The new tax law created the (State and Local Tax) SALT cap in 2017. It limits state and local tax deductions to $10,000 per return for single filers and $5,500 for married taxpayers. The cap will expire in 2025. Many politicians in high-tax states dislike this cap, saying it hurts residents of those states and their ability to provide basic services. This makes the SALT cap repeal a tricky issue for Democrats.

What is SALT Cap?

The SALT cap is designed to reduce the taxes paid by high earners in high-tax states. Repealing the SALT cap would reduce the amount of taxation that is paid by middle-income households. The Tax Policy Center estimates that 2.9 percent of middle-income households would benefit from repealing the cap. By contrast, less than one percent of lower-income households would benefit.

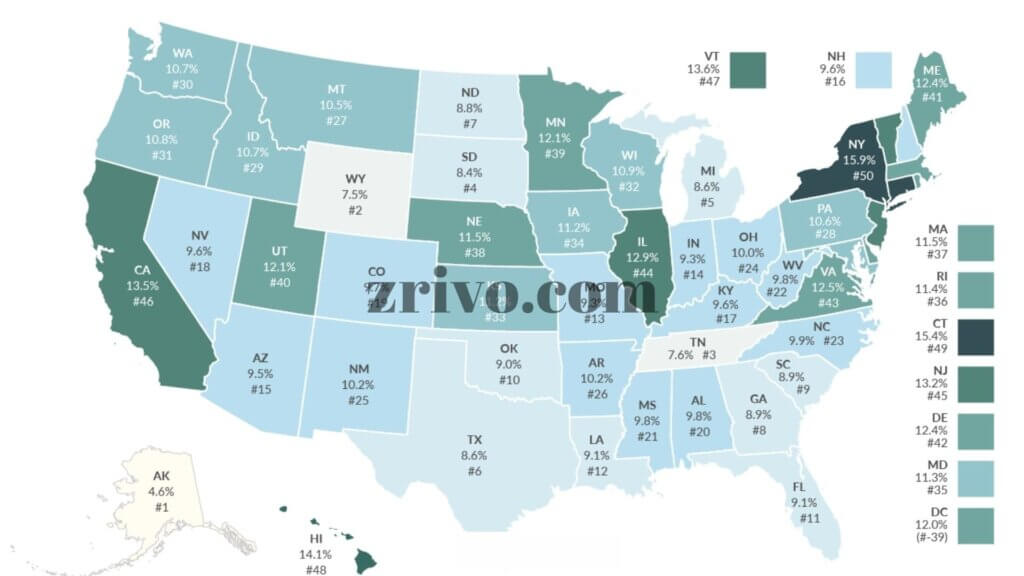

The amount of SALT a household can deduct varies by state. In states with higher tax rates, the percentage of households that claim the deduction is higher. Moreover, taxpayers in these states pay higher state and local taxes. The TPC estimates that the benefit from a repeal of the SALT cap would go to the top 20 percent of earners, while the lower income group would get less than half.

What is the Proposed SALT Cap?

By 2022, the proposed repeal of the SALT cap would mean that the federal government would get about $100 billion less in tax revenue each year. But 61 percent of all the cuts would go to the richest 1 percent of households, who would get most of the cuts. The richest 5 percent of households would get 81 percent of the cuts, while the remaining 80 percent would see no change.

Despite the lowering of the tax burden, SALT deductions would still have an impact on lower-income individuals. According to the Tax Policy Center, this change in SALT deductions would reduce revenue for local governments. Moreover, state and local governments would have less money to spend on government programs.