Form 7202 allows self-employed taxpayers to make claims for up to $15,110 in tax credits. However, self-employed taxpayers must meet specific requirements to qualify. This includes being a sole proprietor or LLC owner or a business partner. This article will be a quick guide for those looking for Form 7202 instructions for 2024 - 2025.

Who Can File Form 7202?

Self-employed individuals must submit this form in response to a series of questions on their tax returns. These questions include questions on employment and qualifying sick leave or family leave. To file an accurate return, self-employed people must review the form to ensure its entries reflect income. It is important to note that the IRS doesn’t currently accept electronic filing of this form, so paper filing is the only option for the time being.

In other words, If you are self-employed, this form is for you. You can use it to claim refundable sick leave and family leave credits. These credits are refundable, so self-employed people can claim them if they cannot work due to COVID-19. To qualify for the credit, you must have taken and received a qualifying leave from a prior employer.

How to File Form 7202?

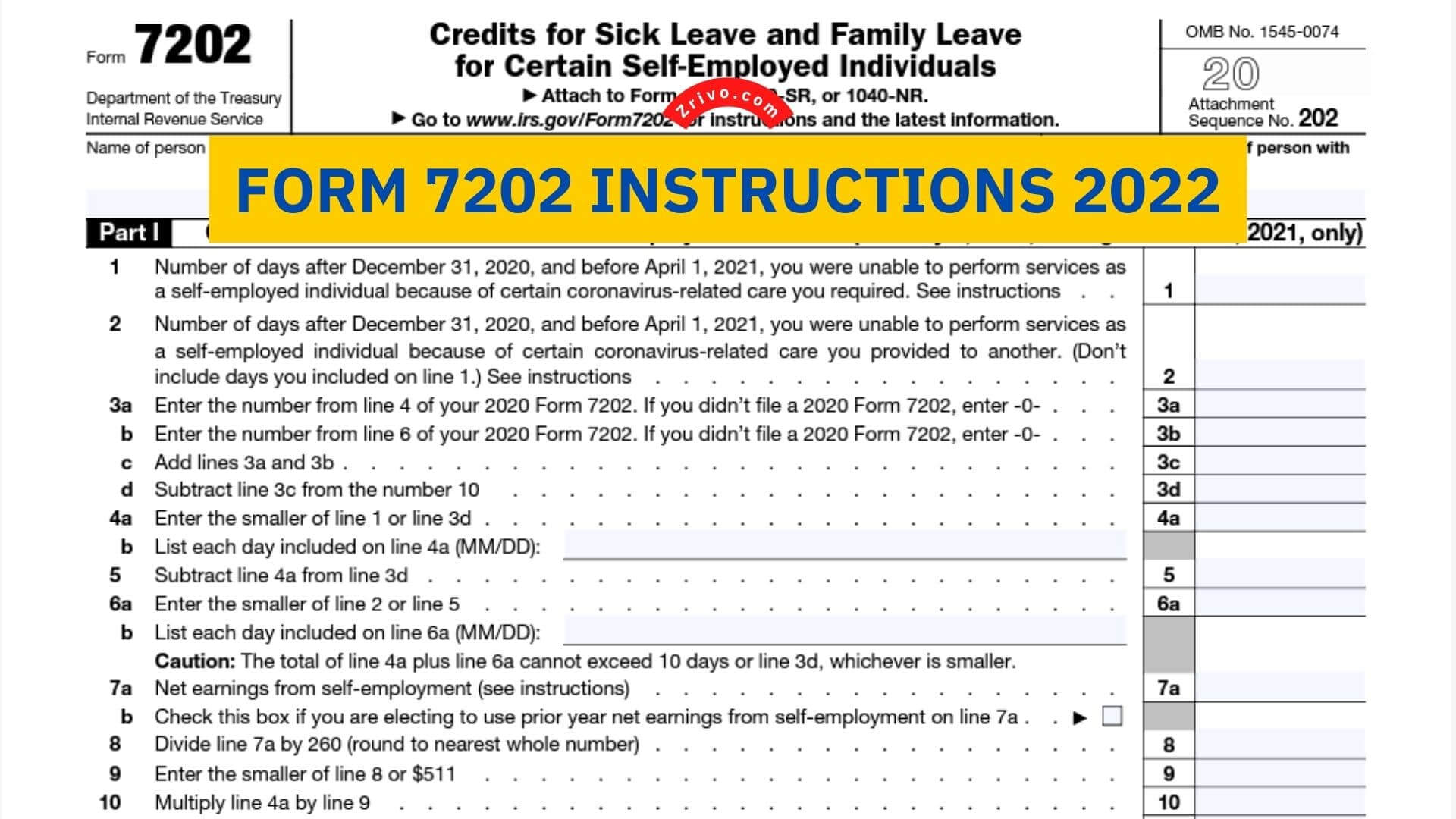

Form 7202 is an IRS tax form that specific self-employed individuals must file with their individual income tax returns. This form is intended to help self-employed individuals claim their qualified family and sick leave equivalent tax credits. Form 7202 can be attached to Form 1040. Self-employed individuals file their taxes.

Form 7202 is not an e-file form, so you should file it manually. You should attach the form as a PDF file if you file it electronically. You will have to type the dates in the form’s input field, and the system will report them in the order they were entered. You can find the Form 7202 forms on IRS’ website and file your Form 7202 on your own without any problem.