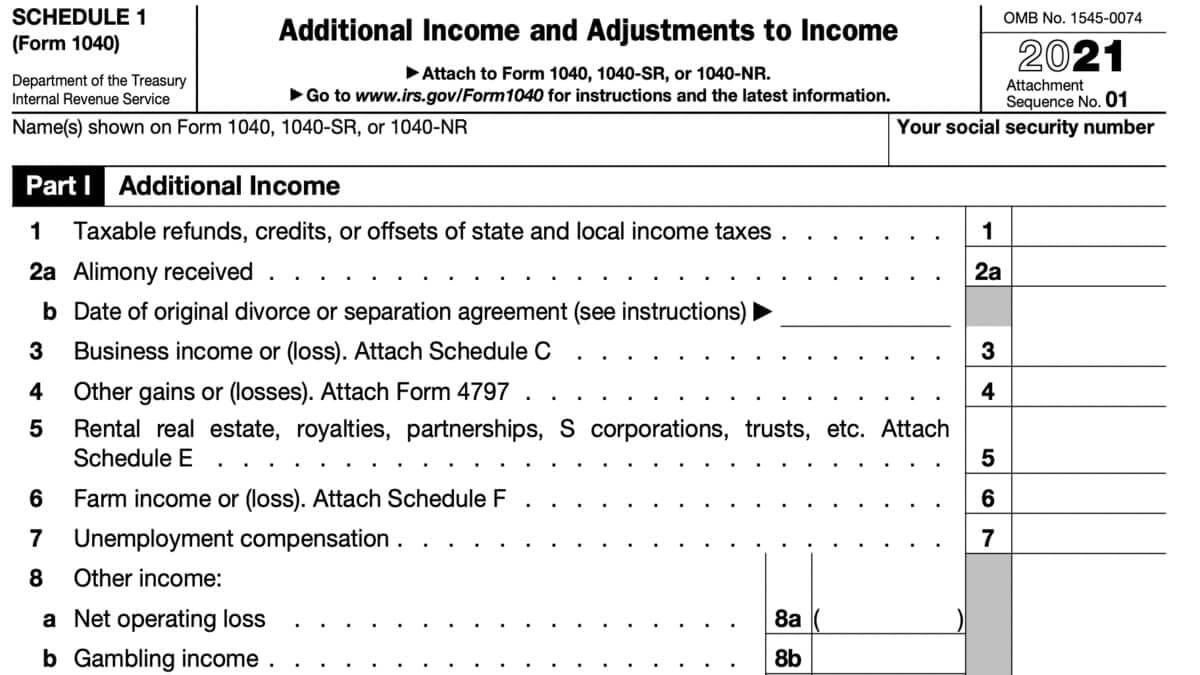

Schedule 1, Additional Income and Adjustments to Income, is the supporting document that reports income earned that you can’t report on other tax forms and figure out adjusted gross income. This tax form is pretty much mandatory to file as you need to calculate your adjusted gross income to clarify eligibility for further tax deductions and credits.

You’ll also reduce taxable income as you’re calculating adjusted gross income. These adjustments are also known as above-the-line deductions, and you can claim these without itemizing taxes. You can both take the standard deduction and claim the adjustments on Schedule 1.

Content of Schedule 1

The Additional Income and Adjustments to Income tax form comprises two sections. In part one, you’ll report additional income earned, and in the second, you make adjustments to your total gross income.

