A tax-exempt certificate in Ohio proves that the business can make such purchases and will resell the items for profit. It can be used to buy any type of item, including computer hardware, furniture, and office supplies. The document is typically presented to the supplier by the buyer or his or her authorized agent.

There are several types of resale certificates in Ohio, each requiring specific data elements. These include the date, a signature (by the buyer or his or her authorized agent), and the exemption reason. Some states also require a statement that the certificate is not valid for use for resale in another jurisdiction.

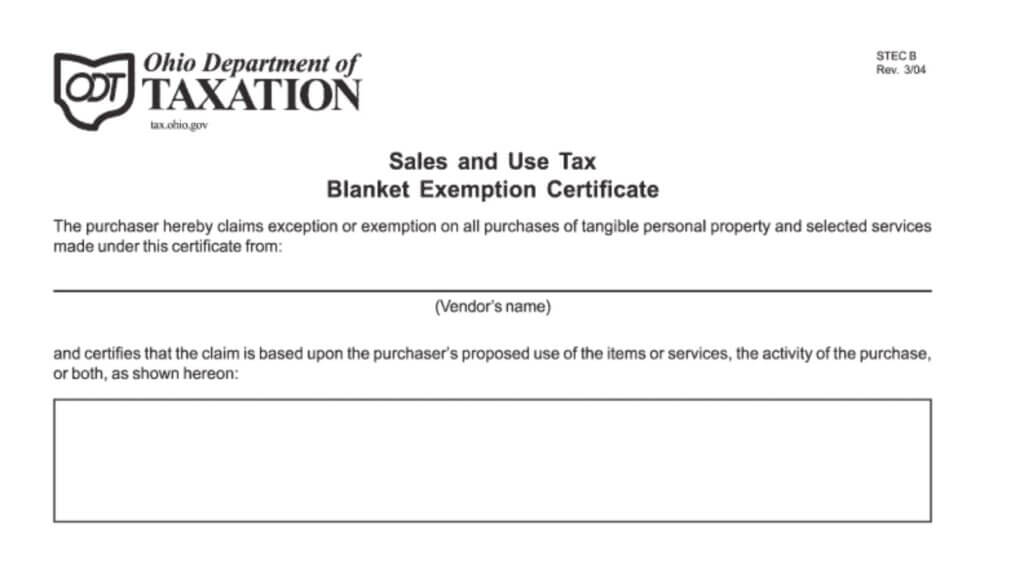

The state of Ohio offers two types of resale certificates, which can be downloaded from the state’s website. These include the Single Unit Exemption Certificate and the Blanket Exemption Certificate. The former is designed for individual purchases, and the latter is intended for ongoing business-to-business transactions. Both are required to include the buyer’s name, address, and purpose for making the sale.

The state of Ohio requires businesses to collect and remit sales tax on all purchases made in the state. This includes purchases from vendors outside of the state that are taxable in the state. Sales tax also applies to purchases made by retailers that have affiliate nexus in the state, or who store inventory in the state for resale. This can include fulfillment by Amazon merchants who make sales through their marketplace. The resale exemption certificate must contain all required information, including the date, both parties’ names and addresses, the legal basis for the exemption, and the type of product or service being purchased.

How to File Ohio Tax Exemption Forms?

Whether a state requires a particular form or not, all exemption certificates must contain certain data elements, including the buyer’s name, address, and purpose for the certificate (resale or other). In addition, most require an employee signature and verification of the buyer’s status as exempt from sales and use tax.

Generally, businesses that purchase tangible personal property for the purpose of using it in their manufacturing operations can claim sales tax exemption on those purchases in Ohio. However, a business must be registered for sales tax collection in Ohio and have economic nexus with the state to qualify for this exemption. There are several different types of economic nexus criteria, which are discussed below.

Ohio Sales Tax Exemption

While state and local taxes like school taxes, severance tax, gas and motor fuel taxes, property taxes, and sales and use taxes get all the attention in Ohio, there are also some less-reported elements of the Buckeye State’s overall tax structure. These include various sales tax exemptions that can provide significant savings to businesses. Ohio’s 5.75% sales tax applies to most retail transactions, but there are some important exemptions for certain types of goods and services. These include prescription drugs, sales for resale, and sales to churches and nonprofit charitable organizations. Ohio also exempts purchases of equipment used to conduct research and development.

You can file a resale certificate with the vendor if you purchase taxable products for resale in Ohio. This allows you to claim a sales tax exemption on all future purchases from that vendor without having to present a new exemption certificate every time. Additionally, Ohio’s unit and blanket resale certificates allow you to save time by not having to fill out a separate exemption certificate for each individual purchase. Alternatively, you can register with the Streamlined Sales and Use Tax Agreement to further simplify your purchasing processes.