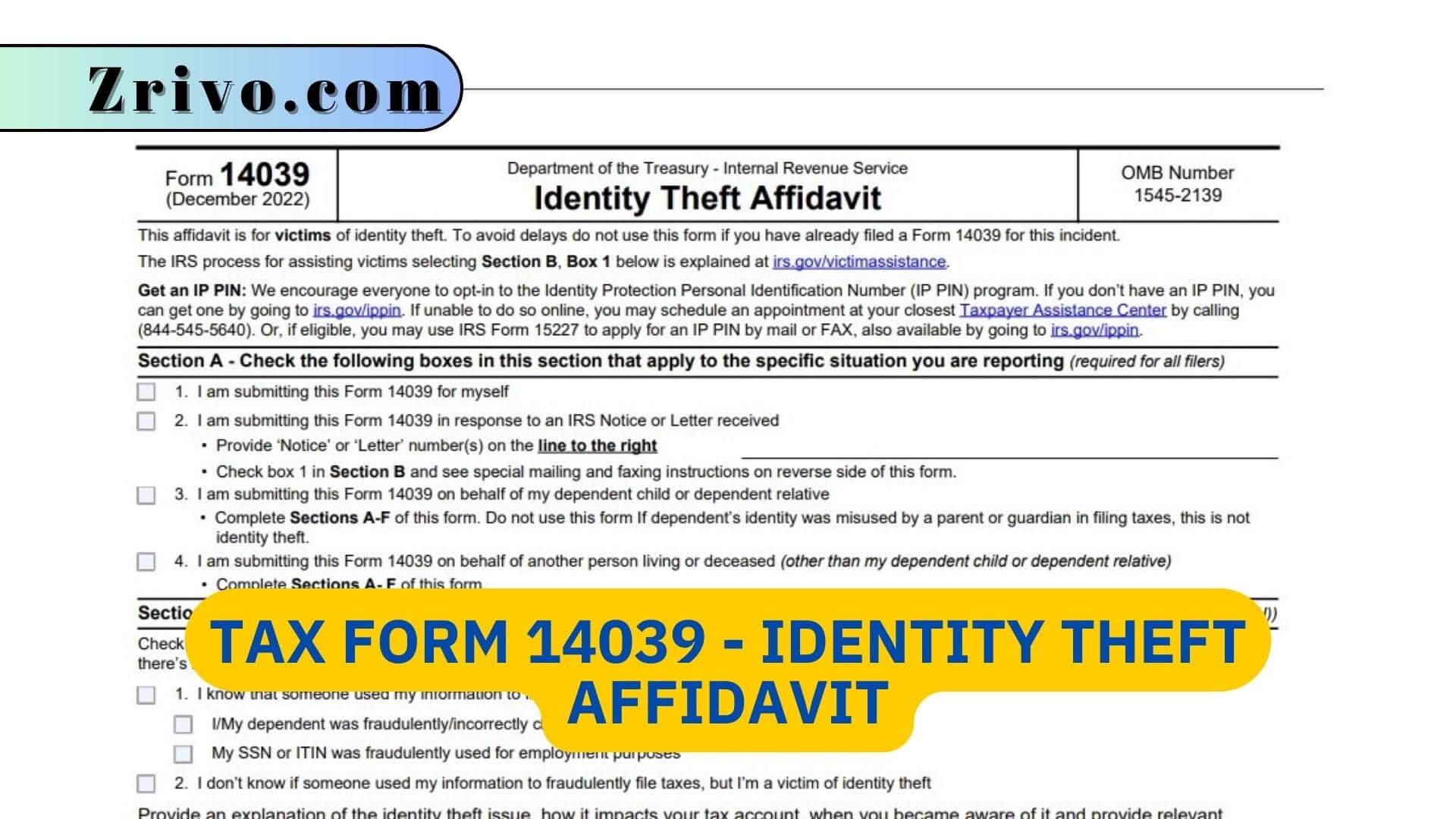

Many different lenders and businesses may require you to complete an identity theft affidavit when you report fraud. Affidavits like Tax Form 14039 – Identity Theft Affidavit typically help the company to verify your identity and resolve the issue quickly. In some cases, you might be required to file an identity theft affidavit with the IRS if someone used your Social Security number to file tax returns in your name.

In this situation, the IRS will assign your case to an employee with specialized training in identity theft issues. You’ll also be able to obtain an ID PIN, which is a six-digit code that helps you confirm your identity when filing future returns. You’ll need to file Form 14039 if someone else used your SSN to file a tax return or if the IRS rejects your e-filed return due to a duplicate return filed using your SSN. Mail the form to the address listed on the IRS notice or letter you received from the agency.

Who Must File Form 14039?

If someone else uses your Social Security number to file a tax return claiming a fraudulent refund, you must submit Form 14039. This form will alert the IRS that your identity has been stolen, and the case will be referred to an employee who specializes in dealing with identity theft cases.

You should also file this form if you discover that your return was rejected because someone else already filed using your SSN, and you believe it’s due to identity theft. You can fax this form to the fax number or address listed on the IRS notice that instructed you to do so or send it by mail.

Lastly, you may also need to file this form if your identity is stolen, but the issue is unrelated to filing a tax return. If this is the case, complete Section A and include a detailed explanation of how you discovered the problem, along with any relevant documentation. This can be an excellent way to help the IRS resolve the issue as quickly as possible. In some cases, the IRS may need to contact your bank or credit card company to verify your identity before they can resolve the problem.