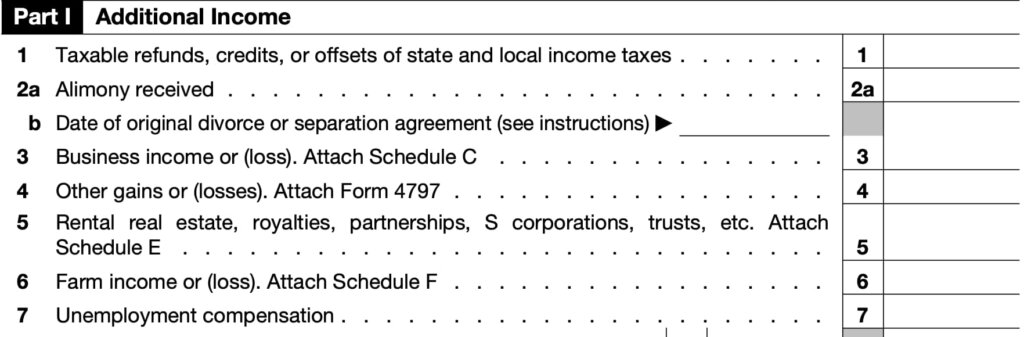

Part 1 – Additional Income

Line 1: Enter the taxable refund amount or offsets to SALT taxes.

Line 2: Enter the alimony received (2a). On Line 2b, enter the date of the original divorce or separation agreement.

Line 3: Enter business income/loss and attach Schedule C to your original tax return.

Line 4: Enter other gains/losses and attach Form 4797 to your original tax return.

Line 5: Enter income earned from rental real estate property, royalties, partnerships, S corporations, trusts, and alike; attach Schedule E.

Line 6: Enter income generated from farm business or loss.

Line 7: Enter the unemployment compensation earned. For the 2025 tax season, the unemployment compensation received is fully taxable regardless of the state you live in, but your state may waive it at the state level.

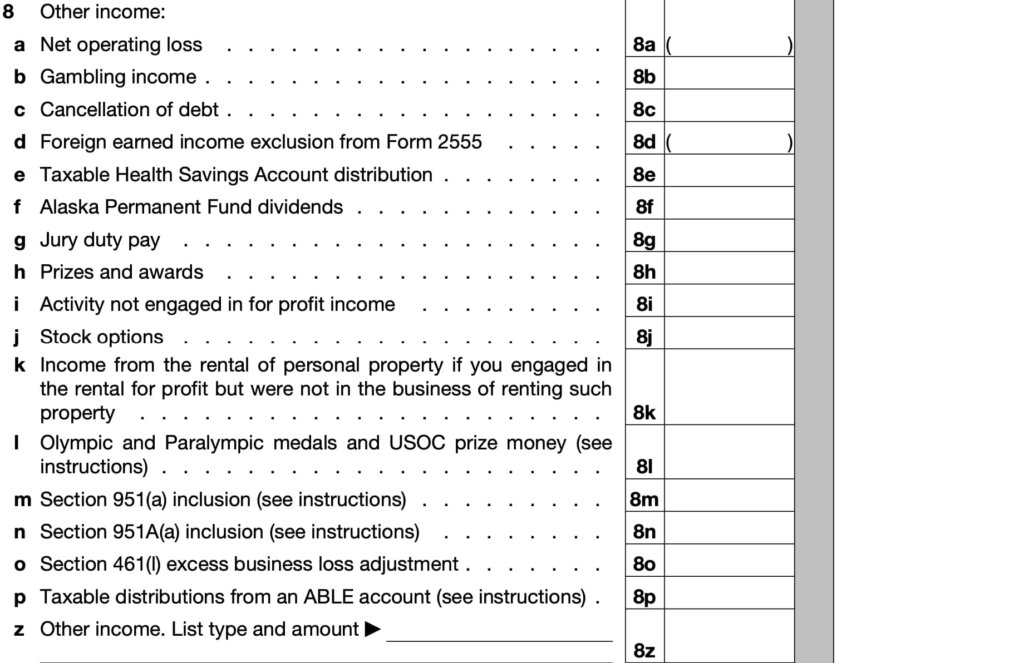

Line 8: On Schedule 1 Line 8, enter the money amounts for the following income types that you’ve earned during the 2025 tax year.

- a. Net operating loss

- b. Gambling income (Form W-2G)

- c. Cancellation of debt (Form 1099-C)

- d. Foreign earned income exclusion (Form 2555)

- e. Taxable HSA distributions (Form 1099-SA)

- f. Alaska permanent fund dividends

- g. Jury duty pay

- h. Prizes and awards (Form W-2 if from employment)

- i. Activity not engaged in for profit income

- j. Stock options (Schedule D)

- k. Personal property rental income if you’re engaged in it for profit motives but weren’t in the business of renting such property

- l. Medals from the Olympics or Paralympics and USOC prize money

- m. and n. Inclusion from Sections 951(a) and 951A(a).

