IL-1040 Form is the basis for individual income tax returns filed in Illinois. It is the most commonly filed state income tax form. Illinois residents and nonresidents must file a return if their base income is greater than their Illinois exemption allowance. Those with other taxable income, such as self-employment, interest, dividends, unemployment compensation, and pensions, may also need to file. Those who do not have enough income to file an IL-1040 Form must pay estimated taxes with Form IL-1040-ES. Taxpayers should also review the IRS IL-1040 Instructions booklet for more information on paying estimated taxes. In addition to federal Form 1040, Illinois requires taxpayers to file Schedule NR if they were nonresidents or part-year residents during the year.

How to file Form IL-1040?

Filling out Form IL-1040 can be a complicated process, especially for taxpayers who are filing their individual income tax return for the first time. To reduce the risk of errors and complications, individuals should ensure they have all necessary documents before beginning to fill out the form. This includes a copy of their previous year’s tax return, W-2 and 1099 forms, bank account information for direct deposit of refunds, proof of Illinois residency, deduction and exemption claims, and more.

To help make the filing process as simple and convenient as possible, the Department of Revenue offers a free online program called MyTax Illinois that allows people to file their state returns and manage their account information without the need for a paid preparer or third-party software. This year, the program has been updated to include a simpler question-and-answer format and has some tax information prepopulated from previous returns.

In addition to MyTax Illinois, the Department of Revenue also provides resources and educational materials for individuals, including tax assistance programs for low- and moderate-income families. These programs offer both in-person and virtual services for free or at a reduced cost, including the Earned Income Tax Credit (EITC), which helps lower-income taxpayers receive larger tax refunds.

Illinois residents who are stationed in the Armed Forces or other states on temporary duty may deduct qualifying military pay from their Illinois taxable income on line 7 of Form IL-1040. However, military personnel who are Illinois residents who earned income in these reciprocal states must file a nonresident return with Schedule NR and report any compensation received from those states, even if the employer did not withhold that state’s tax.

How to Fill Out Form IL-1040?

