The W-9 Form contains plenty of IRS tax code regulations in it. Thus, it is one of the forms that filers often make mistakes on. If you are a vendor or independent contractor, then you need to fill out this form and file it with the IRS to avoid any penalties or interest.

However, although the form itself seems quite straightforward, most filers often make mistakes. It is worth noting that the W-9 Form has six pages of instructions, and the total word count of these instructions is more than 6,000. Thus, it is no surprise that people make mistakes while filling out this form.

For this reason, we have compiled the top 5 mistakes that filers often make while filling out the W-9 Form. They may seem like pretty simple mistakes, but your chances of falling into the same mistake are quite high.

Not Providing the Type of Limited Liability Company

This is the most common mistake that people make on the W-9 Form. Almost half of the filers forget to include the type of limited liability company in their forms. This is an important mistake since LLC types can be treated as S or C corporations.

Therefore, you should double-check whether you have provided the type of limited liability company before you file your form.

Disregarded Entity Use on Line 1 of the W-9 Form

Most companies are confused with the disregarded entity on the W-9 Form. If you make this mistake, you’ll receive plenty of CP2100 notices from the Internal Revenue Service. As a result, you will have to submit the W-9 Form again, or you may have to start back up holding 24% of your future payments.

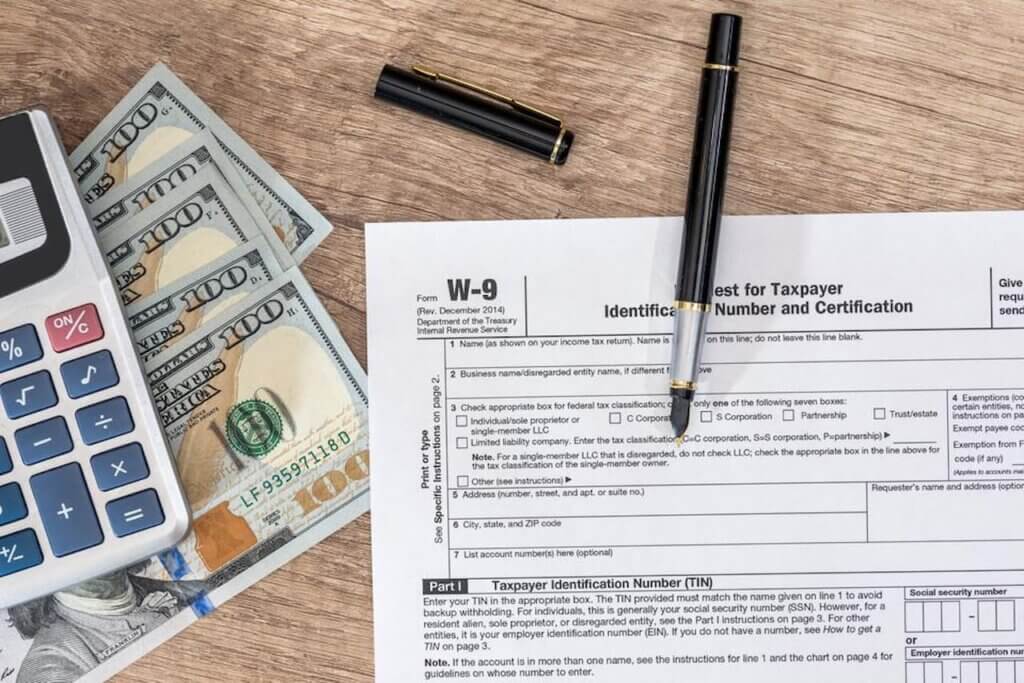

Not Checking the Tax Classification

Most people forget to check the required fields on the W-9 Form. You need to check the federal tax classification available on Line 1 to complete the form. By checking this box, you will let the IRS check if your payment is reportable on the 1099 Form or not.

If you forget to check this box, then the system will automatically assume that a 1099 Form is required, and you will not be exempt from receiving other 1099 Forms. It will be a good idea to check this box as soon as you start filling out the W-9 Form.

Not Signing the W-9 Form

Most people forget to sign their forms, which makes them totally invalid. You may spend hours learning how to fill out the form and reading the instructions, but you may waste all your efforts by simply forgetting to sign the form.

This is another common mistake that most filers make, and it may be a good idea to sign your form before you officially start filling it out.

Leaving the Name on Line 1 of the W-9 Form Blank

Believe it or not, most people forget to fill in the name section on line 1. It is quite natural because you will notice that you need to provide your business name on line 2. Most people automatically fill in this information, but you still need to provide the legal name of the business or individual on your tax return.

If there is a mismatch between the data on the IRS and your form, it will not be accepted, and you will have to file the same form again. It is worth noting that any mistake will lead to a 24% deduction in your future payments due to the backup withholding requirements.