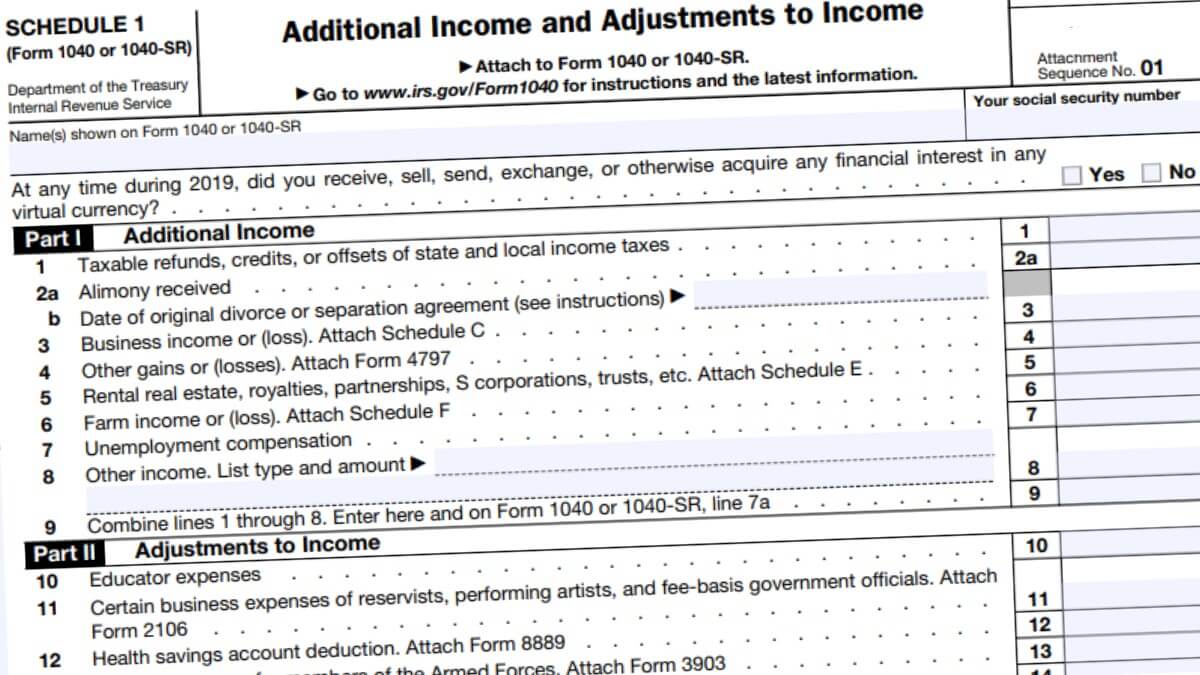

Schedule 1—Additional Income and Adjustments to Income is the IRS tax form for reporting additional income and making adjustments to income. Most commonly used for claiming above-the-line deductions such as educator expenses, HSA and IRA contributions, tuition and fees, and student loan interest.

Schedule 1 must be attached to Form 1040 upon completing it. If filing a paper tax return, staple Schedule 1 and other tax forms and schedules on the top left or right corner.

The above-the-line deductions that you will claim on Schedule 1 can also be taken with the standard deduction. Because these are seen as adjustments rather than a deduction. Besides, you won’t be using Schedule A to take these off of your taxable income. Both Schedule 1 and Schedule A can also be used if you’re itemizing deductions.

Therefore, the adjustments on Schedule 1 can be claimed whether you itemize or take the standard deduction. these adjustments are what’s called the above-the-line deductions.

Fill out Schedule 1—Additional Income and Adjustments to Income below and attach it to your federal income tax return. Schedule 1 is a single-page tax document. You can also fill it out online and print out paper copy or download it as a PDF file to keep it for your own records or print out at a later date.