- o. Excess business loss adjustment from Section 461(l)

- p. Taxable distributions from an Achieving a Better Life Experience (ABLE) account

- z. Specify other income by type and amount.

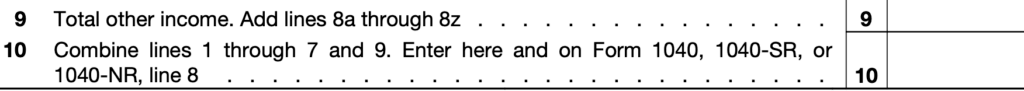

Line 9: Add lines 1 through 8z and enter the results.

Line 10: Combine the money amounts from lines 1 through 7 and line 9; enter the results. This is your total gross income.

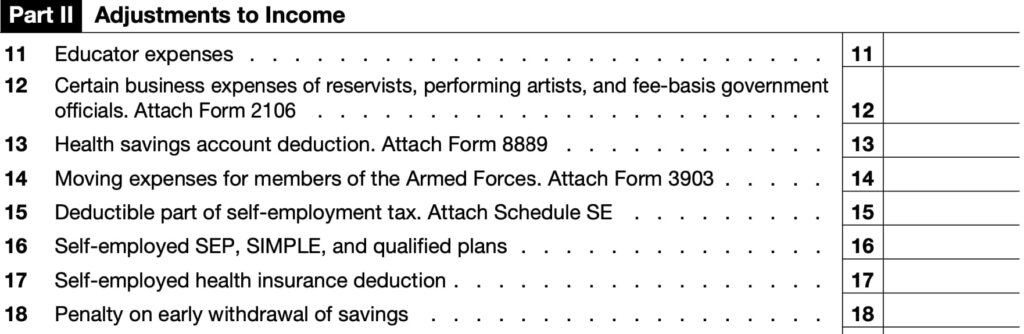

Part 2 – Adjustments to Income

Line 11: If you’re an educator, enter the allowed education expenses, which you can claim up to $250 or double this if married filing jointly and both spouses are educators with expenses allowed.

Line 12: Enter the certain business expenses of reservists, fee-basis government officials, and performing artists; attach Form 2106.

Line 13: Enter the HSA deduction and attach Form 8889.

Line 14: Enter the moving expenses you can claim for being a member of the US Armed Forces.

Line 15: Enter the deductible portion of self-employment tax; attach Schedule SE.

Line 16: Enter the self-employment SIMPLE, SEP, and other qualified plans.

Line 17: Enter the self-employed health insurance deduction.

Line 18: Enter the penalty amount for early withdrawal of savings.

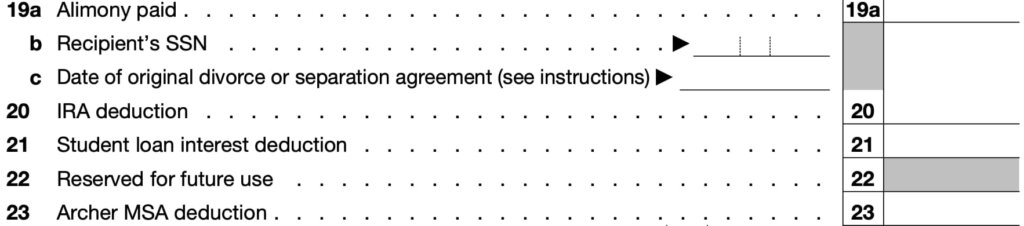

Line 19: Enter the alimony paid with the recipient’s Social Security number and the original divorce or separation agreement date.

Line 20: Enter the IRA deduction you’re claiming for your traditional or other qualifying IRA retirement savings contributions.

Line 21: Enter the student loan interest deduction you can claim up to $2,500.

