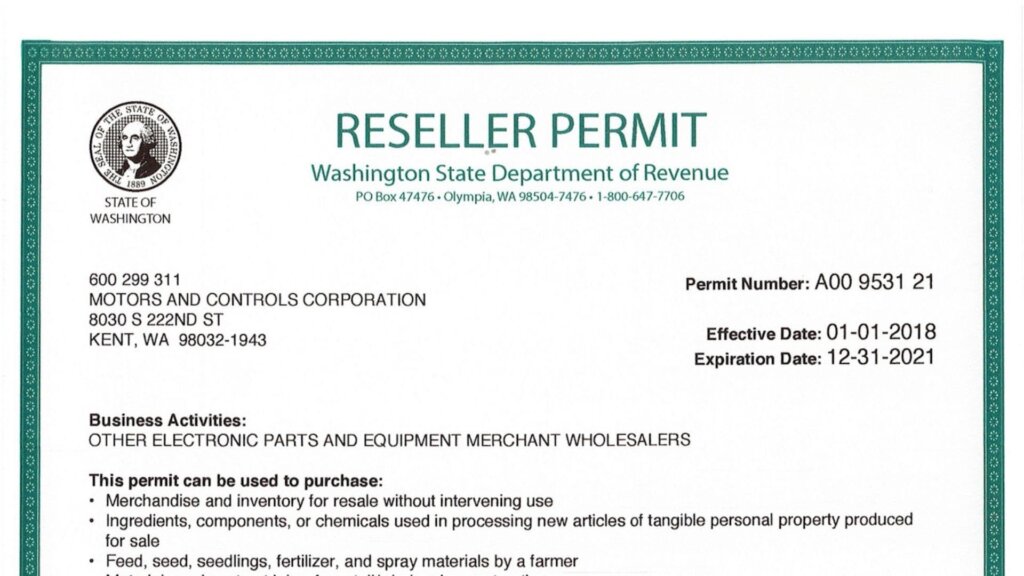

A Washington Reseller Permit is a state-issued permit that allows businesses to buy goods and services for resale without paying sales tax. The permit also acts as a sales tax exemption certificate for the buyer. The permit is not to be confused with a Washington Sales Tax Number used by the business to collect and report sales tax. A reseller permit can be obtained by businesses that are registered to collect sales tax in Washington, as well as some farmers who meet certain thresholds. The days of self-issued resale certificates are numbered; starting January 1, 2010, buyers must present either a reseller permit or a Streamlined Sales and Use Tax Agreement (SSUTA) exemption certificate when purchasing goods and services for resale.

The Department’s web site has more information on this new permit, including a list of eligible businesses. To apply, you will need a valid UBI number, a contact name and address, and a statement that you will collect and remit sales and use tax on a monthly, quarterly, or annual basis.

Washington Reseller Permit Eligibility

The department may revoke or invalidate a reseller permit if it determines that the buyer is not eligible to make purchases at wholesale rates or that the buyer is using a permit without valid business reasons. A person whose permit is revoked or invalidated is prohibited from making any further purchases under that permit, and the department will impose the fifty percent penalty for misuse of the permit. To obtain a Washington reseller permit, you’ll need to meet a few key requirements:

Business Type:

- Generally, businesses that purchase tangible personal property (physical goods) to resell qualify. This includes retailers, wholesalers, manufacturers (for materials used in products they sell), and some qualified contractors (for materials used in contracted projects).

Resale Intent:

- You must intend to resell the items you purchase with the permit at least 5% of the time. Businesses that primarily sell taxable services or make retail sales with minimal resale (less than 5%) wouldn’t qualify.

State Registration:

- You’ll already need to have a valid Washington State Business License (UBI number) before applying for the reseller permit.

Washington Reseller Permit Application

To apply for a reseller permit, you must provide information about your business, including the legal name, address, and email address. You must also provide your Federal Tax ID or Social Security Number and the type of ownership structure (e.g., sole proprietorship, partnership, LLC, or corporation). Although sellers are not required to accept resale certificates for tax-exempt purchases, most do so. However, you should be aware that if you sell to customers who have provided a certificate that is not valid, you may be liable for sales tax.

- Applications are submitted online through the Washington State Department of Revenue (DOR) website [WA DOR reseller permit].

- The application requires basic business information like name, address, and a brief description of your business activity.