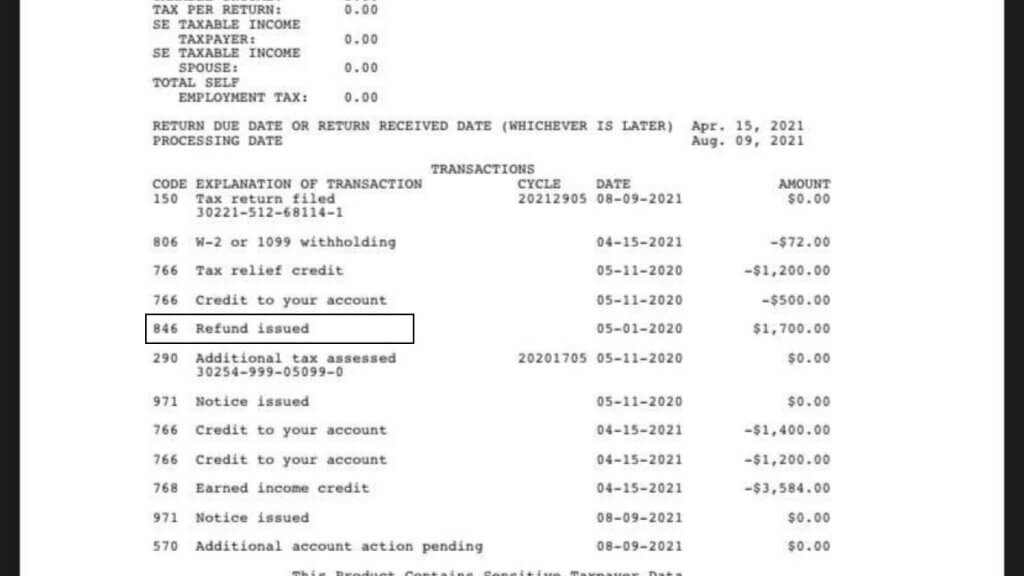

IRS Code 846, also known as “Refunds of Overpayments,” is a section of the Internal Revenue Code pertaining to refunding overpaid taxes to eligible taxpayers. This code plays a crucial role in ensuring fairness and accuracy in the tax system by allowing individuals and businesses to reclaim excess tax payments they may have made.

Key Definitions:

- Overpayment: Occurs when an individual or business pays more in taxes than they owe based on their tax liability.

- Refund: The process of returning excess tax payments to eligible taxpayers.

Eligibility for IRS Code 846

To qualify for a refund under IRS Code 846, individuals and businesses must meet certain criteria, such as:

- The taxpayer must have made more tax payments than their actual tax liability.

- The taxpayer must have filed their tax return within the specified deadline, including any extensions.

- The taxpayer should not have any outstanding federal tax liabilities, such as unpaid taxes or penalties.

- The taxpayer’s tax return should be accurate and free from errors.

IRS Code 846 Receiving Process

When the IRS determines that a taxpayer is eligible for a refund under IRS Code 846, the following process typically takes place:

- The IRS reviews the taxpayer’s tax return and supporting documents to validate the claim for refund.

- Once the claim is verified, the IRS initiates the refund process and calculates the amount to be refunded.

- Taxpayers can choose to receive their refund through direct deposit to their bank account or as a paper check sent via mail.

- The refund process can take several weeks to complete, with the exact timeline depending on various factors such as the complexity of the return, IRS workload, and filing method (e.g., e-filed returns tend to process faster than paper returns).

- In most cases, taxpayers receive their refunds within 21 days if they file electronically.

- Paper returns may take longer, typically around four to six weeks.

Important Notes

- Interest on Refunds: In some cases, the IRS may also provide interest on refunds, especially if the overpayment is due to an error or delay on their part.

- Amended Returns: If a taxpayer discovers errors or omissions on a previously filed tax return that results in an overpayment, they can file an amended return to claim a refund under IRS Code 846. However, a statute of limitations exists for filing amended returns, usually three years from the original filing deadline.

- Offsetting Debts: The IRS has the authority to offset refunds against any outstanding federal tax debts, state tax obligations, or other federal debts owed by the taxpayer.

- Communication with the IRS: Taxpayers can contact the IRS directly to inquire about the status of their refund or seek assistance in case of delays or issues.