Line 22: Enter the adjustment you reserved for the future.

Line 23: Enter the archer medical savings account deduction you can claim.

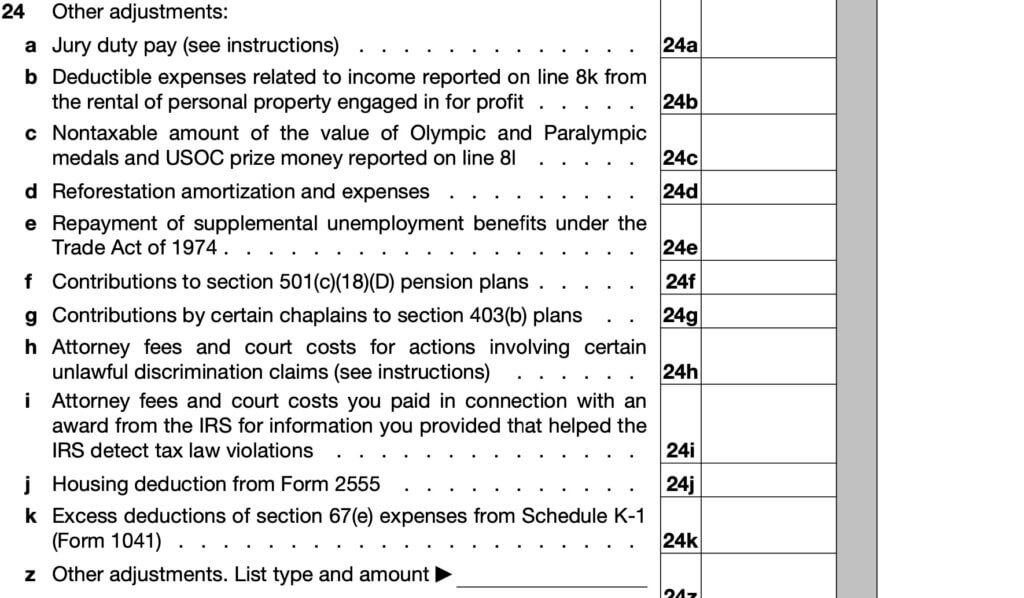

Line 24: On Schedule 1 Line 24, enter the adjustments you can claim for the following spendings/expenses.

- a. Enter the jury duty pay adjustment.

- b. Enter the deductible expenses related to the income reported on Line 8k.

- c. Non-taxable amount of the value of the income earned on Line 8l.

- d. Enter the reforestation amortization and expenses.

- e. Repayment of supplemental unemployment benefits. This is an adjustment you can claim under the Trade Act of 1974.

- f. Adjustment for the contributions made to 501(c)(18)(D) pension plans.

- g. Adjustments for the contributions made to Section 403(b) plans. This above-the-line deduction is only available for certain chaplains to Section 403(b) plans.

- h. Enter the attorney fees and court costs paid for actions involving specific unlawful discrimination claims.

- i. Enter the attorney fees and court costs paid in connection with an award from the IRS for the information you provided that assisted the agency in detecting tax law violations.

- j. Enter the housing deduction and attach Form 2555.

- k. Enter the excess deductions of Section 67(e) expenses from Schedule K-1 from Form 1041.

- z. Specify other adjustments by type and amount.

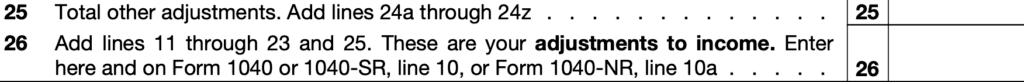

Line 25: Add Lines 24a through 24z. The results are your total other adjustments.

Line 26: Add lines 11 through 23 and amount on line 25. The result is your total adjustments to income.

Attaching Schedule 1

Once you fill it out and enter the amounts on lines that apply to you, attach Schedule 1 to your federal income tax return. Do this by stapling the document along with other tax forms on the top right or left corner.

Lastly, use your adjusted gross income to determine eligibility to claim further deductions.