You will likely need to complete Form 6251 if you’re subject to the alternative minimum tax (AMT) and have taxable income exceeding certain thresholds. This IRS form calculates whether you owe the AMT and, if so, how much. It also adds back some tax breaks you may have claimed on your original Form 1040 tax return. For taxpayers with a high income and a lot of deductions, the alternative minimum tax (AMT) is a way to ensure that these people pay their share of taxes. It uses different rules than the regular tax system to determine your taxable income. This allows the AMT to limit some preferential tax benefits that would otherwise be available.

You can complete Form 6251 on your own or use an online filing provider to e-file it for you. The IRS suggests using an e-filing service to ensure that your return is handled as quickly as possible. If you have any questions, call the IRS toll-free at 800-829-1040.

What is the Alternative Minimum Tax (AMT)?

The AMT is an income tax created to help ensure that wealthier individuals pay their fair share of taxes. Unlike regular income taxes, the AMT doesn’t allow certain deductions and credits that can lower a taxpayer’s tax liability Generally, the AMT is triggered by taxpayers with an income exceeding the AMT exemption limit for the year. You may not have to calculate the AMT for each year, depending on your income level. The AMT uses different rules than regular tax rules to calculate your taxable income. It adds back a few normally tax-free income types and removes certain deductions and credits. This increases your adjusted gross income, raising your AMT tax rate.

The AMT can devastate your finances if you have a high income and claim many tax deductions. You may lose some of the benefits you receive in the traditional tax system, such as deductions for medical and dental expenses or investment interest expenses. However, you can still minimize your AMT tax with a tax strategy. A financial advisor can help you develop a plan to maximize your tax-free income and limit your AMT liability.

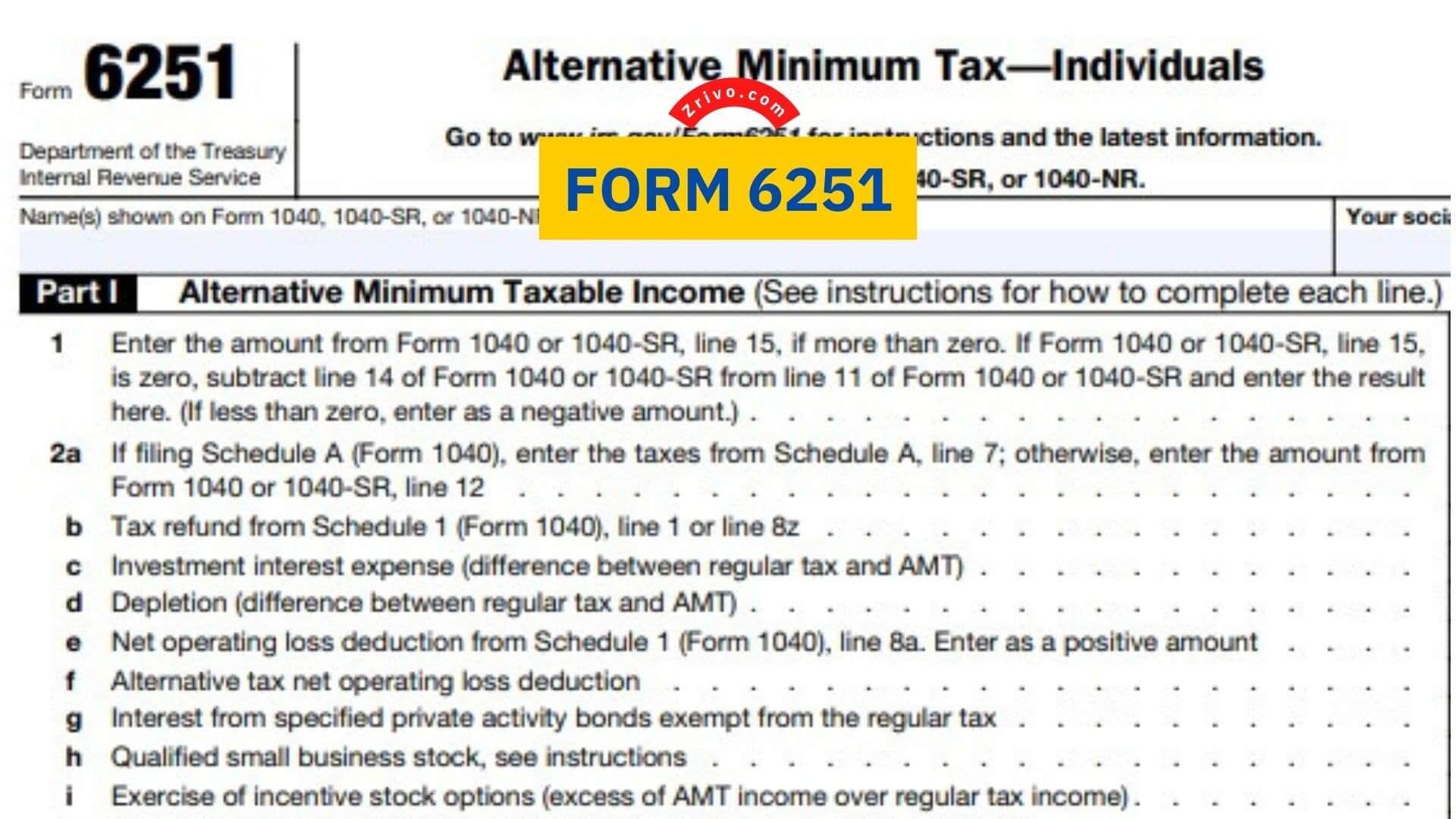

Form 6251 Instructions

To complete Form 6251, you need to provide some basic information about your income and assets. This information includes your adjusted gross income, net worth, capital gains, and losses. Here is what you need to do:

- Part I of the form refigures your income and deductions from the original tax return and subtracts your personal and dependent exemptions to determine the amount of the AMT you owe. The form also includes several lines that allow you to claim an AMT exemption based on your filing status.

- In Part II, you figure your AMT liability by multiplying your alternative minimum taxable income (AMTI) by either 26% or 28%, depending on where you fall within the instructions on line 4. You also subtract any foreign tax credit that you may qualify for from your AMTI.

- Part III refigures your capital gain and qualified dividend income from the original tax return. You can complete this portion of the form online or by hand, and it’s a great resource to use if you have any questions about your income. The form also includes a capital gain excess worksheet that helps you determine whether you have a capital gain excess.