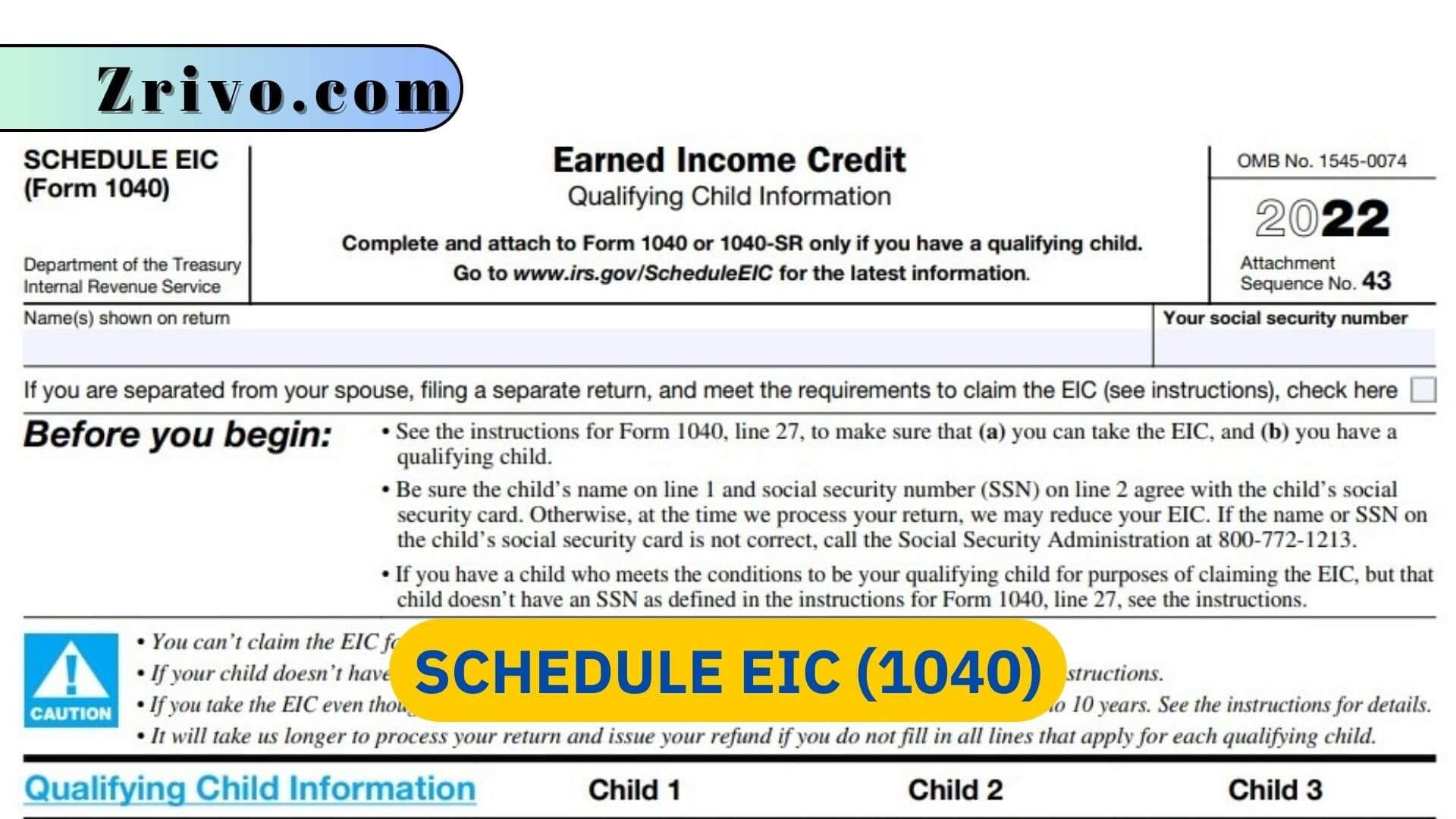

Schedule EIC, also known as “Schedule for Earned Income Credit,” is a tax form specifically designed to determine eligibility for and claim the Earned Income Credit (EIC). The EIC is a tax credit available to qualifying individuals and families with low to moderate incomes, providing a valuable financial benefit. Understanding Schedule EIC, who must file it, how to file, and how to fill it out accurately is crucial for taxpayers to ensure they receive the credit they are entitled to.

Who Must File Schedule EIC?

Filing Schedule EIC is required for taxpayers who meet the following criteria:

- Taxpayers must meet the income and filing status requirements established by the Internal Revenue Service (IRS) to qualify for the Earned Income Credit.

- Taxpayers with one or more qualifying children who meet the income thresholds are generally eligible to claim the EIC. A qualifying child must meet specific criteria, such as relationship, age, residency, and dependency.

- Taxpayers must typically file as Single, Head of Household, Qualifying Widow(er) with Dependent Child, or Married Filing Jointly. The filing status determines the income limits and credit amounts available.

How to File Schedule EIC?

To file Schedule EIC, taxpayers must follow these steps:

- Collect all relevant documents, such as W-2 forms, 1099 forms, and other income statements, as well as information about qualifying children, such as their Social Security numbers and birth dates.

- Fill out Form 1040 or 1040A, the main tax return form, following the instructions provided. Use the information from Schedule EIC to calculate the credit amount.

- Attach the completed Schedule EIC to the tax return. Verify all required information, such as earned income and qualifying child details, is provided.

- Review the tax return and Schedule EIC and verify that all calculations and data entries are correct.

- Submit the tax return, including Schedule EIC, to the IRS by mail or electronically, depending on the preferred filing method.

How to Fill Out Schedule EIC?

When filling out Schedule EIC, follow these steps:

- Enter your name, Social Security number, and filing status at the top of Schedule EIC.

- If you have qualifying children, enter their details, including names, Social Security numbers, relationships, and other relevant information, in the appropriate sections.

- Enter your earned income in the designated space. Earned income includes wages, salaries, tips, and self-employment income.

- If applicable, report any additional income, such as taxable interest or unemployment compensation.

- Use the EIC table or the EIC Assistant provided by the IRS to determine your credit amount based on your filing status, earned income, and number of qualifying children.

- Sign and date the Schedule EIC, certifying that the information provided is accurate and complete.