1099 Forms

All Forms 1099 for your tax duties. Get Forms 1099-A, B, C, CAP, DIV, G, H, INT, K, LTC, MISC, OID, PATR, Q, R, and SA. Fillable and printable versions of each Forms 1099 is available to use.

-

What Happens if I Lose My 1099?

Losing your 1099 form can feel stressful, especially when tax season is approaching. This form is crucial for reporting income…

-

1099 vs. W-2

1099 vs. W-2: What’s the difference? In the U.S., the distinction between a 1099 and a W-2 is significant when…

-

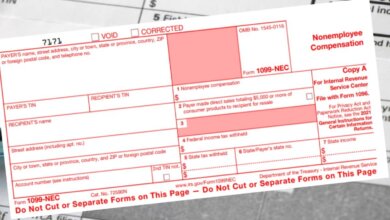

Form 1099-NEC Instructions 2024 - 2025

The Form 1099-NEC has been re-introduced by the IRS to specifically address the reporting of nonemployee compensation. It is paramount…

-

1099 Form 2024 - 2025

In June , the IRS announced that they were going to launch a filing portal special for the 1099 Form. This…

-

Form 1099-MISC Instruction 2025

Form 1099-MISC is a tax form that reports miscellaneous payments made in a trade or business. The Form can be filled…

-

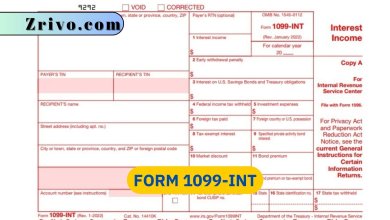

Form 1099-INT

A 1099-INT is a tax form that reports interest income. It is usually issued by banks and other financial institutions…

-

Form 1099-S

Form 1099-S, officially known as the “Proceeds from Real Estate Transactions,” is a tax form issued by the Internal Revenue…

-

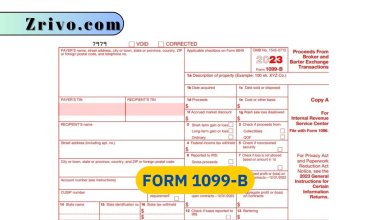

Form 1099-B 2024 - 2025

Brokers use Form 1099-B to report proceeds from stock transactions. It shows whether your gains were short-term or long-term and…

-

1099 Composite: A Comprehensive Guide

1099 Composite is a tax form that is generated by broker-dealers or other financial institutions. It combines various types of…