Form 8917 is the Internal Revenue Service (IRS) tax form used to claim the tuition and fees deduction. This deduction is intended to help students, or their parents offset the costs of a post-secondary education, such as college or vocational school. The form allows taxpayers to reduce their taxable income and lower their tax liability or increase their refund. However, a few rules must be followed when filling out the form. Generally, taxpayers can’t use Form 8917 if they have a filing status of married filing separately, someone else claims them as a dependent, or their modified adjusted gross income (MAGI) is more than $80,000 as a single filer ($160,000 for married filers).

The tax deduction is only available for expenses related to a student’s education, including tuition and fees, required course materials, and the cost of certain housing accommodations. The amount of the deduction is limited to $4,000 per year and is only available to individuals who itemize their tax returns. The deduction is not refundable and cannot be carried over into future years. Students may also claim other education-related tax credits, such as the American Opportunity Tax Credit and Lifetime Learning Credit, which offer a dollar-for-dollar reduction in their taxable income.

A taxpayer or their dependent must receive a form 1098-T from the educational institution in order to qualify for the deduction. In addition, the educational institution must be qualified for federal financial aid and must have been a place that offers courses that meet an eligible educational program.

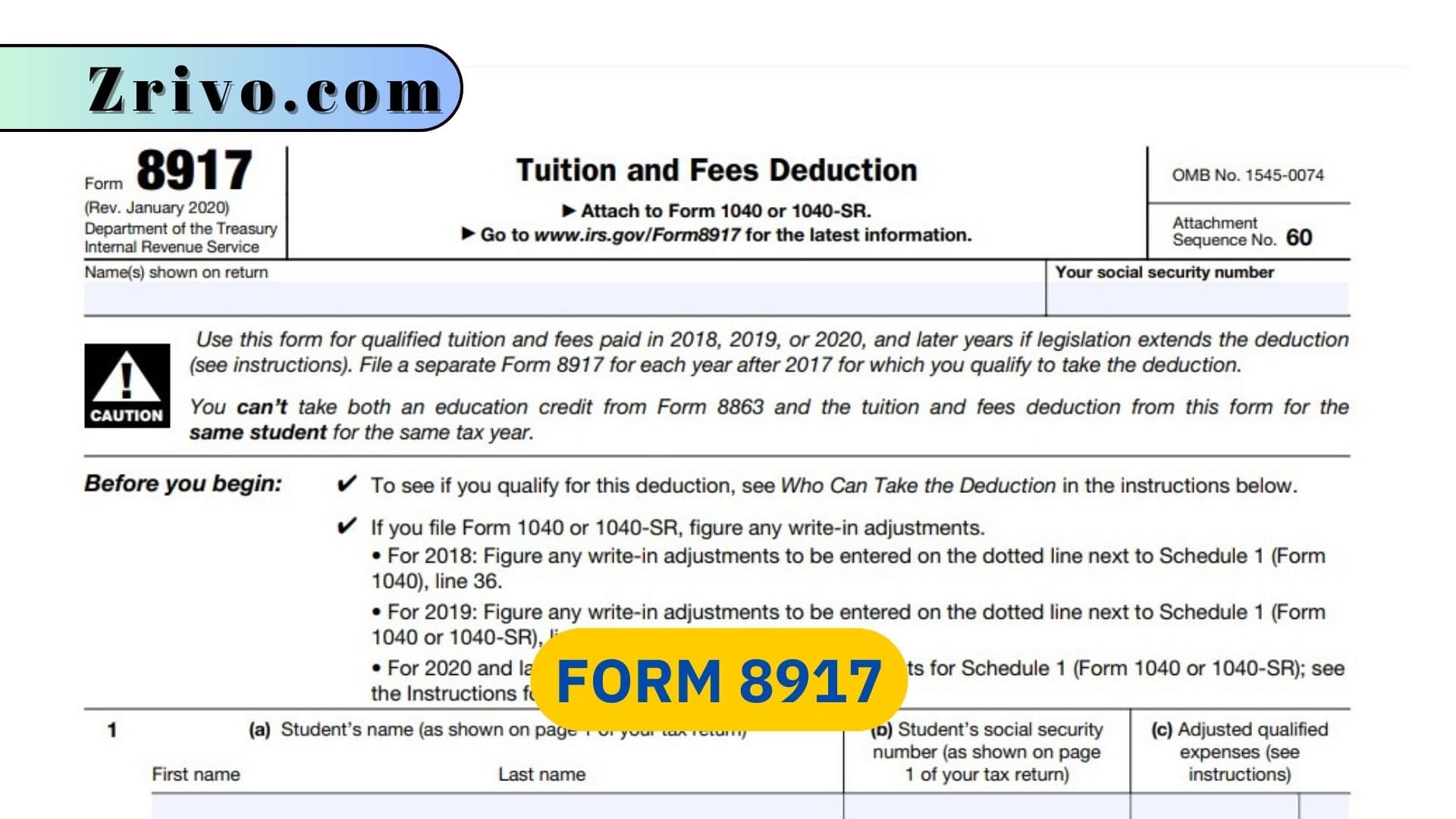

How to File Form 8917?

The form requires taxpayers to fill out basic information, such as their name, address, and social security number. They also need to provide details about their qualified expenses during the tax year. The IRS also provides a worksheet to help taxpayers calculate their maximum deductions.

To determine the amount of qualified expenses, taxpayers must determine their adjusted gross income. This can be done by summing up lines 23 through 33 of Schedule A of Form 1040 or by adding up line 15 of Form 1040A. They must then subtract the amount of line 4 from their adjusted gross income. The result is the amount of their tuition and fees deduction. The deduction is limited to the cost of tuition and fees, which are not covered by other educational tax benefits like the American Opportunity Credit or the Lifetime Learning Credit. The deductible amount cannot exceed $4,000.