Employees file Form 2106, Employee Business Expenses, to deduct ordinary and necessary expenses for their job, and Form 2106 Instructions, both provided by the IRS and us, are not so hard to understand. Many employers reimburse job-related expenses, but the IRS offers tax breaks through Form 2106 for those who don’t. Form 2106 allows employees to deduct expenses that are ordinary and necessary for the performance of their jobs, which means they must be common in your trade or business and must help you do your job. Some examples of work-related expenses include a personal cell phone, clothing worn on the job, travel and meals while away from home for business purposes. Other expenses that may be deductible include medical and dental care, insurance premiums, and membership fees for professional organizations. This article will cover detailed Form 2106 Instructions for taxpayers.

How to File Form 2106?

When completing Form 2106, you must answer several questions regarding your vehicle and other work-related expenses. For example, you’ll need to know the year, make, and model of your vehicle and its mileage numbers. You’ll also need to decide whether you will use the standard mileage rate or actual expenses when calculating your deduction. If you’re not sure which method to use, it’s best to figure your costs both ways and use whichever is more beneficial for you.

Depending on the type of expenses you’re claiming, you may need to provide documentation such as receipts or other written records. For example, if you’re deducting car expenses, you’ll need to include your car’s purchase date, the number of miles driven for business purposes (including commuting), and any other information your employer or insurer requests.

How to Fill Out Form 2106?

