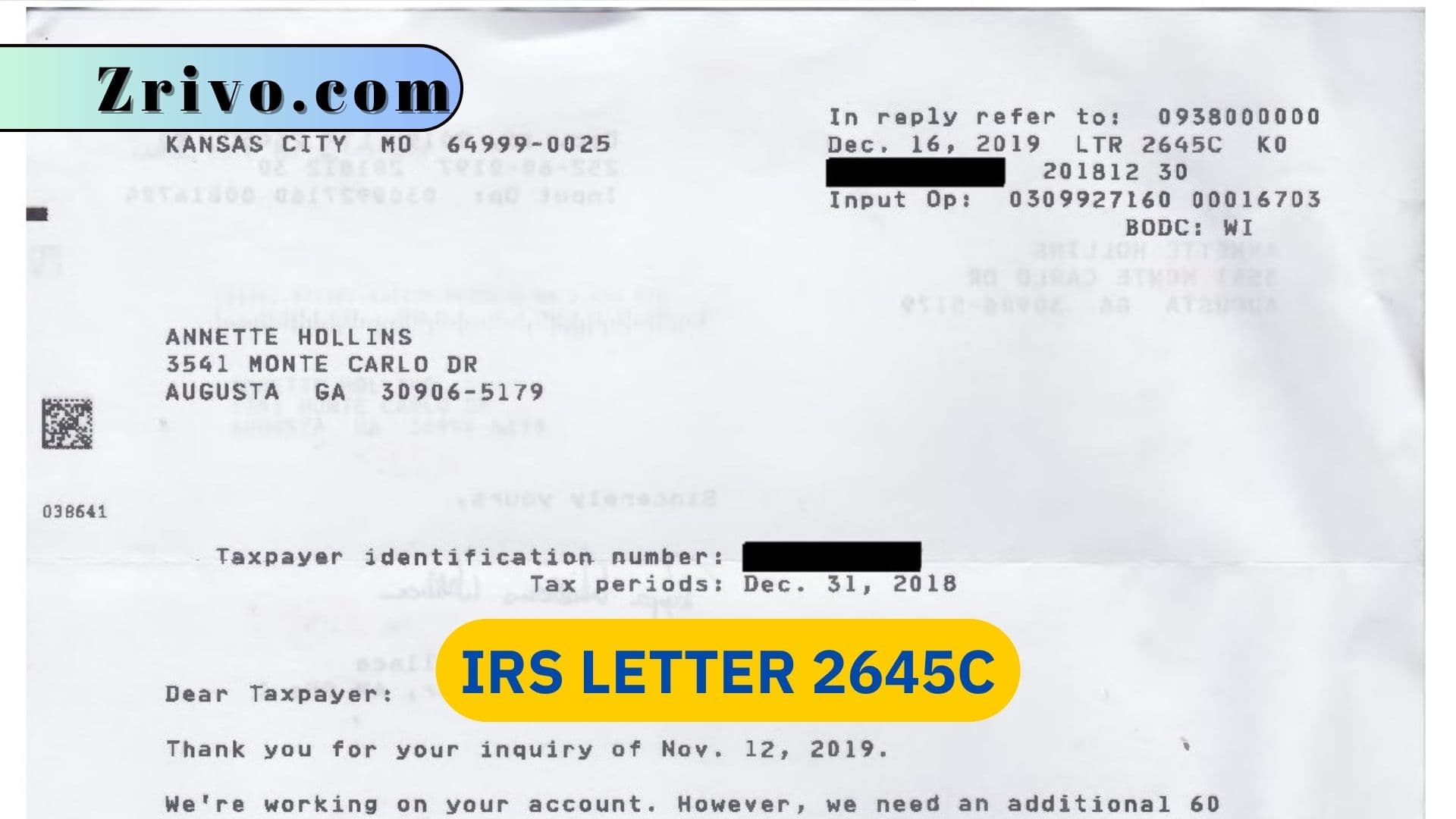

IRS Letter 2645C is a formal communication sent by the IRS to taxpayers. It is typically used to notify individuals or businesses about specific issues or discrepancies on their tax returns. The letter is part of the IRS’s effort to ensure compliance with tax laws and maintain the tax system’s integrity. This process may delay any refunds or overpayments you might have been expecting. When you get this letter, it’s almost guaranteed that the IRS has received a tax return with your name and Social Security Number but believes some of your documents are missing or still being processed.

