If you are a resident of Idaho or your business has a presence in the state, you may need to file Idaho Form 850. Form 850 is the most used form to file and pay sales tax in Idaho. It is important to double-check all information before submitting the form, as errors could result in significant penalties. If you are unsure of how to fill out this form, consider consulting with a tax professional or the Idaho State Tax Commission. Once you have completed the form, you should submit it through the designated submission method. You should also keep a copy for your records.

How to Fill out Idaho Form 850?

The State of Idaho has a few different methods for filing sales and use taxes, including Autofile, Taxpayer Access Point, and the official website. The method you choose will depend on your filing frequency and the total liability you expect to have. Filling out Idaho Form 850 is simple, and you can do it online from any location. Make sure to review the entire document before submitting it, and be aware of any deadlines or tax rates you may need to know.

Idaho Form 850 Instructions

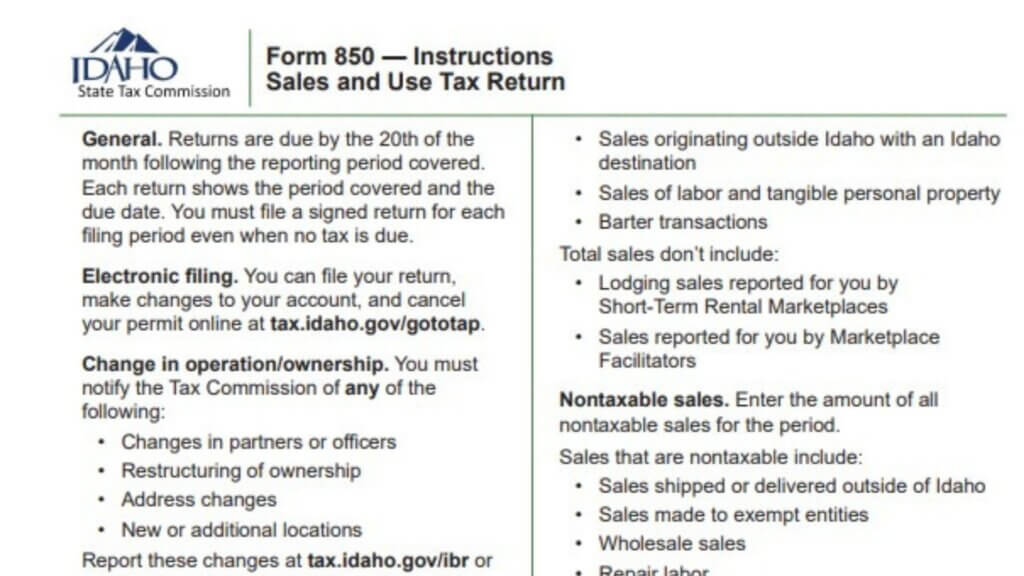

The Idaho State Tax Commission published Form 850, Sales and Use Tax Return instructions. The instruction guide is based on the latest version of the form and provides additional details to help users correctly complete their returns. It also includes tips for filing a return, including how to avoid overstating sales and reporting shipping charges.

Businesses that collect sales and use tax in Idaho must file a monthly, quarterly, semiannual, or annual return. The filing frequency is based on the amount of tax liability expected to be due. Once the business has filed its first return, it will be assigned a filing frequency based on the total expected tax liability.

Those who submit this form must carefully read the guidelines and requirements to ensure they fully understand everything. Additionally, they should prepare the necessary documents and information needed to complete the form correctly. They should then sign the document where required and submit it through the designated submission method. Finally, they should keep a copy of the completed form for their records.

Filing Sales Tax Returns in Idaho

Filing Idaho sales tax returns is a complicated process that involves collecting and reporting sales data. It also requires remitting the collected tax dollars to the state. This can be done online through the State Tax Commission’s TAP portal or by mailing a check to the agency.

Idaho is a destination-based sales tax state, so you must determine the local sales tax rate based on where your goods are being sent to ensure sales tax compliance. Fortunately, only a few towns in the state have rates higher than 6%. Additionally, blanket resale certificates are permitted, which simplifies the filing process.

If you collected more tax than what is listed on your return, you can submit a written refund claim to the state tax commission. Upon receiving your refund claim, the state tax commission will review it to make sure that all the necessary information is included.