- Checkboxes

- Box 14 – Other

- Boxes between 15-20 Fill out these sections if you have a state income tax.

Can I request an Extension of the W2 Form?

You can always request an extension if you cannot produce your W2 Form on time. Extension requests generally last for 15 days but can be up to 30 days if the employer can prove that a deadline is approaching.

Also, remember that any undelivered W2 Form is subject to 4 years of retention. This is true even if it was produced electronically. However, it is best not to send an undelivered W2 Form to the Social Security Administration.

If you need to correct a mistake on a previous Form W2, you can file a W-2C. You should always make sure that you write the Form in dark ink and create a legible copy. If the previous Form W2 contained incorrect names or amounts, you could file a W-2C to correct the information.

I Lost My Form W-2; What Should I Do?

The first thing that you should do when you have lost your Form W-2 is to contact your previous employer. You can do this by email or phone call. If they have changed their mailing address, you can correct it. Otherwise, you should contact the IRS for help. This is important because it can cost thousands of dollars if you do not file your W2 Form on time.

Key Components of a W-2 Form

| Aspect | Description |

|---|---|

| Employee Information | – Employee’s name, address, and Social Security Number (SSN). |

| – Employer’s name, address, and Employer Identification Number (EIN). | |

| Income Details | – Total wages earned by the employee during the tax year (2024). |

| – Amount of federal, state, and local income taxes withheld from the employee’s paycheck. | |

| Tax Withholding | – Information on any pre-tax deductions, such as retirement contributions or healthcare premiums. |

| Benefits | – Value of non-cash benefits, such as healthcare coverage or stock options. |

| Additional Income | – Any additional income sources, like tips or bonuses, subject to taxation. |

| 2025 Comparison | Compare the W-2 Form for the tax year 2025 to the previous year’s to track financial changes. |

W-2 vs. W-4

| Aspect | W-2 Form | W-4 Form |

|---|---|---|

| Issuer | Employer | Employee |

| Purpose | Reports annual income and tax withholding | Employee’s withholding allowances |

| Filing Frequency | Annually (end of the tax year) | As needed (typically when starting a new job or when financial circumstances change) |

| Impact on Taxes | Reflects actual income and taxes withheld | Affects tax withholding for future paychecks |

| Employee’s Responsibility | Review for accuracy; used for tax filing | Complete and submit to the employer for tax withholding adjustments |

W-2 vs. W-9

| Aspect | W-2 Form | W-9 Form |

|---|---|---|

| Issuer | Employer | Payer (e.g., client, company) |

| Purpose | Reports annual income and tax withholding | Collects taxpayer’s identification information for reporting income, usually for non-employee compensation |

| Tax Classification | Employee (subject to tax withholding) | Usually used by independent contractors (no tax withholding) |

| Submission | Issued by employer to employee | Provided by taxpayer to payer |

| Timing | End of each tax year | Typically requested before providing services or receiving payments |

W-2 vs. 1040

| Aspect | W-2 Form | 1040 Form |

|---|---|---|

| Purpose | Reports annual income and tax withholding | Complete income tax return |

| Issuer | Employer | Individual taxpayer |

| Tax Calculation | Pre-calculated withholding based on earnings | Self-calculated based on various income sources, deductions, and credits |

| Filing Frequency | Employer provides annually | Taxpayers must file yearly by April 15th (or extension date) |

| Attachment Requirement | Not required | Required to file taxes |

W-2 vs. W-3

| Aspect | W-2 Form | W-3 Form |

|---|---|---|

| Purpose | Reports individual employee’s W-2 data to the Social Security Administration (SSA) | Transmittal summary form for all W-2 forms submitted to the SSA |

| Submission | Sent by the employer to the SSA | Prepared and submitted by the employer |

| Required for Filing | Must be submitted with individual W-2 forms | Required when filing 250 or more W-2 forms |

| Employee’s Involvement | Employee receives W-2 Form | No direct involvement |

W-2 vs. K-1

| Aspect | W-2 Form | K-1 Form |

|---|---|---|

| Issuer | Employer | Partnership or S Corporation |

| Purpose | Reports employee’s earnings and tax withholding | Reports a partner’s share of income, deductions, and credits from a partnership or S Corporation |

| Taxation | Subject to tax withholding based on wages | Income reported on K-1 is typically passed through to the partner’s personal tax return (1040) |

| Form Type | Individual employee receives W-2 | Each partner receives a K-1 for their respective share of the business’s income and expenses |

W-2 vs. 1099-MISC

| Aspect | W-2 Form | 1099-MISC |

|---|---|---|

| Issuer | Employer | Clients, Contractors |

| Employee or Contractor | Employee | Independent Contractor |

| Income Reporting | Earned income (salary, wages) | Miscellaneous income (e.g., freelance, self-employment) |

| Tax Withholding | Yes | No (usually) |