The Internal Revenue Service allows taxpayers to request their tax return transcripts for at least the past three years. A transcript features basic information about the tax return and shows the Adjusted Gross Income. So if you ever wonder about your adjusted gross income in the past, requesting a transcript is a great way to obtain the information you need.

Often times, you will be requested a tax transcript when applying for a loan especially a home loan or college financial aid. Since your tax return tells a lot about your current financial situation, it is a way for lenders to determine your creditworthiness. Same with any other IRS tool or app, obtaining what you need is super simple and takes minimal effort.

IRS Get Transcript

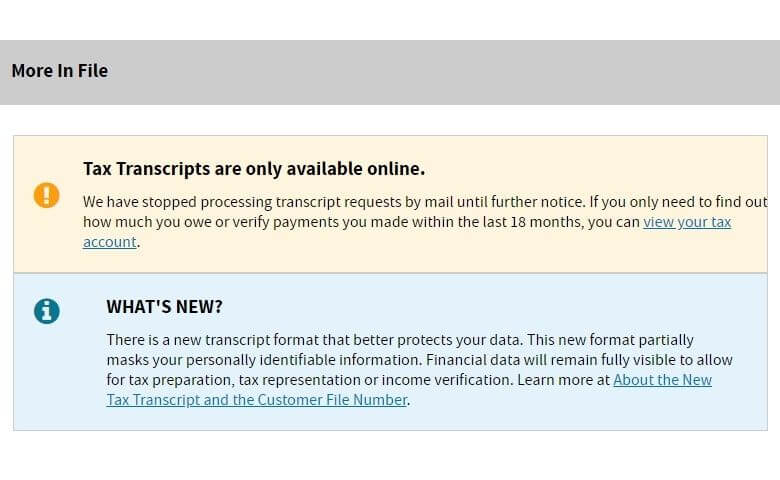

To get your tax return transcripts, you must use the IRS Get Transcript tool. In order to have access to your transcripts, you will need the following to verify who you are.

- Social Security Number

- Have access to your e-mail

- Personal account number from a mortgage, credit card, home equity line of credit or car loan

- Phone number (mobile)

If the information on your tax return matches with what you provide on Get Transcript, you will be able to download tax return transcripts online. Since you will obtain your documents in PDF, it already comes in a printable format. You can use any PDF reader or even your browser to view and print out tax return transcripts. If you want to save time, simply send your transcripts to the lender(s) requesting it.