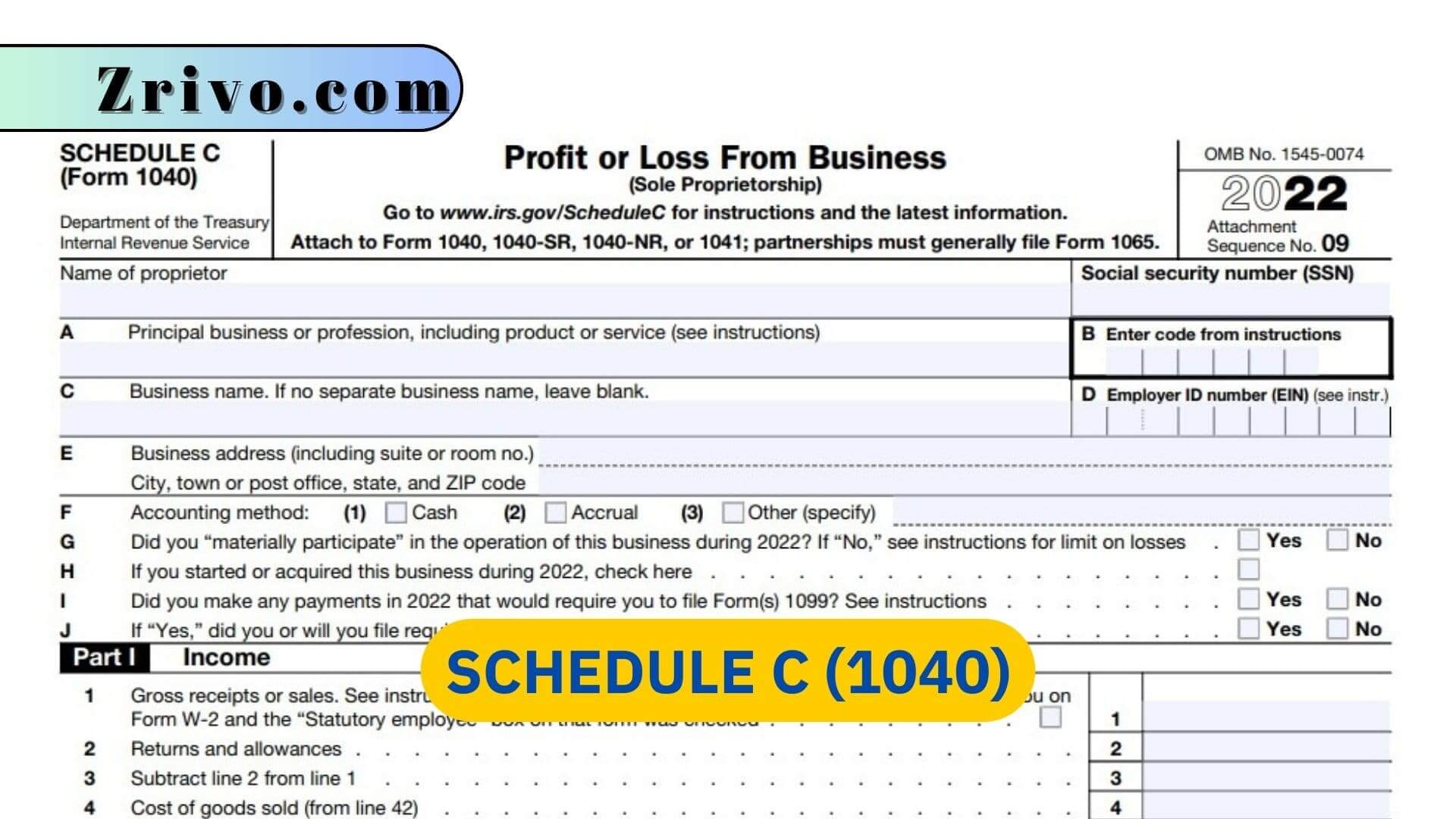

Schedule C (1040) is a supplemental tax form that’s filed with your Form 1040 when you run a business. Also known as the Profit or Loss from Business form, it’s used to report both income and expenses related solely to your small business. The information on this tax form helps the IRS calculate federal taxes based on business activities.

You must use Schedule C if you work as a self-employed freelancer, run a one-person business, or own a single-member LLC that’s not treated as a corporation. You also need to file this form if you earn income from a side hustle, such as delivering food for DoorDash or Lyft, or are an artist or musician. However, you can’t claim income from a hobby on this form. Instead, you would report it on Schedule 1 (1040) as Additional Income.

How to File Schedule C?

When filling out this tax form, you’ll need to include all of your business income and expenses from the year. This will help the IRS determine your net profit or loss, which is what you’ll be reporting on your return. You’ll need to provide information on advertising expenses, rent, insurance, supplies, and vehicle-related expenses, among other things. To be eligible for a tax deduction, these expenses must be ordinary and necessary for your trade or business.

In addition to your Schedule C, you might also need to file Forms 1099 and 3800. Form 1099 is a reporting tool that’s used by companies to share with the IRS any payments they made to independent contractors and other non-employees. Form 3800, on the other hand, is a tax form that the IRS uses to figure your Social Security and Medicare taxes.

How to fill out Schedule C?

The parts of the forms included below are the ones you won’t need the IRS instructions to fill out Schedule C. The rest of the form is more likely to require you to get help from the IRS Instructions. Here are the instructions for Schedule C:

- Enter info like your business type, SSN, and complete checkboxes about your business in separate lettered boxes (A-J)

Part 1 – Income

- Line 1: Gross receipts or sales

- Line 2: Returns and allowances

- Line 4: Cost of goods sold from Line 42

- Line 6: Other income, including federal or state gasoline or fuel tax credit or refund

Part 2 – Expenses

- Line 9: Car and truck expenses

- Line 12: Depletion

- Line 13: Depreciation and Section 179 expense deduction

- Line 18: Office Expense

- Line 30: Expenses for business use of your home

Part 3 – Cost of Goods Sold

- Line 33: You are expected to explain how your value your inventory in this section. ( Cost Method, Cash Accounting, Lower Cost or Market)

- Line 42 amount = Line 4 amount.

Part 4 – Information on Your Vehicle

If you claim expenses for a truck or car, you must complete Part 4. Don’t forget to bring your mileage records with you will need those to prove yourself to claim your vehicle expenses. You will need certain numbers; the IRS does not want you to guess or estimate any expense.

Part 5 – Other Expenses

This section is for any expenses you didn’t report on Lines 8-26 or 30. Don’t forget to go back to Line 27a and enter the total of all lines, including anything in Part 5.

You’ll also use this Schedule C to calculate your Self-Employment Tax, which is the amount you owe in Social Security and Medicare taxes for working as a freelancer or independent contractor. If you have any other questions regarding the contents of Schedule C, be sure to check out the Schedule C instructions page on the IRS website.