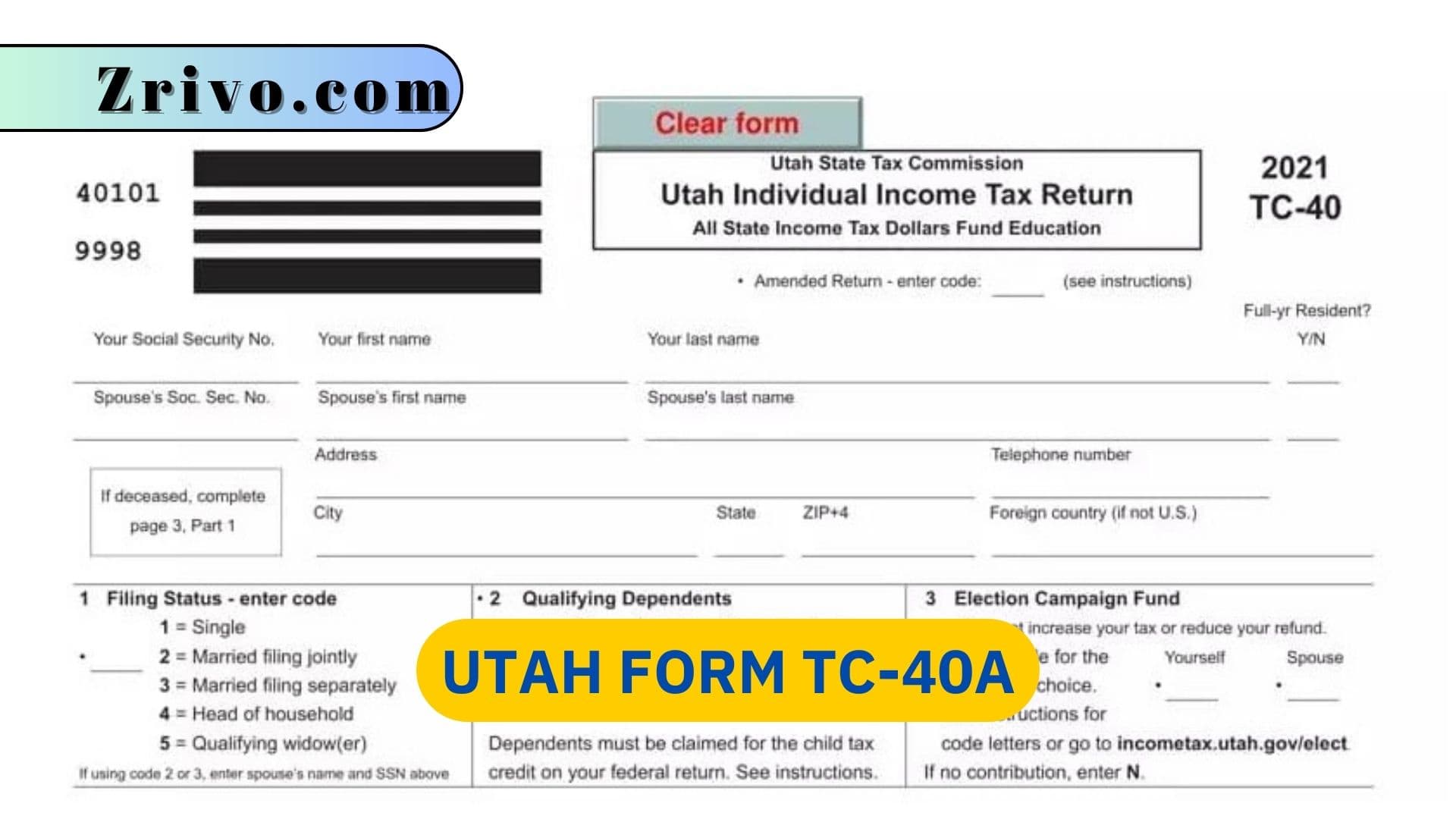

Individuals, businesses, and organizations can file Utah State Form TC-40A (Credit For Income Tax Paid To Another State). The form is broken down into sections that detail the taxable value of real estate, tangible personal property, and motor vehicles. Using this document can help prevent overpayments by making sure that all types of property are being assessed correctly. TC-40A, Credit for Income Tax Paid to Another State, must be completed and attached to a Utah individual income tax return. The taxpayer must provide the code and amount of each addition to income and subtractions from income. This information is used to calculate the Utah tax liability or refund owed. Those who are not residents of Utah must complete this form to claim the nonresident credit for tax paid to other states.

TC-40A is used to report the amount of tax that was withheld from your wages or pass-through entity withholding. Then, the totals are used to calculate your Utah state income tax. It is important to note that the totals entered on this form will not necessarily match the totals reported on your W-2 or 1042-S. This is because different types of tax are deducted at the University, including FICA (Social Security and Medicare) and Federal Income Tax.

How to Fill Out TC-40A?

The first step in filing Utah Form TC-40A is determining how much you paid Utah income tax. This can be done by using the worksheet provided above. The amount you need to enter in COLUMN A is the total from federal forms 1040A, 1040EZ, or Telefile line 18. In COLUMN B, note that the amount in box a is the federal adjusted gross income. Similarly, the amount in box b is the total of all other federal income reported to Utah.

You must also subtract any non-taxable additions to income. This can include municipal bond interest excluded from federal adjusted gross income, railroad retirement benefits, or other forms of compensation not included in your federal return. Once you have calculated your Utah tax, add lines 7 and 8. The resulting sum is your tax liability or refund owed.

Once you have finished calculating your Utah tax, you can submit it. Generally, you should use the same method of filing your federal tax return to file your state return. However, you may need to attach additional documents to your Utah tax return. These documents may include federal forms W-2 and 1099, Utah mineral production withholding information, and the TC-675R or Utah Schedule K-1 for a pass-through entity.

If you have questions about completing form tc-40a, contact the Utah Department of Revenue by phone or email. You can also visit the FAQ page for more information. You can also edit your tc-40a document in our online editor. Easily type text, blackout confidential details, upload images, insert checkmarks and signs, drop new fillable fields, and more. You can then download, export, or print your document. You can also sign your tc-40a document by drawing, typing, or uploading an image of your signature.