Form 4797 is a tax form distributed by the Internal Revenue Service (IRS) to report gains made from the sale or exchange of business property, including property that generates rental income or is used for industrial, agricultural, or extractive resources. If you’re a business owner, it’s important to understand how Form 4797 works so that you can correctly report your gains and losses on your taxes.

To make this process easier, creating a file or spreadsheet that lists each piece of property you own is a good idea. This will make it simpler to determine whether or not you have an asset that belongs in each section of Form 4797.

How to file Form 4797?

Form 4797 is an IRS form used when someone sells property used as a business. This type of real estate can produce cash flow and can be beneficial to investors who are looking to maximize their profits. However, filling out this form can be complicated, and getting help from a professional is best.

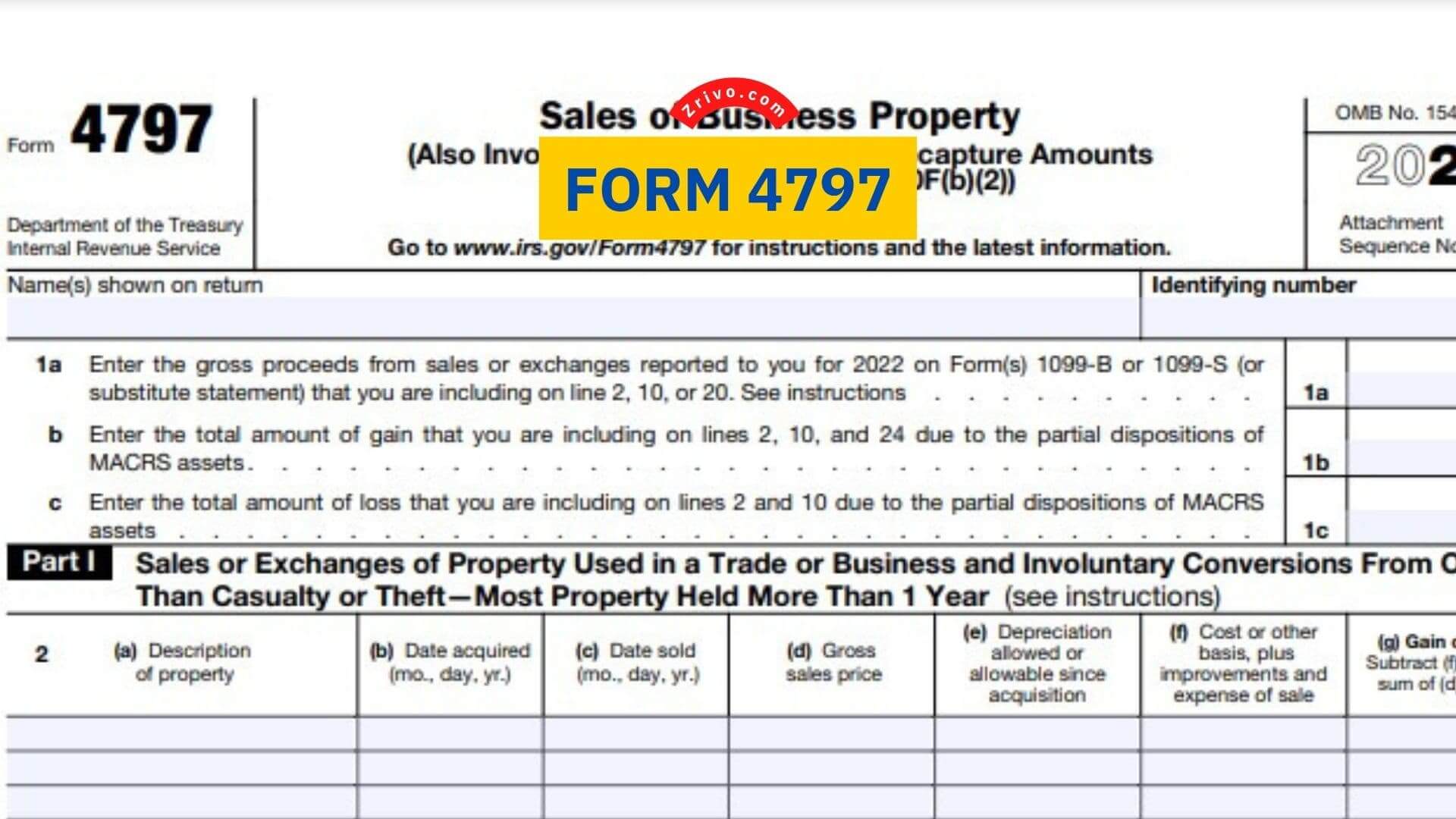

When filing this form, you must provide the followings:

- You must enter descriptions of each property

- You must enter the date that the property was acquired and sold

- You must enter the purchase date of each property

- You will also need to enter the depreciation amount taken for each piece of property.

The information that you will enter on this form will be used to calculate your gains and losses for the tax year. It is important to follow the instructions on this form carefully because it can result in penalties or fines if you do not fill it out correctly. It is also important to note that you will need to include any nonrecaptured Section 1231 losses on this form. This will ensure that the IRS has an accurate picture of your income for the tax year.

For more information on how to file this form, you can visit the IRS website or seek help from a professional. Regardless of which method you choose, it is important to remember that this form must be filed by the due date. You will need to fill out this form if you have realized capital gains or losses from the sale of business property in the current tax year. This form is also used to report gains and losses from previous years as well. This form is a bit different from Schedule D, a general tax form used to report personal gains and losses.

What is the Difference Between Form 4797 and Schedule D?

Whether you need to file Form 4797 or Schedule D depends on the type of property you sold or transferred. Taxpayers who sell property primarily used for personal purposes will likely use Schedule D to report their gains and losses. However, property used for business and personal purposes may be reported on both forms. For example, If you purchased two condos, one was used as your primary residence while the other was rented out to others. When you sold the property, you realized a profit of $45,000. This gain is taxable, but you can exclude $22,500 of it on Schedule D. If you were a self-employed person or an independent contractor who generated your income from your main home, you would be eligible to claim that exclusion.

Another situation where you might be required to report your gains on Form 4797 is if you owned depreciable property and non-depreciable property in the same transaction. In this case, you need to allocate the amount you realize between the two types of property based on their Fair Market Values (FMVs). It is important to note that Form 4797 requires a lot of information and can be very confusing for taxpayers who are not familiar with it. Therefore, getting professional advice from a CPA or other tax professionals is a good idea before you file your taxes.

Things to Consider When Filing

When it comes to determining whether or not you should report a gain or loss on the sale of business property, there is a lot to keep in mind. For one thing, you’ll need to consider the “cost basis” of the asset that you’re selling. This is not just the amount that you originally paid for the item, but also any depreciation that has been accumulated. Another important factor to consider is how long you’ve owned the item in question. This will help you determine how much of a gain or loss you should include when reporting on Form 4797.

You should also be aware of any special provisions that apply to the property you’re selling. For example, if you own a home that’s used for both business and residential purposes, you may not have to report any gains from the sale of that house on Form 4797. However, if you own a duplex and use one of the units as a rental to generate income for your business, you might have to report any gains on that duplex when filing your taxes. In this case, you’ll need to account for the gain in part I of Form 4797.

If you have any other assets subject to tax treatment via Form 4797, it’s best to check with a professional tax expert to ensure that you comply with all of the IRS rules and regulations. In addition to this, it’s important to remember that fully understanding and complying with the requirements of Form 4797 will take some time and effort, so make sure to get the right help when filing your taxes.