IRS Forms

Internal Revenue Service tax documents and forms. Get the tax forms that you need to file your taxes and perform your duties.

Check out more in IRS Forms

-

What Happens if I Lose My 1099?

Losing your 1099 form can feel stressful, especially when tax season is approaching. This form is crucial for reporting income…

-

How to Fill Out Form 8958?

Form 8958 is designed for individuals who are subject to community property laws and file separate federal income tax returns.…

-

Distribution Code on 1099-R: What Does It Mean?

Understanding the Distribution Code on 1099-R is crucial for anyone involved with retirement accounts, pensions, or annuities. Form 1099-R is…

-

Form 1040-SS 2024 - 2025

IRS Form 1040-SS, officially titled “U.S. Self-Employment Tax Return (Including the Additional Child Tax Credit for Bona Fide Residents of…

-

Form 8862 2024 - 2025

Taxes can be complex, especially when it comes to claiming credits that reduce your tax liability. Sometimes, the IRS may…

-

Form 8283 2024 - 2025

When it comes to charitable giving, donations don’t always have to be in the form of money. Many taxpayers choose…

-

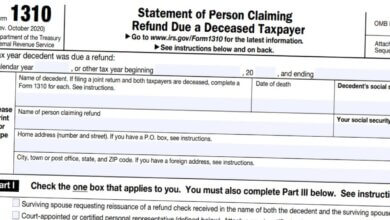

Form 1310 Instructions 2024 - 2025

IRS Form 1310, officially titled “Statement of Person Claiming Refund Due a Deceased Taxpayer,” is a crucial document used by…

-

1099 vs. W-2

1099 vs. W-2: What’s the difference? In the U.S., the distinction between a 1099 and a W-2 is significant when…

-

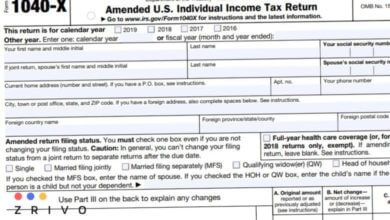

1040-X Form Instructions 2024 - 2025 Amended Tax Return

The 1040-X Form, officially named the “Amended U.S. Individual Income Tax Return,” is a document provided by the U.S. Internal…