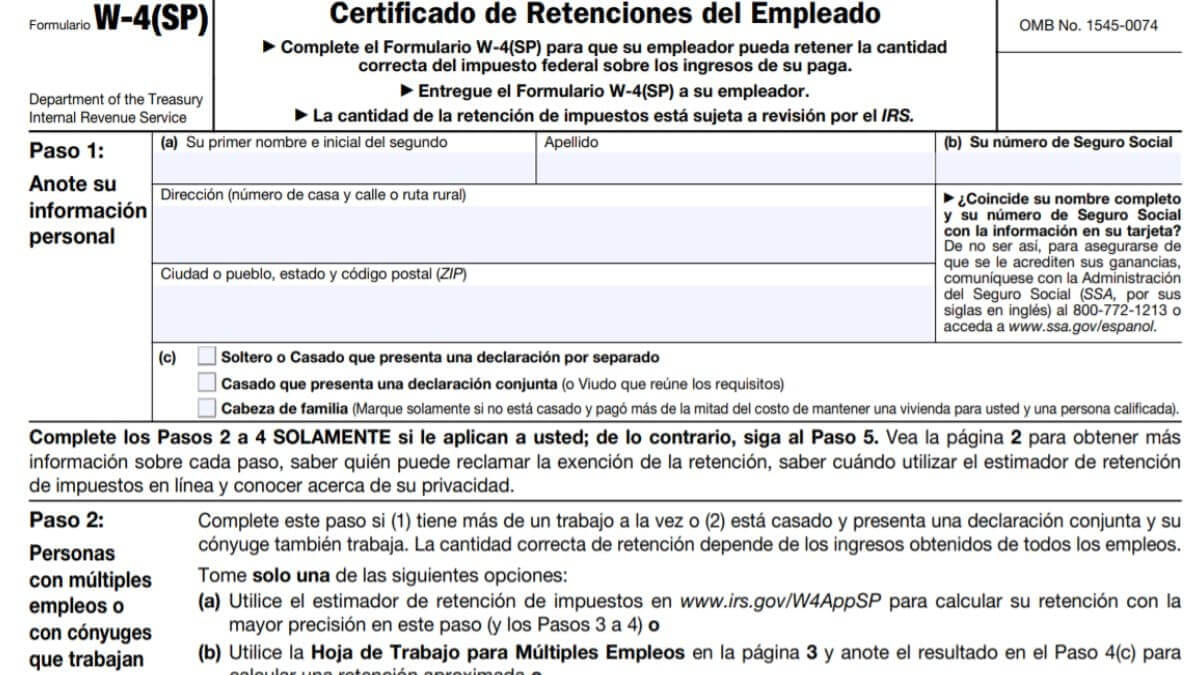

Form W4 Spanish, also known as Form W4 SP is the employee’s withholding certificate in Spanish. Employees can fill out this tax form just like the English version of this tax form to provide information about their anticipated tax return so that the employer can withhold federal income taxes accurately.

The biggest mistake known about this tax form is that it can be filed by any employee if the employee’s first language is Spanish. This is completely wrong. As an employee working within 50 of the states, you must fill out the English version of Form W4.

Form W4 SP is only accepted by the Internal Revenue Service if you’re working in Puerto Rico. Other than the residents of Puerto Rico, you must fill out W4 Form 2023 for the current tax year, not the W4 SP Form 2025.

Update: Any Spanish-speaking employee now can file Form W-4 regardless of the state of residence and workplace.

The only difference between the English and Spanish versions of Form W4 is the language. Aside from that, there is no difference between the two forms. You can simply go ahead and file Form W4 if you’re working in Puerto Rico and furnish your employer with a copy.

Form W4 SP will then be used by your employer alongside Publication 15-T to figure out tax withholding. If you’re working at two or more jobs, make sure to file Form W4 for each job you’re holding.

Form W4 WP 2025 can be previewed below along with the instructions to file. The below version of Form W4 Spanish is fillable online which means you can fill it out on your computer online, then print out a paper copy with your information on it. This will enable you to save time while finishing a copy of the tax form.

Key Differences Between Form W-4 and Form W-4 Spanish

When comparing Form W-4 to Form W-4 Spanish, there are a few key differences to keep in mind.

Here is a comparison table outlining the main differences between the two forms:

| Aspect | Form W-4 (English) | Form W-4 Spanish |

|---|---|---|

| Language | English | Spanish |

| Official Title | Employee’s Withholding Certificate | Certificado de Retención del Empleado |

| Purpose | Determine federal tax withholding | Determine federal tax withholding |

| Legal Name | Form W-4 | Formulario W-4 |

| Sections | Follows the same sections and fields | Follows the same sections and fields |

| IRS Guidance | Follows IRS guidelines and instructions | Follows IRS guidelines and instructions |

| Acceptance by Employers | Widely accepted by U.S. employers | Accepted by U.S. employers serving Spanish-speaking employees |

| Translation Quality | Officially translated by IRS | Officially translated by IRS |

Key Changes for 2025

In 2025, there have been some significant changes to Form W-4. It’s essential to be aware of these changes to ensure accurate tax withholding.

Old vs. New W-4

| Aspect | 2025 W-4 | Previous Versions |

|---|---|---|

| Filing Status | More straightforward and intuitive | Used allowances |

| Personal Allowances | Removed | Utilized personal exemptions |

| Additional Income and Deductions | Accommodates additional income | No specific provisions |

| Multiple Jobs | Easier to calculate | More complex calculations |

How to Fill Out Form W-4 in Spanish

Step-by-Step Guide

Step 1: Provide Personal Information

- Enter your name, address, and Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

Step 2: Choose Your Filing Status

- Indicate your marital status, such as Single, Married, or Head of Household. This impacts your withholding rate.

Step 3: Claim Dependents

- Specify the number of dependents you’re claiming, which can affect your withholding.

Step 4: Additional Income and Adjustments

- If applicable, provide information about other sources of income or deductions, such as multiple jobs or itemized deductions.

Step 5: Sign and Date

- Sign and date the form to certify that the information is accurate.