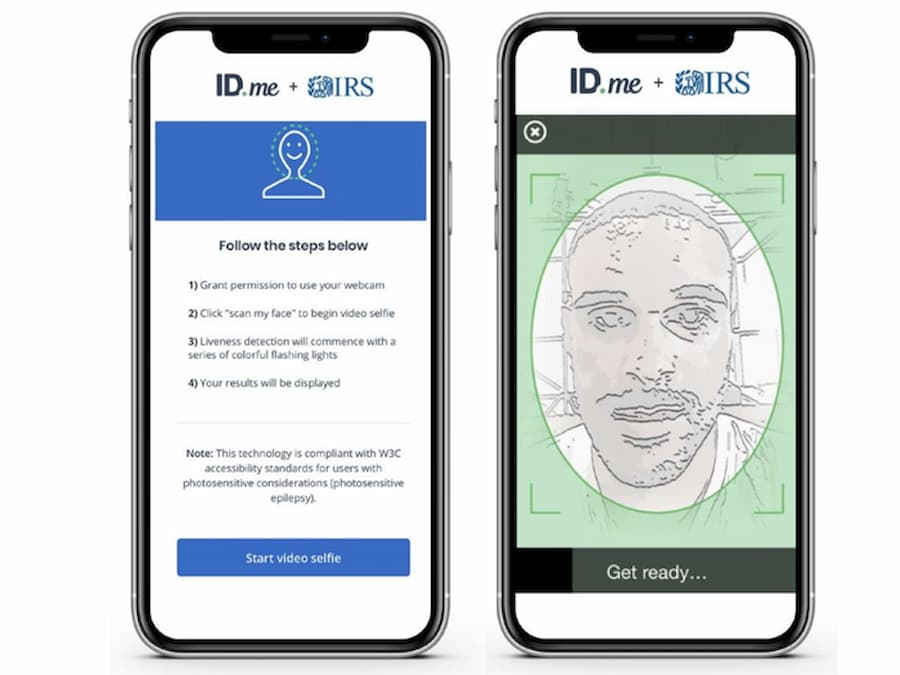

The IRS has made changes to the way it handles identity verification for taxpayers who e-file their returns. This includes requiring taxpayers to submit a photo of themselves. In the past, taxpayers had to provide official documents, such as a passport or driver’s license, to prove their identity. Since then, the IRS has made the process more convenient for taxpayers by asking them to upload a selfie.

Taxpayers are asked to provide a selfie to verify their identity

A recent proposal from the Internal Revenue Service required taxpayers to provide a selfie in order to access its website. This did not apply to everyone. Only those who wanted to set up an account would be asked to provide their photo. It also raised privacy concerns. While the IRS is correct to focus on fraud, it shouldn’t make its tax-filing process more difficult for everyone.

IRS has updated its requirements for e-filed returns

Whether you file your taxes electronically or through a paper filing system, you may want to read the IRS’s new e-file requirements. In the last several years, the IRS has made it easier to submit your tax returns electronically. For example, the IRS has made it easier to e-file Form 1040X, which is an amended version of a previous year’s tax return. The e-file requirements have recently been rolled out to more tax forms, including Forms 1040-NR and 1040-SS (which are filed by nonresident aliens with U.S.-connected income).

Using an ID PIN to confirm your identity is an option for taxpayers

Using an ID PIN to confirm your tax identity is a valuable way to prevent fraud and ensure that you are not paying too much in taxes. However, there are some risks associated with this method. For example, identity theft can result in a tax refund that is not legitimate. Recovering from this type of fraud can take months, or even years, so taking the appropriate precautions is essential. Thankfully, the IRS has made it easier than ever to protect your identity.

Getting an ID PIN

Getting an ID PIN with the IRS is relatively easy. First, you must ensure you’re eligible for the service. If you don’t, you can find out more here. A valid IP PIN is a stringent process that the IRS must verify your identity. Once you’ve passed this process, the IRS will send you a verification code by email. You can use the code to complete the application process.

Requirements for obtaining an ID PIN

If you haven’t yet received your IP PIN from the IRS, you can still opt-in to receive one. This process will require you to submit proof of your identity, such as a copy of your Social Security card. You can also opt-in to receive one for your spouse or dependent. Once you have passed the verification process, you will receive a temporary IP PIN. This temporary PIN will only last for a year, so you will need to apply again next year