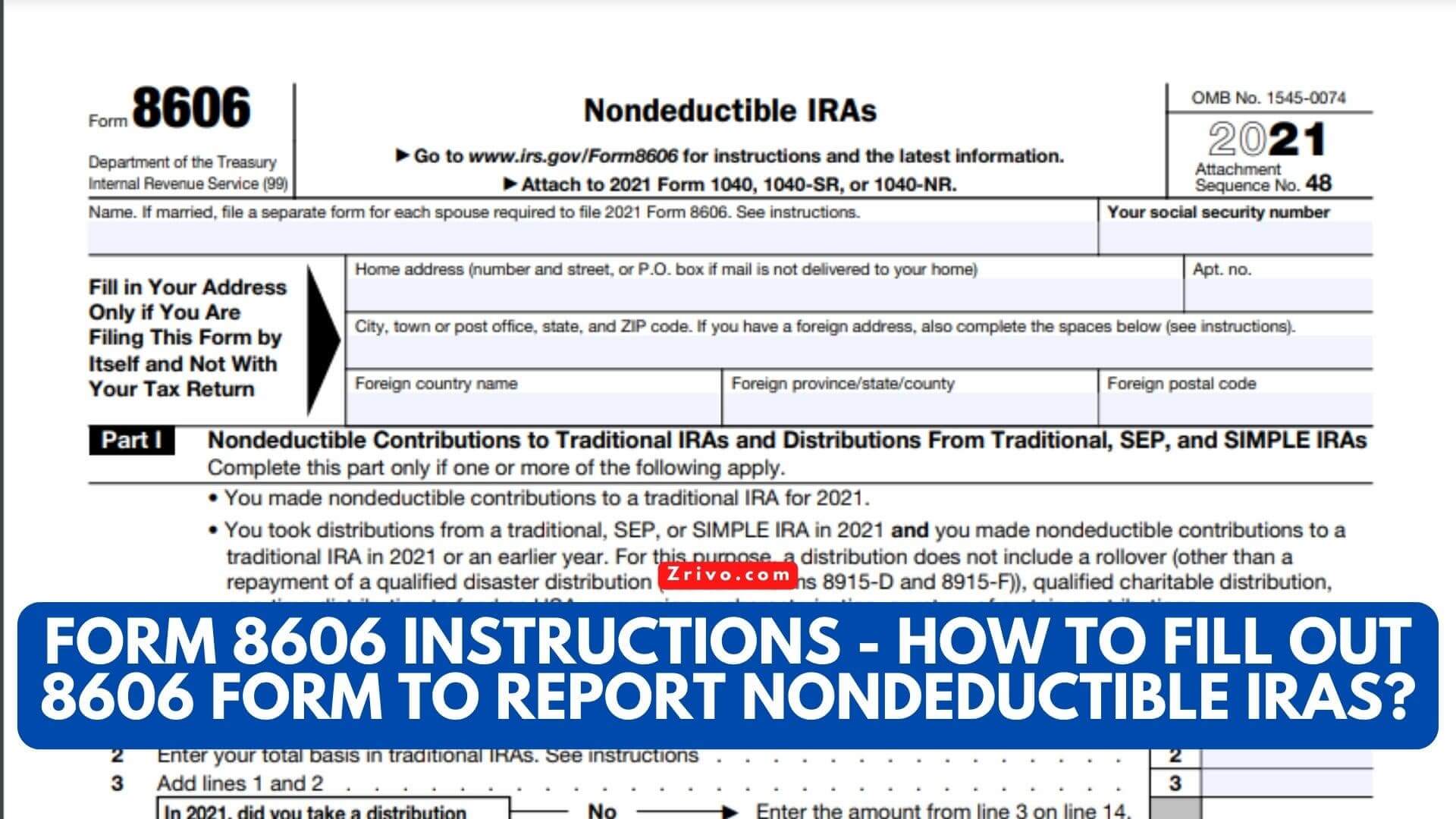

If you need to file Form 8606 but are unsure about how to do it, have no worries! We’ve got your back. All you need to do is follow these seven simple steps respectively!

- Step 1: Visit the IRS website and download the most recent Form 8606. Make sure that you have the appropriate software to run the PDF file you downloaded for editing.

- Step 2: If you have any deductions, such as the IRA Deduction Worksheet, you need to write down the result on Line 1 of Form 8606.

- Step 3: If it is your first-year filing of Form 8606, then you need to type 0 to line 2. Otherwise, you need to use the Total Basis Chart.

- Step 4: You need to provide your nondeductible contributions first, and then the deductible contributions on line 3.

- Step 5: You need to provide the total amount of your SEP, SIMPLE and traditional IRAs on line 6.

- Step 6: If you have any converted amount from SEP, SIMPLE, or traditional IRA in the previous year, you have to provide the net balance that was converted on the form.

- Step 7: If you used first-time homebuyer distribution between 1988 and 2010, you need to provide the capacity expenses on line 20. However, this balance should not exceed $10,000.

Other than these, all you need to do is follow the instructions available on the form and lines. Make sure that you accurately fill out the form to prevent any penalties, delays, or interest. As you can file Form 8606 via mail, you can also file it online, which is the recommended method by the IRS due to its benefits.