Schedule SE, a supplement to your income tax return, may be required if you are self-employed. The amount on Schedule SE is an estimate of your self-employment income. For instance, if you made $12,000 in 2011, you’d report $2,000 of your self-employment income on your income tax return and claim a deduction on your Schedule SE. In addition, you’ll pay a separate Medicare and Social Security tax, depending on your income.

Self-employment tax is based on business income.

When you are self-employed, you are required to pay taxes on your income. These include Social Security and Medicare. You may need to pay an additional Medicare tax if you earn a lot of money.

In addition to paying taxes, self-employed people must report their net income. This can be done by filing Form 1040. The amount of the self-employment tax depends on the profits of your business. You can deduct half of your self-employment tax from your income taxes. However, you must explain any deductions to the IRS.

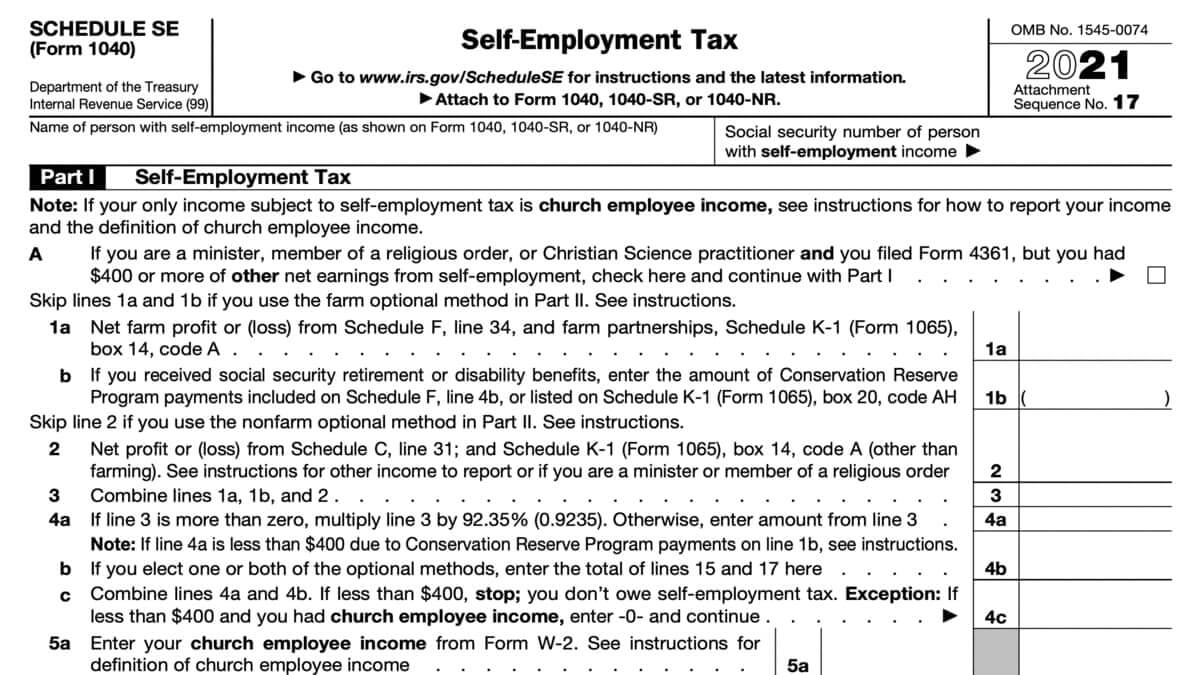

There are several ways to deduct self-employment taxes. Whether you itemize your deductions, you can claim a 50% deduction of your self-employment tax on Schedule 1 of Form 1040. Self-employment taxes are divided into two parts: Part I and Part II.

Part I requires information about your net income, which includes earnings from any businesses you run. You must also report losses if you have any. For this reason, Schedule SE is a form you should fill out carefully.

It’s a summation of the Social Security and Medicare components of the self-employment tax.

The self-employment tax is a tax charged on the income earned by a self-employed person. The self-employment tax differs from the payroll tax imposed on workers by an employer. Unlike the payroll tax, the self-employment tax is a tax that has to be paid regardless of whether or not a person receives Social Security or Medicare benefits.

The self-employment tax rate is 15.3% of net earnings, including the 2.9% Medicare component. Self-employment earnings are the first factor in calculating your maximum Social Security payment. In 2022, the full Social Security payment was $147,000. For married couples, this is higher.

To calculate your self-employment tax, you must complete a Schedule SE form. It’s a complicated tax form and requires a lot of information. The IRS wants to encourage people to use this form when calculating their taxes. This will help keep the public programs running.

It’s a deduction for those whose self-employment income is less than $6,540

You can claim a deduction on Schedule SE if you have self-employment income. This form is part of Form 1040 and helps calculate your self-employment tax. You can also use this form to report your net earnings. The net earnings are the total profits and losses from all your businesses.

Aside from the main form, you can also complete an optional method. There are some optional methods for calculating self-employment income, and they may help you to qualify for various tax credits. Some of the benefits of this method include a reduced tax rate and an honor for Social Security coverage.

One example of an optional method is the farm option. Under this method, you can deduct a percentage of your farm income. You must meet specific requirements. For instance, you must be a regular self-employed person and have earned at least $8460 in the prior year.

You must pay SE tax if you are a self-employed nonresident alien.

If you are a self-employed nonresident alien, you will need to pay Schedule SE tax. This tax is applied to your net earnings, including the income you receive from your self-employment businesses.

To avoid paying the SE tax, you must ensure you have enough net earnings in your tax year. The minimum requirements are that you have $400 in net earnings in at least two of the three years before filing your taxes. There are optional methods for calculating your SE tax that may increase your credit or lower your tax, depending on how much you earn.

You can use the optional method if you are self-employed and have net earnings of less than $4480. It’s important to know that this credit only applies to the first $4480 of your net earnings, and there is a five-year limit on this option.

You must also be careful to keep your tax rate the same as it was at the beginning of your fiscal year. If your tax rate is higher, you’ll need to pay more in self-employment taxes.

Fill out Schedule SE to figure out taxes on your self employment income. The Social Security Administration also uses the information provided on this tax form to determine benefits under the Social Security program.

Fill out Schedule SE online

If you’re preparing a paper tax return, this version of Schedule SE can help you prepare the tax form quickly and efficiently. Once you’re done entering money amounts and your information, save it as a PDF and print out a paper copy.

You can also enter your signature if you have the proper equipment, such as a touchscreen or a large enough trackpad. If not, you can always sign the document after printing the paper copy.

Why file Schedule SE?

Schedule SE, self-employment tax, is a mandatory tax form for those who are self-employed. File Schedule SE to figure out self-employment tax owed. These taxes are also known as the Social Security and Medicare taxes.

Although there is no shortcut to filling out Schedule SE, your self-employment tax is usually 15.3 percent of your taxable income. This 15.3 percent is made up of 12.4 percent Social Security tax, and the rest 2.9 percent is the Medicare taxes.

If you’re struggling filling out the Schedule SE, make sure to consult a tax professional, as it can take some time to fill out Schedule SE properly. If there are errors on this tax form, you’re more than likely to amend your federal income tax return, considering it will directly affect your tax liability.