Whether you are an individual taxpayer or a small business owner, you may need to fill out Form 3115 at some point. This IRS form is used to request a change in either the overall method of accounting or the accounting treatment for a specific item. There are several different accounting methods to choose from, and certain rules must be followed when filing Form 31115. For example, if you are changing your accounting method from cash basis to accrual basis, you must file this form to get the IRS’ official OK. The same goes for changing from an intangible assets cost segregation study to a tangible assets depreciation study, or vice versa. You must also file this form to correct omitted depreciation. This is done by using code 7 if the asset is still in use or code 107 if the asset has been disposed.

If you are making a change in your accounting method, it is best to file this form as early as possible during the year of the change. This will give the IRS plenty of time to review your request and make any necessary changes. The IRS website lists the address where you should send Form 3115, along with any additional documentation that needs to be included with your submission. This includes your company’s income statement and balance sheet from the previous year as well as your accounting details and totals for the current year.

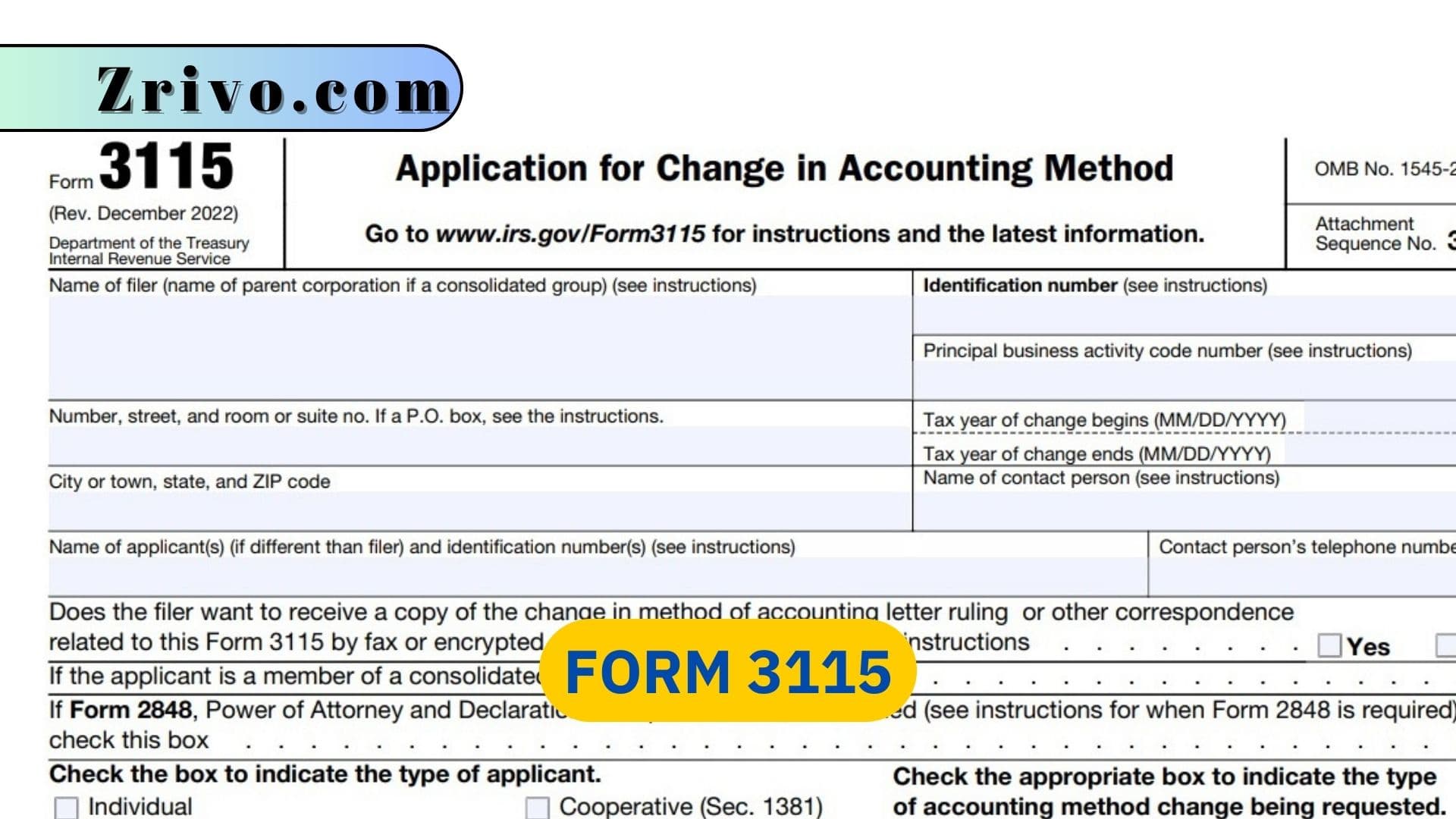

How to Fill out Form 3115?

You’ll have to provide a lot of detailed information when filling out Form 31115, including your business’s financial statement information and its balance sheets. You’ll also need to include tax year details, accounting details and totals, and any adjustments you made in your books. Depending on the kind of change you’re making, you may need to include additional information, like a statement explaining why your business is changing its accounting methods or a letter ruling from the IRS that grants you permission to make a non-automatic change. For example, if you’re changing from cash basis to accrual basis, the IRS will want to know what kinds of assets you own and when you record income and expenses. The simplest way to do this is by submitting a 3115 Form.

Some types of changes don’t require you to file a 3115, though. For example, if you’re making a depreciation change due to the implementation of a cost segregation study on your property, that doesn’t qualify as an accounting method change under the automatic change rules. Instead, you’ll have to request a letter ruling from the IRS in order to make that change.