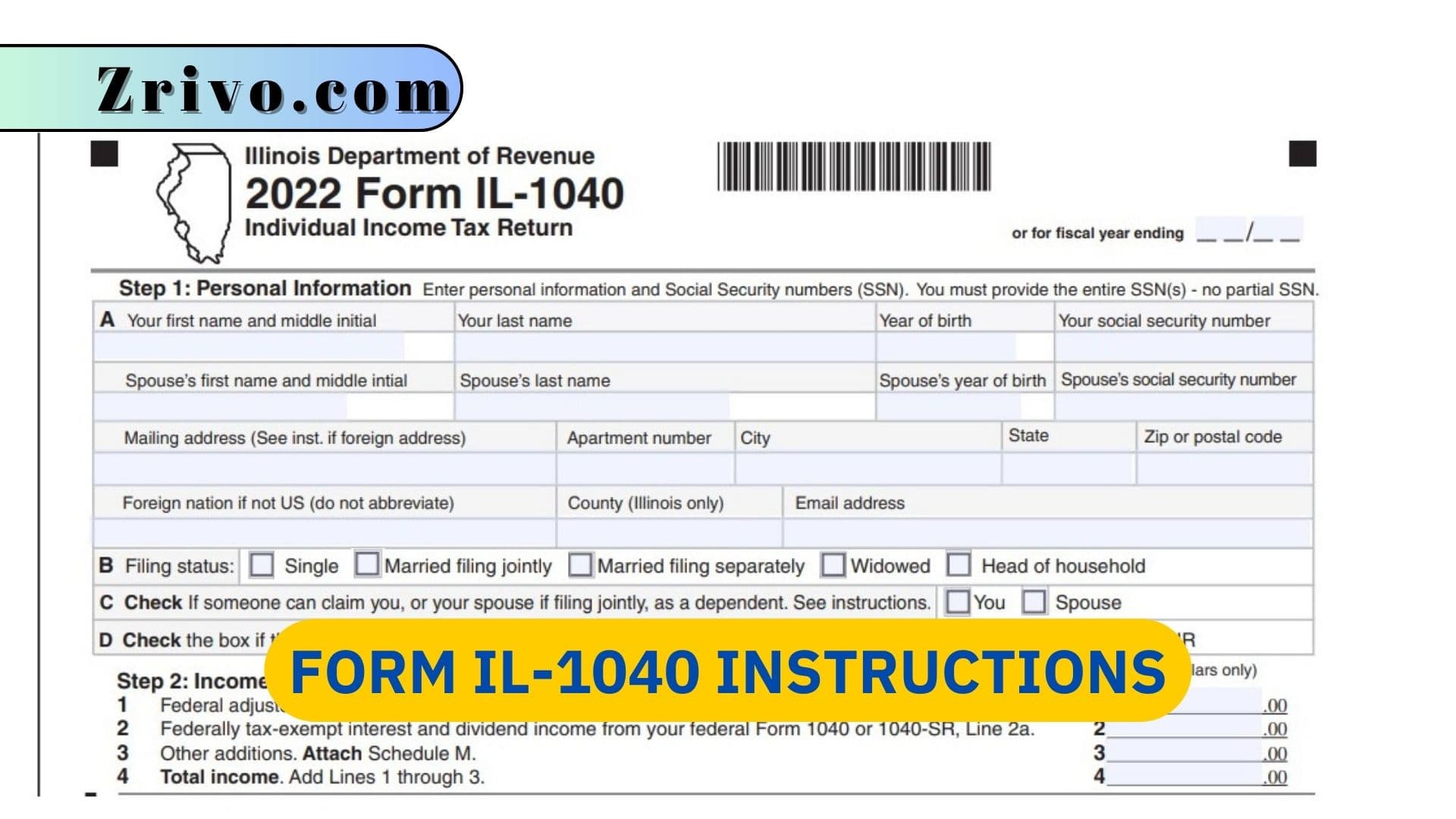

Form IL-1040 is a big tax form to complete. You can visit the link to download the PDF version of the form. Illinois Department of Revenue makes it possible for you to complete Form IL-1040 in 12 steps. You can follow these steps to fill out your Form IL-1040 without any problems.

Step 1: Personal Information: This is where you need to enter your personal information.

Step 2: Income: Add Lines 1 through 3 to figure your total income.

Step 3: Base Income: Subtract Line 8 from Line 4 to figure your Illinois base income.

Step 4: Exemptions: Enter the exemption amount for yourself and your spouse. Add Lines 10a through 10d to figure your Exemption allowance.

Step 5: Net Income and Tax: Add Lines 12 and 13. This is your net income and tax, and it cannot be less than zero.

Step 6: Tax After Nonrefundable Credits: s. Subtract Line 18 from Line 14 to figure your tax after nonrefundable credits.

Step 7: Other Taxes:

- Household employment tax

- Use tax on internet, mail order, etc.

- Compassionate Use of Medical Cannabis Program Act and sale of assets by gaming licensee surcharges

Add these lines to figure your total tax here.

Step 8: Payments and Refundable Credit: Add Lines 25 through 29. This is your total payments and refundable credit.

Step 9: Total:

Line 31 – If Line 30 is greater than Line 24, subtract Line 24 from Line 30.

Line 32 – If Line 24 is greater than Line 30, subtract Line 30 from Line 24.

Step 10: Underpayment of Estimated Tax Penalty and Donations: Add Lines 33 and 34 to figure your total penalty and donations.

Step 11: Refund or Amount you owe:

Line 36 – You have an amount on Line 31, and this Amount is greater than Line 35, subtract Line 35 from Line 31. This Amount is your overpayment.

Line 38 – Checkboxes for your preference ( direct deposit or paper check.)

Line 39 – Subtract Line 37 from Line 36 to figure the Amount to be credited forward.

Line 40 – Here is the formula for the Amount you owe:

- If you have an amount on Line 32, add Lines 32 and 35.

- If you have an amount on Line 31 and this Amount is less than Line 35, subtract Line 31 from Line 35.

Step 12: Health Insurance Checkbox and Signature: Finish and sign the form.