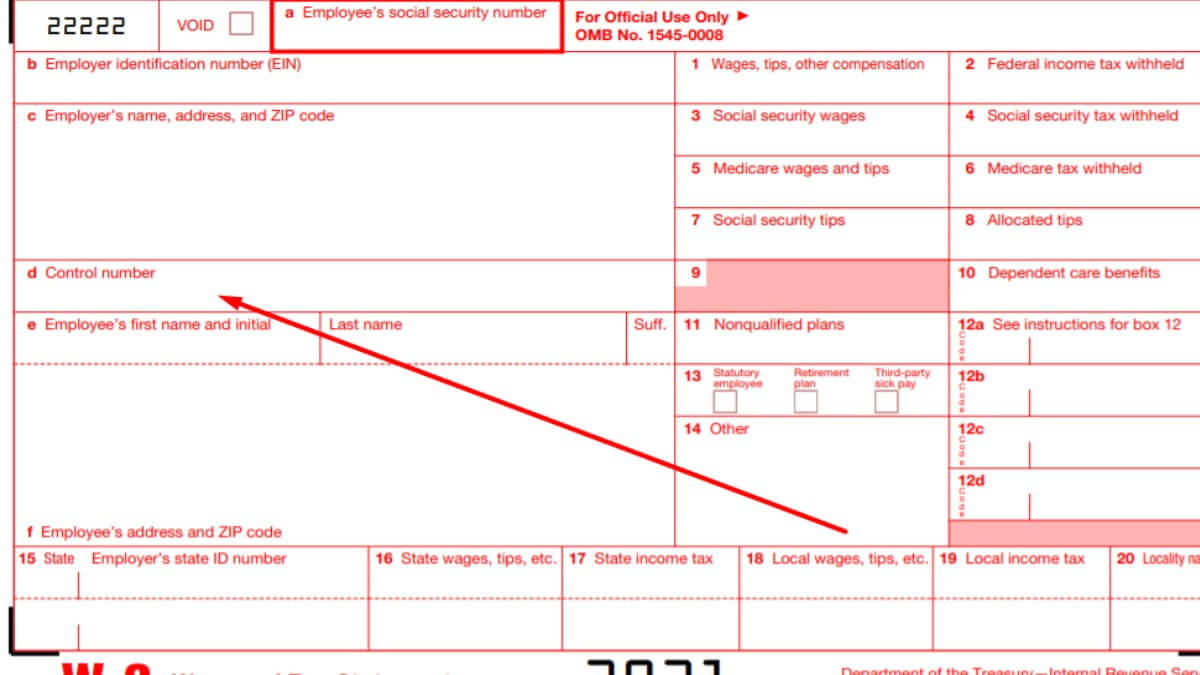

Form W-2, Wage and Tax Statement includes many information about an employee’s payroll. The Internal Revenue Service wants employers to file Form W-2 for every employee that worked in the company and received $600 or more in compensation during the tax year.

One of the few boxes that got employees wondering is the Box D that includes the control number. Form W-2 control number has nothing to do with an employee’s compensation or taxes. This box is dedicated for payroll departments to help identify each Form W-2. If you received your Form W-2 with a control number on it, know that it won’t affect the way you file taxes with the W-2. If your W-2 doesn’t include a control number, the same applies.

There are many frequently asked questions about Form W-2 control number Box D. We’ll try to answer some of these questions.

What are control number digits?

There aren’t specific digits for the control number Box D on Form W-2. Employers or the payroll departments can enter any digit on this box to identify each Form W-2 filed. However, Box D control numbers are formatted as 5-digit numbers, so must be entered accordingly when filing.

I get an error when filing taxes, what to do?

It’s very uncommon to get errors when e-filing taxes with a Form W-2 without a control number, but if you’re getting errors or your return is rejected due to this, just enter a random 5-digit number you can remember like 12345.

There are also instances where the control number may get in the way of importing Form W-2. Instead of importing Form W-2, enter your W-2 manually with the control number on it. You aren’t required to enter a control number on Box D with most tax preparation services, but some may require you to do so. In that case, follow the above paragraph.