The Kentucky Homestead Exemption Application Form is a document used to claim a property tax exemption on your primary residence in Kentucky. This exemption can significantly reduce your property tax bill, so it’s worth applying if you qualify. You can file the Kentucky Homestead Exemption Application Form in three ways:

- Online: The Kentucky Department of Revenue has an online portal where you can submit your application electronically.

- By mail: You can mail your completed application to your local Property Valuation Administrator’s (PVA) office.

- In person: You can take your completed application to your local PVA office in person.

Kentucky Homestead Exemption Eligibility

To qualify for the Kentucky Homestead Exemption, a homeowner must be 65 or older and own and occupy the home as his or her primary residence. He or she must also be a Kentucky resident and document his or her total disability. Documentation can include Medicare cards the Social Security Administration issued and birth certificates. If you’re applying for the Disability Exemption, additional documentation is required, including medical records and a verification letter of disability from the Social Security Administration.

A homestead exemption can save a lot of money. However, you must apply for the exemption by submitting an application form to your local property valuation administrator. This application can be submitted online using an electronic signature solution. If you’re applying for the exemption due to disability, you must present documentation from a state or federal agency.

Kentucky Homestead Exemption Disability Requirements

To qualify as disabled, you must be classified as totally disabled by any public or private retirement system. This includes Social Security Disability Insurance (SSDI), the Kentucky Public Employees Retirement System (KPERS), and private disability insurance plans.

You do not need to provide medical documentation of your disability with your application, but the PVA may request it later if they need to verify your eligibility.

If you own your home with other people, only one of you needs to be eligible for the homestead exemption. However, everyone who owns the home must sign the application form.

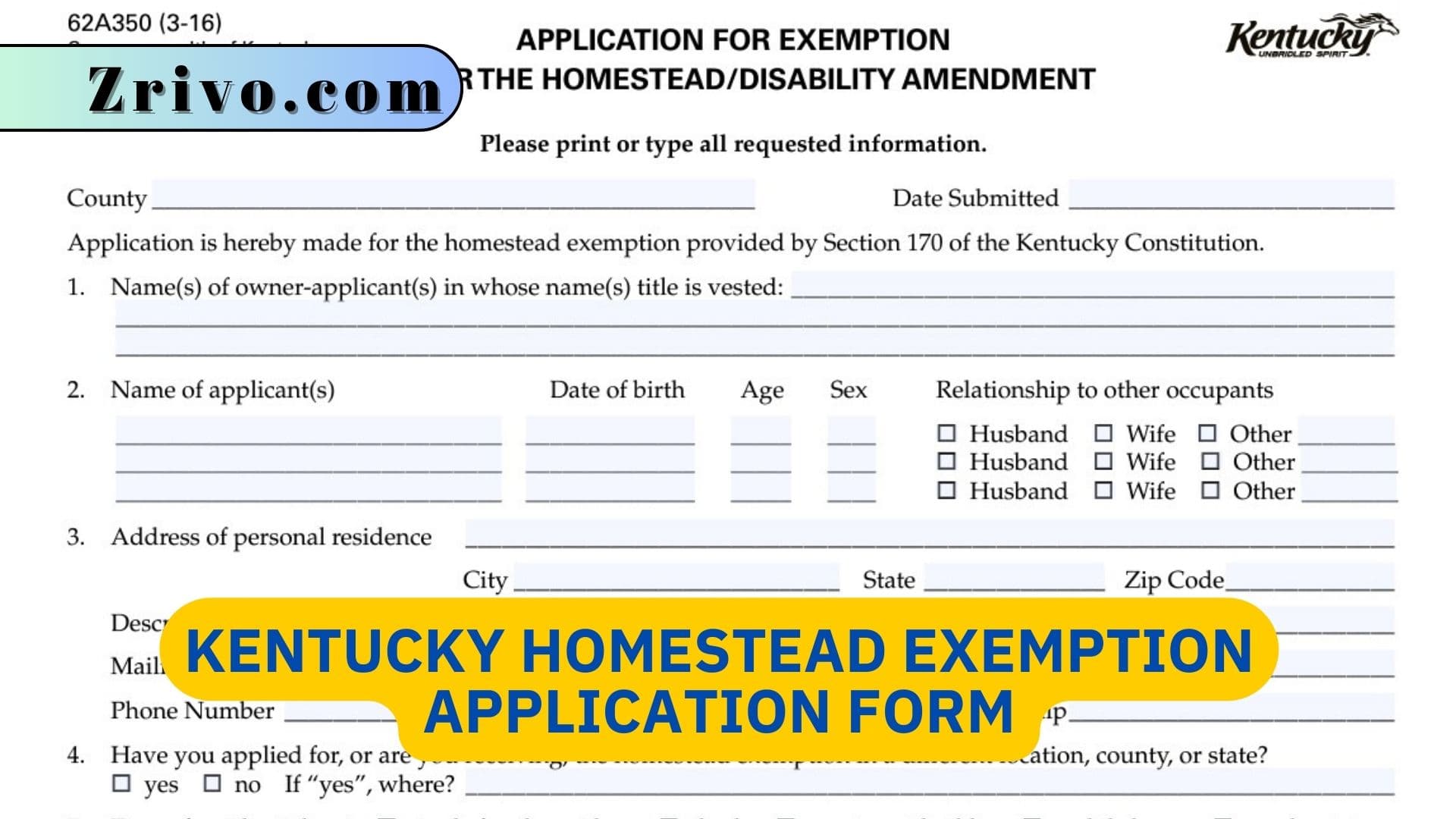

How to Fill Out Kentucky Homestead Exemption Application Form?

The Kentucky Homestead Exemption Application Form is relatively simple to fill out. However, it’s important to ensure you answer all the questions accurately and completely. Here are some tips for filling out the form:

- Read the instructions carefully before you begin.

- Gather all of the required documentation, such as proof of age and disability (if applicable) and proof of ownership of your home.

- Answer all of the questions on the form to the best of your ability.

- If you are unsure about any of the questions, contact your local PVA office for assistance.

How Much is the Homestead Exemption in Kentucky?

The current homestead exemption amount is $46,350. This means the assessed value of your property will be reduced by $46,350 before property taxes are calculated. The exemption amount is adjusted every two years based on the cost of living index.