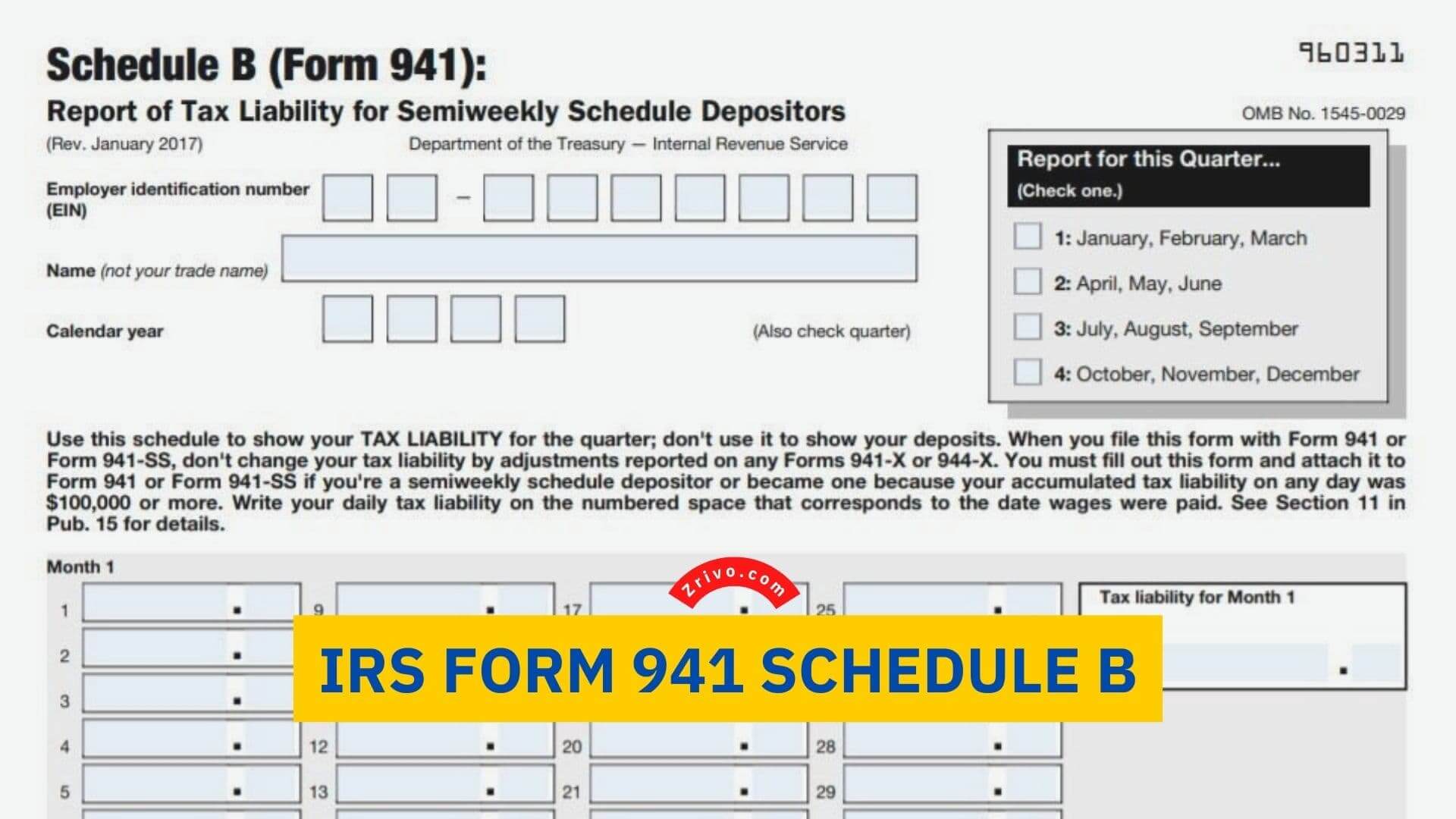

Generally, Form 941 Schedule B is used in conjunction with Form 941 to report employee wages and taxes. This is a tax reporting form that breaks down taxes payable each day of the quarter. This can help employers reconcile withholdings and make tax payments. The IRS also uses this form to process tax payments.

Form 941 Schedule B can be filled out and filed by businesses with semiweekly or monthly deposits. These businesses have to file the form when they have more than $50,000 in employment taxes. It is also necessary to report tax liabilities if the total amount of tax liabilities is more than $100,000.

In order to avoid penalties, you should review the tax return you are filing and make sure that you have filled in the correct information. You can also print the payroll registers to check for mistakes.

How to Fill out Form 941 Schedule B?

Form 941 Schedule B is filed on paper or electronically. The deadline for filing this form is July 31. If a business fails to file Form 941 in time, penalties may be imposed by the IRS. The 941 Form Schedule B requires the following information:

- The name of the business,

- The business’s EIN,

- The number of employees, and

- The total amount of taxes withheld from employee wages.

- These numbers must be entered in numbered spaces on Schedule B.

- There are 3 different sections for 3 different months on Schedule B Form 941.

- Don’t use Schedule B to show your deposits.

When you file this form with Form 941 or Form 941-SS, don’t change your tax liability by adjustments reported on any Forms 941-X or 944-X.

You must fill out this form and attach it to Form 941 or Form 941-SS if you’re a semiweekly schedule depositor or became one because your accumulated tax liability on any day was $100,000 or more.

Write your daily tax liability on the numbered space that corresponds to the date wages were paid. See Section 11 in Pub. 15 for details.