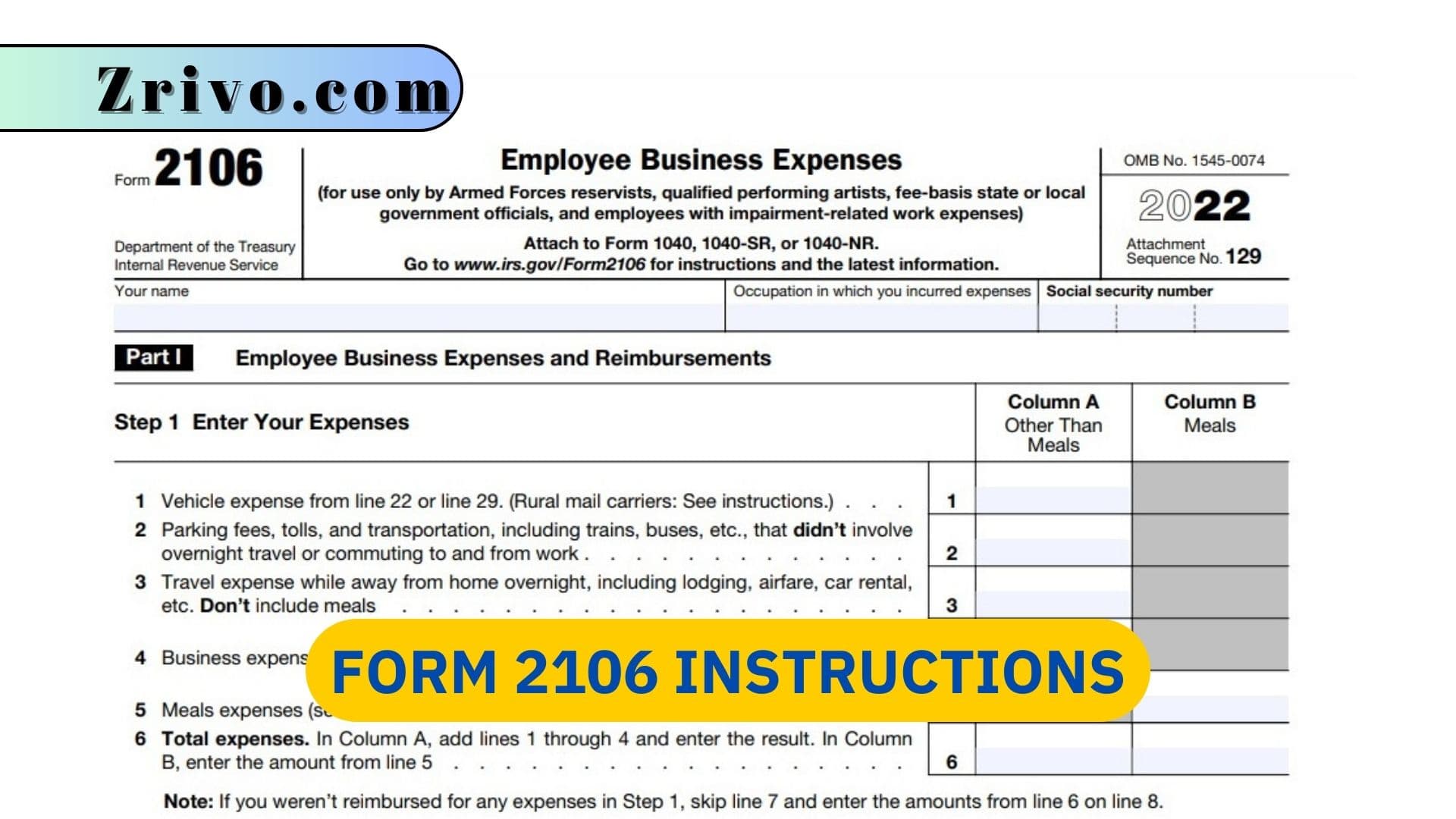

Form 2106 has two Parts:

- Part I Employee Business Expenses and Reimbursements

- Part II Vehicle Expenses

Part I Employee Business Expenses and Reimbursements

— Step 1 Enter Your Expenses—

Line 1 – Vehicle Expenses from Line 22 or 29.

Line 2 – Parking fees, tolls, and transportation, including trains, buses, etc.(overnight travel or commuting to and from work not involved. )

Line 3 – Travel expenses while away from home overnight, including lodging, airfare, car rental, etc. ( Meals not included).

Line 4: Business expenses not included on lines 1 through 3. ( meals not included).

Line 5: Enter meal expenses.

Line 6: Total expenses. Add lines 1 through 4 in Column A. In Column B, enter the amount from line 5. This is your total expenses.

Line 7:

–Step 2 Enter Reimbursements Received From Your Employer for Expenses Listed in Step 1–

–Step 3 Figure Expenses To Deduct–

Line 8: Subtract line 7 from line 6. If zero or less, enter -0- here. If line 7 exceeds line 6 in Column A, report the excess as income on Form 1040 or 1040-SR, line 1 (or on Form 1040-NR, line 1a).

- You can’t deduct employee business expenses if both columns of line 8 are zero. You are done. Stop here and attach Form 2106 to your return.

Line 9: In Column A, enter the amount from line 8.

Line 10: Add the amounts on line 9 for both columns and enter the total here. Also, enter the total on Schedule 1 (Form 1040), line 12.

Part II – Vehicle Expenses

There are 4 sections in this part:

- Section A – General Information

- Section B – Standard Mileage Rate

- Section C – Actual Expenses

- Section D – Depreciation of Vehicles

Line 11: The date the vehicle placed in service

Line 12: Total miles driven in 2022

Line 13: Business miles on line 12

Line 14: Business use percentage. Divide Line 13 by Line 12.

Line 15: Average daily roundtrip commuting distance

Line 16: Commuting miles included on line 12

Line 17: Other miles. Add lines 13 and 16 and subtract the total from line 12

Line 18-21: Answer the questions.

Line 22: Multiply line 13 by 58.5¢ (0.585) (January 1–June 30) and 62.5¢ (0.625) (July 1–December 31). Enter the result here and on line 1. Standard Mileage Rate.

Line 23: 23 Gasoline, oil, repairs, vehicle insurance, et

Line 24a: Vehicle rentals.

Line 24b: Inclusion amount.

Line 24c: Subtract line 24b from 24a.

Line 25: Value of employer-provided vehicle.

Line 26: Add lines 23, 24c, and 25

Line 27: Multiply line 26 by the percentage on line 14

Line 28: Depreciation (see instructions)

Line 29: Add lines 27 and 28. Enter total here and on line 1.

Line 30: Enter cost or other basis.

Line 31: Enter section 179 deduction and special allowance

Line 32: Multiply line 30 by line 14.

Line 33: Enter depreciation method and percentage.

Line 34: Multiply line 32 by the percentage on line 33.

Line 35: Add lines 31 and 34

Line 36: Enter the applicable limit (explained in the line 36 IRS instructions)

Line 37: Multiply line 36 by the percentage on line 14

Line 38: Enter the smaller of line 35 or line 37. If you skipped lines 36 and 37, enter the amount from line 35. Also, enter this amount on line 28 above