Pennsylvania state income tax is a tax on taxable personal income. The statewide rate is 3.07%, and the local rates can add up to another 2% or so in some cities. Pennsylvania state also offers a number of deductions and credits. Some of these include tax-exempt alimony and child support, a medical savings account deduction, and contributions to 529 college savings plans. The state’s taxes are based on eight enumerated classes of income: compensation; net profits from the operation of a business, profession, or farm; capital gains; rents, royalties, and copyrights; interest; dividends; estate and trust income; and gambling and lottery winnings.

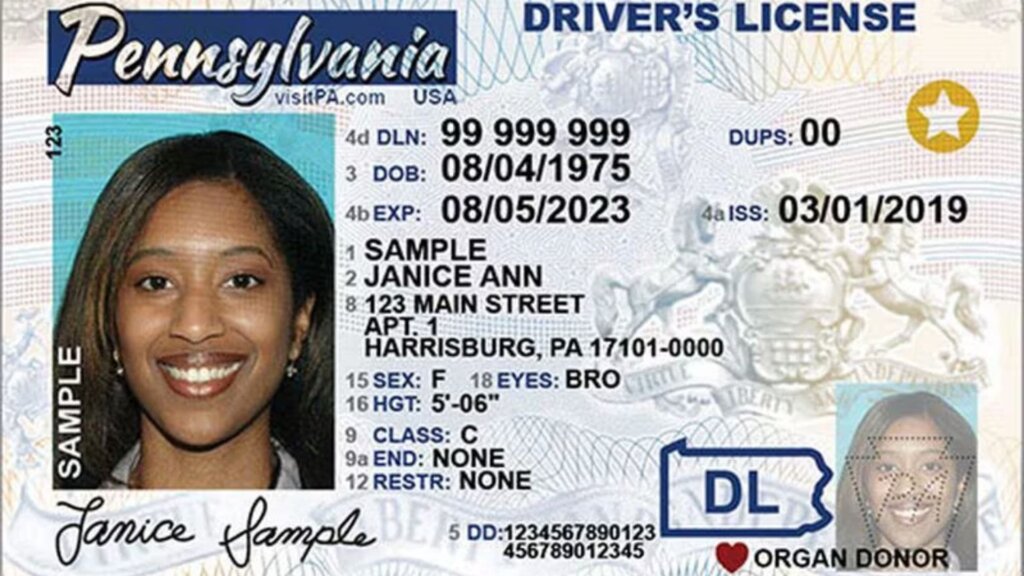

Nonresidents must pay state income tax on the Pennsylvania-source portion of their income unless it is clearly excluded from taxation by law or a constitutional provision. There are many factors that determine domicile, including church membership, vehicle registration, driver’s license, voter registration, bank accounts, and residence. A Pennsylvania tax attorney can help you understand your obligations.

Pennsylvania State Income Tax Withholding

As a small business owner, you’re responsible for withholding state and local payroll taxes from your employee’s wages. These include a state income tax, which employers must withhold from taxable compensation paid to resident and nonresident employees. In addition, Pennsylvania has a local earned income tax and a local services tax that vary by jurisdiction. The state also requires you to register as an employer online and obtain a PA employer withholding account, which is used for filing withholdings and unemployment taxes. Once you’ve registered, the Department of Revenue will assign an employer withholding deposit and reporting frequency. Rippling automatically calculates and submits all withholdings at the state and local level to ensure compliance and prevent infractions.

How to Determine Pennsylvania Residency Status?

To determine whether you’re a resident of Pennsylvania, consider the following questions: Does your residence qualify as your primary place of employment? Does your work require you to travel outside the state? If so, are you a full-time or part-time employee?

A nonresident of Pennsylvania can claim a credit against their Pennsylvania state income tax for taxes paid to another state. This credit must be equal to or greater than the Pennsylvania income tax imposed on them. In addition, the state does not tax income from Indiana, Maryland, Ohio, Virginia, or West Virginia. To claim a credit, you must submit Form PA-40.

Pennsylvania State Income Tax Due Date

The due date for filing a Pennsylvania state income tax return is April 15. If this date falls on a Saturday, Sunday, or business holiday, the entity must file its return no later than the first business day following the date. Pennsylvania also provides a five-month extension to file pass-through entity returns by submitting REV-276, Application for Automatic Extension of Time to File the PA-20S/PA-65 Information Return through myPath or the MeF federal and state e-file program.

If you are a nonresident employee who is paid Wage Tax by a Philadelphia-based employer, and the amount withheld exceeds your tax liability, you may be entitled to a refund of that amount. However, you must submit a claim for a Wage Tax refund to the Philadelphia Department of Revenue.