Form 1099-MISC is a tax form that reports miscellaneous payments made in a trade or business. The Form can be filled out by a business or an individual and includes information about the payments made, like income from royalties, rent, and medical payments.

1099-MISC Form is easy to understand and fill out. It is made up of several boxes. On the left, there is a field for the payer’s account number. This is generally filled out if the payer has more than one account for the recipient. Similarly, there are several fields for the recipient’s contact information.

When Do We File 1099-MISC Form?

The 1099-MISC Form is notable for its ability to alert the IRS of owed taxes. The IRS will send you a 1099-MISC Form if you report payments that are over $600. The Form is also relevant if you receive royalties, prizes, or other forms of compensation.

The 1099-MISC Form is not only relevant to self-employed individuals but also for businesses with independent contractors. For example, if you have an independent contractor who earned more than $600 in the last calendar year, you may need to fill out a 1099-MISC Form. However, if you have an independent contractor who earns less than $600 in the same year, you do not need to fill out a 1099-MISC.

Note: If you are paying someone at least $600 in cash or in-kind for rent, medical services, or any other typical service, you must file a Form 1099-MISC. Again similarly, if you are paying someone more than $600 in cash or in-kind for prizes or other awards, you will need to file a 1099-MISC Form.

How to Fill Out 1099-MISC Form?

Whether a small business owner or an independent contractor, you’ll need to know how to fill out the 1099-MISC Form. This Form has been designed to help you report payments you have made to others. This includes royalties, tax-exempt interest, and backup withholdings. It is also used to report payments you have made to non-corporate entities.

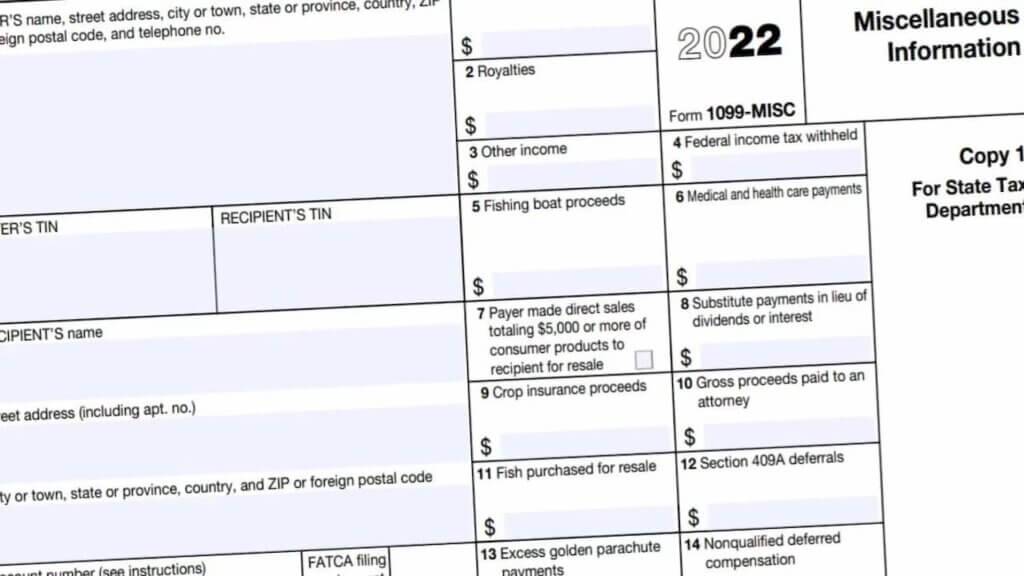

If you are self-employed, you’ll have to file Form 1099-MISC to report all of the revenue you earned during the year. This Form has several boxes, each for a specific payment type. For example, Box 7 is for rent. Box 6 is for payments to a healthcare provider, and Box 5 is for an individual’s share of the sale proceeds. The 1099-MISC Form contains other standard boxes, such as Box 16, which is for state tax withheld.

It also contains a couple of side-by-side boxes, such as Box 7 and Box 18. In Box 7, you’ll need to enter the recipient’s name and tax identification number (TIN) to report your income. You’ll also need to enter the recipient’s street address and zip code. This information should be correct since the IRS will not process a downloaded 1096 Form.

There are other similar forms, such as Form 1099-SA and Form 1099-R. These are primarily used to report non-employee compensation. You’ll also need to file Form 1099-MISC, which is used to report payments to non-corporate entities. You’ll also need to report the tax-exempt interest on Form 1099-MISC.

You’ll need to provide Form 1099-MISC to your clients if you’re an independent contractor. You can choose to mail this Form to the recipient or e-mail it to them. If you use e-mail, you’ll need to follow the guidelines of the IRS to ensure that you’re not delivering the Form to the wrong address.

We also suggest using a software program to make filling out Form 1099-MISC easier. This can save you time and money.

Step-by-Step Instruction

- Recipient Information: Provide the recipient’s name, address, and taxpayer identification number (TIN). Double-check the accuracy of this information to prevent errors.

- Payer Information: Include your business name, address, and TIN. Ensure consistency with your business’s tax records.

- Box 1: Rents: Report amounts of $600 or more paid for rent of property.

- Box 2: Royalties: Report payments of $10 or more in royalties during the tax year.

- Box 3: Other Income: This box includes a variety of payments such as prizes, awards, and certain payments to fishing boat crew members.

- Box 4: Federal Income Tax Withheld: Report any federal income tax withheld from the payments.

- Box 5: Fishing Boat Proceeds: Applicable to fishing boat operators who share proceeds with crew members.

- Box 6: Medical and Health Care Payments: Report payments made to medical and healthcare service providers.

- Box 7: Non-employee Compensation: This is a key box for reporting payments to independent contractors and freelancers.

- Box 8: Substitute Payments: Report substitute payments in lieu of dividends or tax-exempt interest.

- Box 9-10: These boxes are reserved for future use and currently remain empty.

- Box 11: Payer’s State Number and Box 12: State Tax Withheld: These boxes capture state-specific information.