The Internal Revenue Service offers a tax credit to encourage people with lower incomes to contribute to their retirement savings accounts. This credit is known as the Saver’s Credit. To claim the credit, taxpayers must file IRS Form 8880, “Credit for Qualified Retirement Savings Contributions.” Unlike deductions, credits directly reduce the amount of taxes owed. In order to qualify for the Saver’s Credit, taxpayers must have a qualifying retirement account (traditional IRAs, Roth IRAs, 403b plans, and 401k plans) and meet certain other requirements. Tax law changes, so it’s best to consult a professional before filing your return.

You can claim the amount of Saver’s Credit based on your filing status, adjusted gross income, and the amounts you contributed to qualifying retirement programs. You can use the worksheets in the instructions for Form 1040A or Form 1040 to figure your credit amount.

You must have a qualifying employer-sponsored retirement plan to claim the saver’s credit. These include traditional IRAs, Roth IRAs, 403b plans, and simple 401(k) plans. You can also contribute to an Achieving a Better Life (ABLE) account, an IRS-approved special needs savings plan. These accounts are not tax-deferred, but the contributions you make to them may be tax-deductible if certain conditions are met.

To qualify for the credit, you must have an adjusted gross income of at least $55,000 for single filers and $90,000 for married couples filing jointly. You must also not be a full-time student and not be claimed as a dependent by another person. You can file Form 8880 to claim the credit if you meet these requirements.

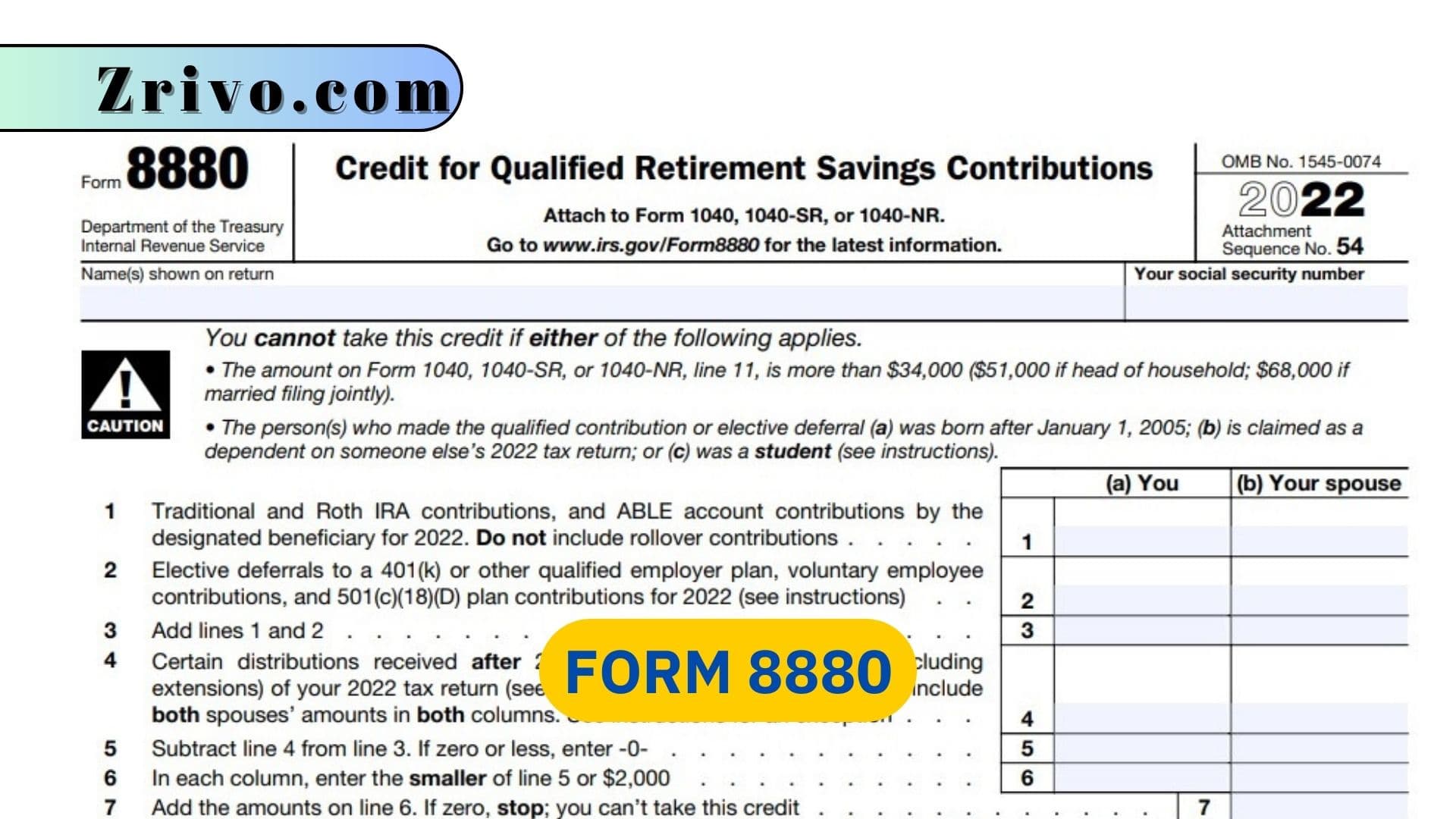

How to Fill out Form 8880?

The first step in filling out Form 8880 is to enter your income and employment information. Then, calculate your retirement contribution and taxable income to find out if you’re eligible for the credit. You can use a calculator or an online tool to help you with this calculation. After calculating your credit, complete the remaining parts of the form. In general, you will need to provide the following information:

- On line 2 of the form, you must list your adjusted gross income. This includes any earnings from jobs you held in the year as well as other types of income, such as interest or dividends. In addition, you must include the number of dependents you have.

- If you’re married, both spouses must include their individual taxable income and the number of dependents they have. You should also list your spouse’s name and Social Security number on this page. In addition, you must provide your total deductible contributions to qualifying retirement accounts. This amount includes contributions made to traditional and Roth IRAs as well as to 403b, 401k, and 457 plans. You may also qualify for the credit if you contributed to an Achieving a Better Life (ABLE) account.

You should carefully review your entries and double-check for accuracy before submitting Form 8880. Inaccurate information can lead to delays from the IRS or other tax issues. Moreover, doctoring the information on this form could land you in serious trouble.