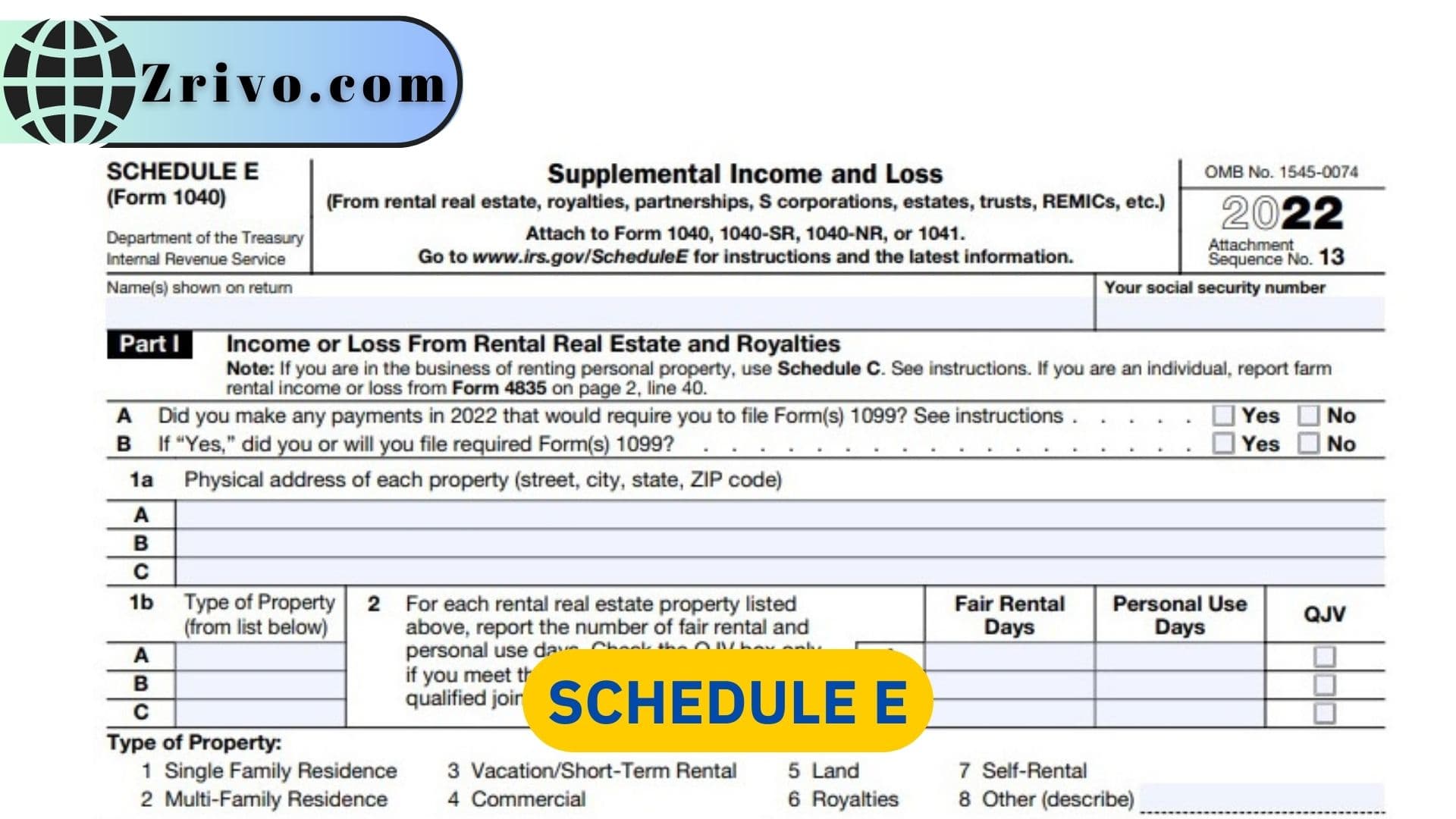

Whether you live in a rental or vacation home, it’s important to understand the taxes and filing requirements associated with this type of income. Schedule E is one of the most common forms you must complete. It’s part of the IRS 1040 that handles supplemental income and loss. Schedule E is used to report supplemental income from many different sources, including real estate investment property and pass-through business entities like partnerships and S corporations. It’s also used to report other types of passive income, such as royalties.

However, you can’t use Schedule E to report rental activity that you conduct for your own personal use on a regular basis, such as vacation rentals or short-term rentals. This is because it’s considered a business activity; thus, you must pay self-employment taxes on the profits generated from it.

Who Must File Schedule E?

You will likely fill out a Schedule E form if you earn a lot of rental income. Whether you own property in a single city or several across the country, this form helps you break down your revenue and expenses by property and into 15 expense categories. When you are a landlord, it’s important to be sure that the income and expenses you are reporting on Schedule E is accurate. The IRS will review your tax return for errors or omissions and can ask you to provide supporting documents if necessary.

The IRS defines rental income as the fair market value (FMV) of the consideration you receive in exchange for renting out real estate. This FMV can be in the form of cash, property, or services. The IRS usually considers rental income passive income and does not require a self-employment tax. However, there are exceptions for certain real estate activities that must be reported on Schedule E.

If you are a property owner who provides basic services, such as heat, light, water, and trash removal, you may be required to file Schedule E. In these situations, you will need to report your rent and all associated expenses on Part I of the Schedule E form. You should also report the income and expenses from any personal property that you rented out in a business. This includes vehicles, equipment, furniture, and anything else you use or own due to your property rental.

For example, if you own a vacation home or a second home that you only use occasionally, you can deduct the interest you paid on your mortgage as an itemized deduction on line 8 of Schedule A. Your rental activity must be included on Schedule E if you own a real estate investment corporation or partnership. The IRS has specific guidelines for this type of passive income. Consulting with a professional accountant is best if you are unsure how to report your income or expenses.

How to fill out Schedule E?

- In general, the first section of Schedule E is where you list your property type and address. This information determines if you’re subject to special IRS rules for renting out certain types of real estate. For example, if you rent out apartment complexes, your property’s address must be specific to the building or complex that houses those apartments.

- Next, you’ll need to report your deductible expenses on Schedule E. There are 15 different expense categories to choose from, and each one is broken down into subcategories to make it easier to understand. Some of these categories are self-explanatory, such as advertising expenses, whereas others are a little more complicated.

- For example, you may want to consider including costs for hiring a real estate agent or lawyer to handle the legal aspects of your rental business. Additionally, you should also include your mortgage interest paid to banks or other financial institutions.

- The other sections of Schedule E will allow you to report your supplemental income and losses. These are usually income or losses that you receive from other sources besides your employment, such as a partnership or S corporation profits and distributions.

- Royalty income is another source of supplemental income that you should report on Schedule E, page 1. However, royalty income is only reported on this form if you’re not engaged in your business activity, and the income comes from an area you don’t normally participate in.

- To complete this form, you should attach it to your personal 1040 tax return and submit it by the deadline. You can prepare the document yourself or hire a professional to do so for you. It’s a good idea to let a pro prepare the paperwork for you so that it’s accurate and doesn’t contain errors.