The Employer ID Number is a unique set of numbers that can be perceived as the social security number of businesses. You can see the Employer ID Number under different names, like EIN, Federal Tax Identification Number, and Federal Employer Identification Number. The EIN consists of nine digits and is the most important number for the Internal Revenue Service to identify businesses.

Every business that is based in the United States must acquire its EIN. We should state that none of the businesses can take any legal action, especially in operations related to taxation, without an employer ID number.

If you have lost your EIN or somehow need to check whether your EIN is correct, you may want to verify it. Here are the three methods to verify your Employer ID Number – EIN.

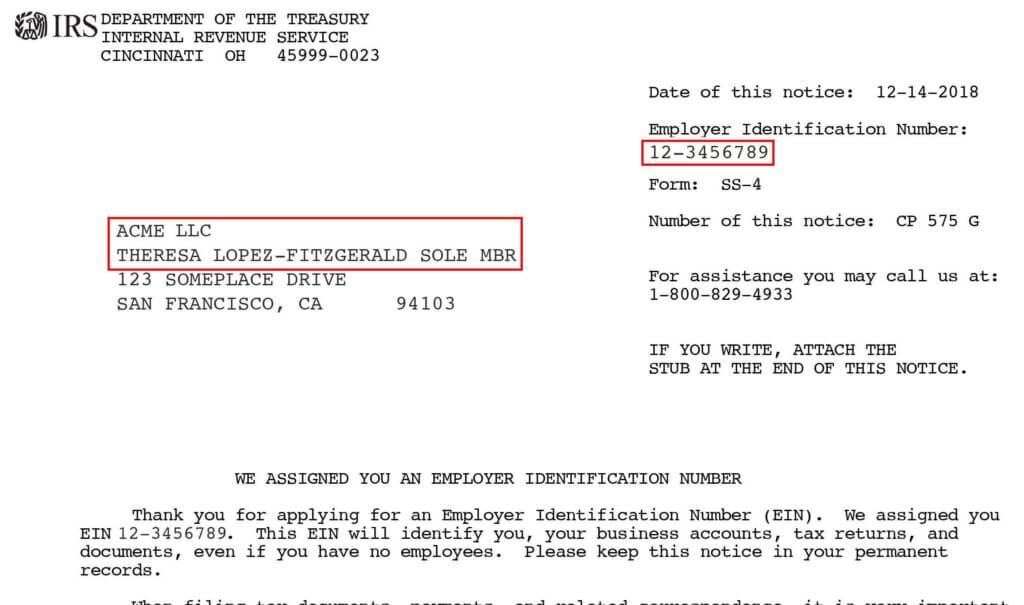

Check IRS confirmation letter to verify EIN

The first and easiest way to verify your employer identification number is by checking the IRS confirmation letter. This is the document you are going to receive from the IRS once you get your employer ID number for the first time. The IRS may also deliver the document via email if you request it.

All you need to do is check this letter and look for the employer identification number on it. It is generally shared on the right-top of the letter. However, most business owners tend to lose this document or delete it from their email accounts as well. If somehow you can’t find this document, have no worries. You still have two other methods to verify your Employer ID Number.

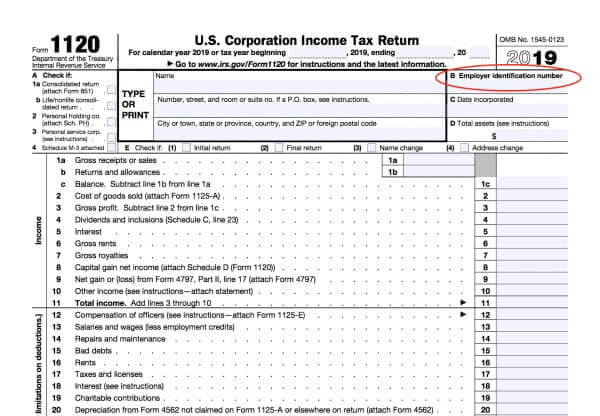

Finding other documents that your EIN is written on

In this method, you have more options to verify your Employer ID Number since you should have plenty of documents at hand to check your EIN. If you have founded your business using your employer identification number, it will be written on plenty of documents.

Some of these documents may include:

- 1099-Misc forms that your business issued to independent contractors

- Your business license

- Your return documents from the previous years

- Fictitious name statement of your business

- Sales tax permit

- Documents you submitted for the application of bank accounts, credit cards, or business loans

- Business entity banking statement

All these documents are important documents that you need to keep safe all the time. We bet you will verify your Employer ID Number (EIN) by finding one or more of these documents. However, if somehow you cannot find any of these documents, you have one last resort to consider.

Contacting the IRS to learn your Employer ID Number

If none of the previous methods helped you find or verify your Employer ID Number, you can always get in touch with the IRS and learn your EIN. However, this method will only work on weekdays between 7:00 AM and 7:00 PM. You need to call 800-829-4933, the IRS Business & Specialty Tax Line.

The person you will talk to will ask for some personal and identifying information. This is because the EIN is one of the most important numbers for your business, and it will only be shared with authorized people. For this reason, a business owner, business partner, corporate officer, or executor of an estate can get this number by calling the IRS.

We recommend repeating the employer ID number to the person you are talking to receive confirmation. In addition to this, you may want to keep your EIN in a secure place. If people with bad intentions acquire this number, they can file tax returns on your behalf.