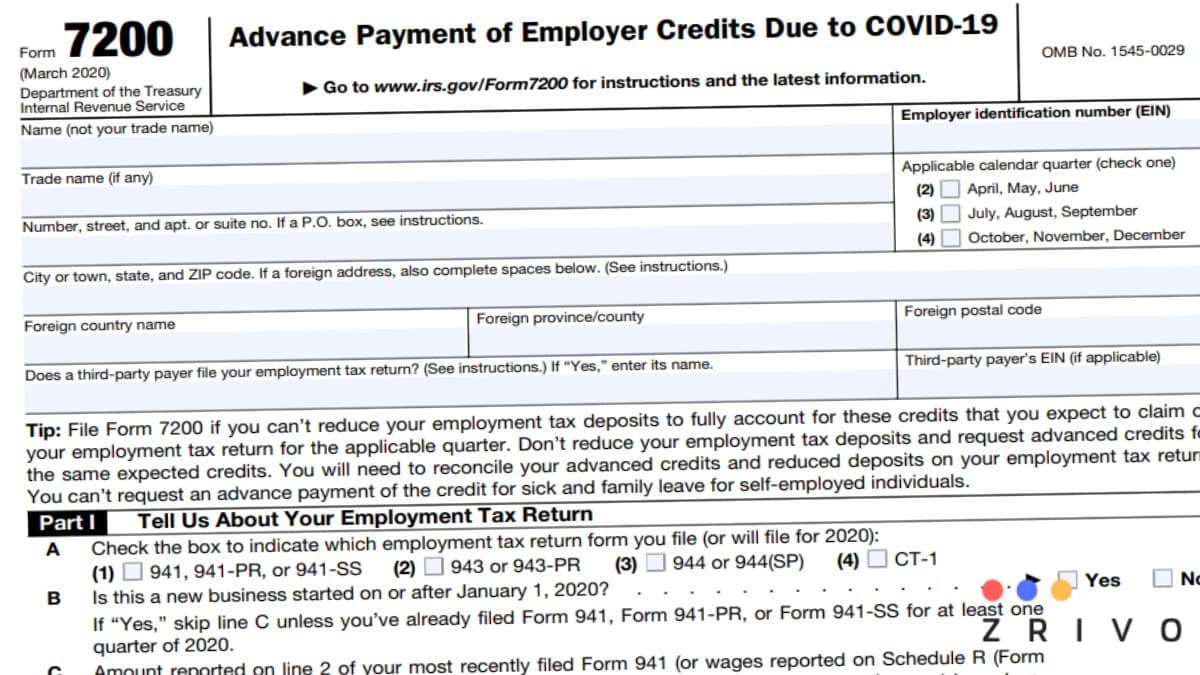

IRS Form 7200—Advance Payment of Employer Credits Due to COVID-19 is to request an advance payment of tax credits for qualified family leave wages, sick pay, and employee retention credit.

File Form 7200 to request advance payment for the above that you will claim in the following IRS tax forms.

- Employer’s Annual Railroad Retirement Tax Return – Form CT-1

- Employer’s Annual Federal Tax Return – Form 944

- Employer’s Annual Federal Tax Return for Agricultural Employees – Form 943

- Employer’s Quarterly Federal Tax Return – Form 941

For Puerto Rico, file Form 7200 for the following IRS tax forms.

- Planilla para la Declaración Anual de la Contribución Federal del Patrono de Empleados Agrícolas – Form 943-PR

- Planilla para la Declaración Federal Trimestral del Patrono – Form 941

For American Samoa, the Commonwealth of the Northern Mariana Islands, Guam, and the U.S. Virgin Islands, file Form 7200 for the following IRS tax form.

- Employer’s Quarterly Federal Tax Return – Form 941-SS

Instructions to File Form 7200 2024 - 2025

Here are instructions to file Form 7002 line by line. Form 7200 is a single-page IRS tax form, so, it shouldn’t take too long for you to understand and file.

First and foremost, check the correct applicable calendar quarter for 2024.

Part 1 of Form 7002

Line A – Select the IRS tax form that you’re filing for Form 7002. It can be either one of the employment tax returns that listed above.

Line B – State whether or not you are a new business started operations after January 1, 2024.

Line C – Enter the amount reported on Line 2 of the most recent Form 941—Employer’s Quarterly Federal Tax Return.

Line D – Enter the number of employees working for you.

Part 2 of Form 7002

Line 1 – Enter the total employee retention credit for the quarter you’re filing Form 7002. This is usually half the amount of the qualified wages paid to the employees in the current quarter. For example, if you’ve paid qualified wages between June 13, 2024, and June 31, 2024, add up the 50% of the wages with the 50% of the qualified wages paid in the fourth quarter for the fourth quarter and enter it on Line 1.

Line 2 – Enter the total amount of qualified sick leave wages paid so far in the current quarter.

Line 3 – Enter the total amount of qualified family leave wages paid so far in the current quarter.

Line 4 – Enter all the qualified wages you’ve paid so far in the current quarter. Add lines 1 through 3 and enter the total amount on Line 4.

Line 5 – Enter the total amount by which you have already reduced your federal employment tax deposits for the credits for the qualified leave wages and sick pay.

Line 6 – Enter the total advanced credits requested on previous Forms 7002.

Line 7 – Add the amounts on Lines 5 and 6 and enter the result here.

Line 8 – Subtract the amount on Line 7 from Line 4. If the result is zero or less, you shouldn’t file Form 7002.