The IRS also has an online tool where you can provide all the information they ask for easily and quickly. Be sure to read the instructions carefully, as there are specific ways to complete this process. Alternatively, you can call the IRS directly or schedule an appointment with a local office to do this in person.

What are the Reasons for IRS Letter 2645C?

- Income Discrepancies: The IRS compares the income reported on your tax return with the Information they receive from employers, financial institutions, and other sources. They may send this letter to request clarification if there are discrepancies, such as unreported income or inconsistencies.

- Tax Return Errors: Mistakes can happen when preparing tax returns, especially when filing complex forms. IRS Letter 2645C might inform you of errors detected in your return and prompt you to take corrective action.

- Verification of Identity: In certain cases, the IRS might suspect identity theft or fraudulent activity associated with your tax account. The letter could be a request for you to verify your identity and confirm the accuracy of the filed return.

- Additional Information Needed: The IRS may require supplementary documentation to support deductions, credits, or other claims made on your tax return. Letter 2645C would outline the specific Information they need.

- Tax Compliance Reviews: Sometimes, the IRS selects tax returns randomly for further review to ensure compliance with tax laws. Receiving this letter might indicate that your return has been selected for such a review.

- Notice of Audit: In some cases, IRS Letter 2645C may serve as a preliminary notice of an impending audit. This could be a full-scale audit or a more focused examination of specific aspects of your return.

What to Do After IRS Letter 2645C?

When you receive IRS Letter 2645C, it means that the IRS has received documentation or Information from you or your power of attorney and must verify your identity before processing the document. They will let you know when they have verified your identity. The primary purpose of this letter is to protect the IRS and taxpayers from fraud. Therefore, it’s important to respond as quickly as possible. Receiving IRS Letter 2645C can be unsettling, but it’s crucial not to panic. Here’s a step-by-step guide on what to do if you receive this letter:

- Take the time to read the letter thoroughly and understand the reason for its issuance. Pay close attention to any deadlines mentioned in the letter.

- If the letter requests additional Information or documentation, gather all the necessary paperwork. Ensure that you have copies of everything you submit to the IRS.

- Consider consulting a tax professional, such as a certified public accountant (CPA) or a tax attorney. They can help you understand the issue, determine the best course of action, and represent you before the IRS if needed.

- The IRS typically sets a deadline for responding to their letter. It’s essential to adhere to this deadline to avoid further complications.

- When providing any additional information to the IRS, be truthful and accurate. Misrepresentation or providing false Information can have serious legal consequences.

- Maintain copies of all correspondence with the IRS, including your response to the letter. Having a well-organized record will be beneficial if you need to follow up or appeal their decision.

- The letter may include specific instructions on how to resolve the issue. Follow these instructions carefully.

- If you disagree with the IRS’s findings, the letter should outline your appeal rights. If you choose to appeal, ensure you do so within the designated timeframe.

- Dealing with the IRS can be stressful, but remaining calm and composed is essential throughout the process.

Documents You Need to Provide to the IRS

After receiving IRS Letter 2645C, the specific documents you need to provide to the IRS will depend on the reason for the letter and the Information they are requesting. Generally, the IRS may ask for supporting documentation to address the issues mentioned in the letter. Here are some common documents that taxpayers may need to provide:

- Income Documents, Expense Receipts, Proof of Deductions, Bank Statements, Business Records, Investment Records, Rental Income and Expenses, Proof of Identity, Correspondence, Supporting Forms and Schedules, Healthcare Documents, Social Security Statements, Educational Expenses, Previous Tax Returns