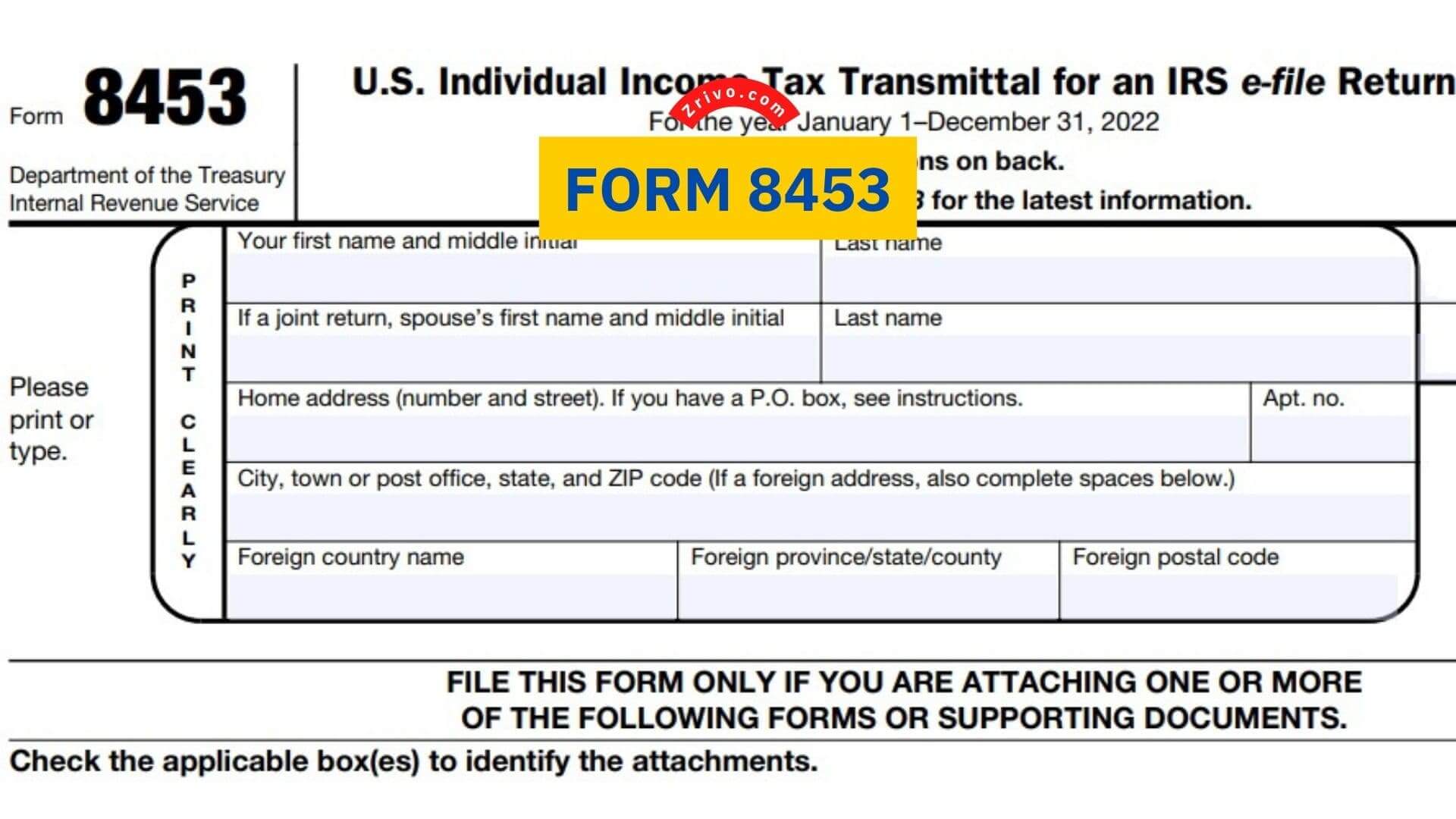

Form 8453 is used to verify that the IRS has received an electronically transmitted return and is complete. Form 8453 should be attached to a return and mailed to the IRS when you receive an electronic version of your request. Form 8453 also is required to be attached if you file a tax return using a software program that supports PDI. This is especially important if you are filing your return electronically. There are a couple of ways to make use of Form 8453.

- To use the Form 8453 feature, click the “Form 8453” option in your tax preparation software. This will open a window to let you select whether or not to attach the Form 8453 PDF file with your return.

- If you choose to print Form 8453, you’ll need to remember the name and location of your saved PDF file. Once you have the PDF file, you can scan it into your return and attach it to your electronic tax return.

- Alternatively, if you don’t want to print or save your Form 8453 PDF, you can enter a five-digit PIN number that will be used by the ERO to sign your return electronically. You will need to retain this number for three years in case the IRS asks you for more information on your return.

- If the ERO changes the electronic tax return after Form 8453-C has been signed, and before transmittal, the ERO must have the officer complete and sign a corrected Form 8453-C. This is because the total income on Form 1120, line 11, differs from the amount on the electronic return by more than $150, or the taxable income on Form 1120, line 30, differs from the amount on the electronic return.

When to file Form 8453?

When it comes to e-filing your taxes, you can send Form 8453 when it makes sense for your particular situation. For example, you might need to mail this form if you need to attach a consolidated Form 8949 with your Short Term Gains CSV to the top of your return.

You also might need to mail this form if you have a supplemental statement (like a 1099-B) that was required by the IRS to be attached to your return. These statements can include items like your brokerage statements or your W-2 wages and tax forms.

The best way to decide whether or not you need to send Form 8453 is to review your e-filing options for the year. If you have a choice, it might be best to opt for a paper filing option and mail your supplemental statements later.

The information you enter on Form 8453 is confidential and should not be disclosed to anyone else. It is important to make sure that your information is accurate and complete.

If you have any questions about the form or how to fill it out, you can contact the IRS at 1-877-366-3255. You can also visit the IRS website to learn more about the tax filing process.

Unless you are sending Form 8949 or Form 1099-B, you will not need to mail any other attachments to the IRS with your e-filed tax return. However, if you are using the summary transaction method for your Form 1099-B transactions (meaning that you entered your totals instead of entering each sale), you will need to mail a supporting statement with Form 8453.

How to file Form 8453?

Form 8453 is used by an Electronic Return Originator (ERO) to send any required paper document attachments or allowed supporting documentation to the IRS for electronically filed returns. The IRS requires the ERO to mail Form 8453 within three business days after receiving an acknowledgment that the IRS has accepted the electronically filed return.

Important note: This form should be kept for 3 years after the year in which the return is filed. Unless the client requests that the form be destroyed, the ERO must retain it for the entire three-year period.

If a taxpayer is filing Form 500, 500 EZ, or 500X, the ERO must have the taxpayer complete this form and sign it. The ERO must also affix a signature in the space provided for the preparer and check the box labeled “Check as if paid preparer” before transmitting the form to the Georgia Department of Revenue.

The ERO must also provide a copy of this form to the taxpayer(s). If the ERO makes changes to the electronic return after the GA-8453 has been signed by the officer, whether it was before transmission or if the return was rejected after transmission, the ERO must have the taxpayer complete and sign a corrected GA-8453.