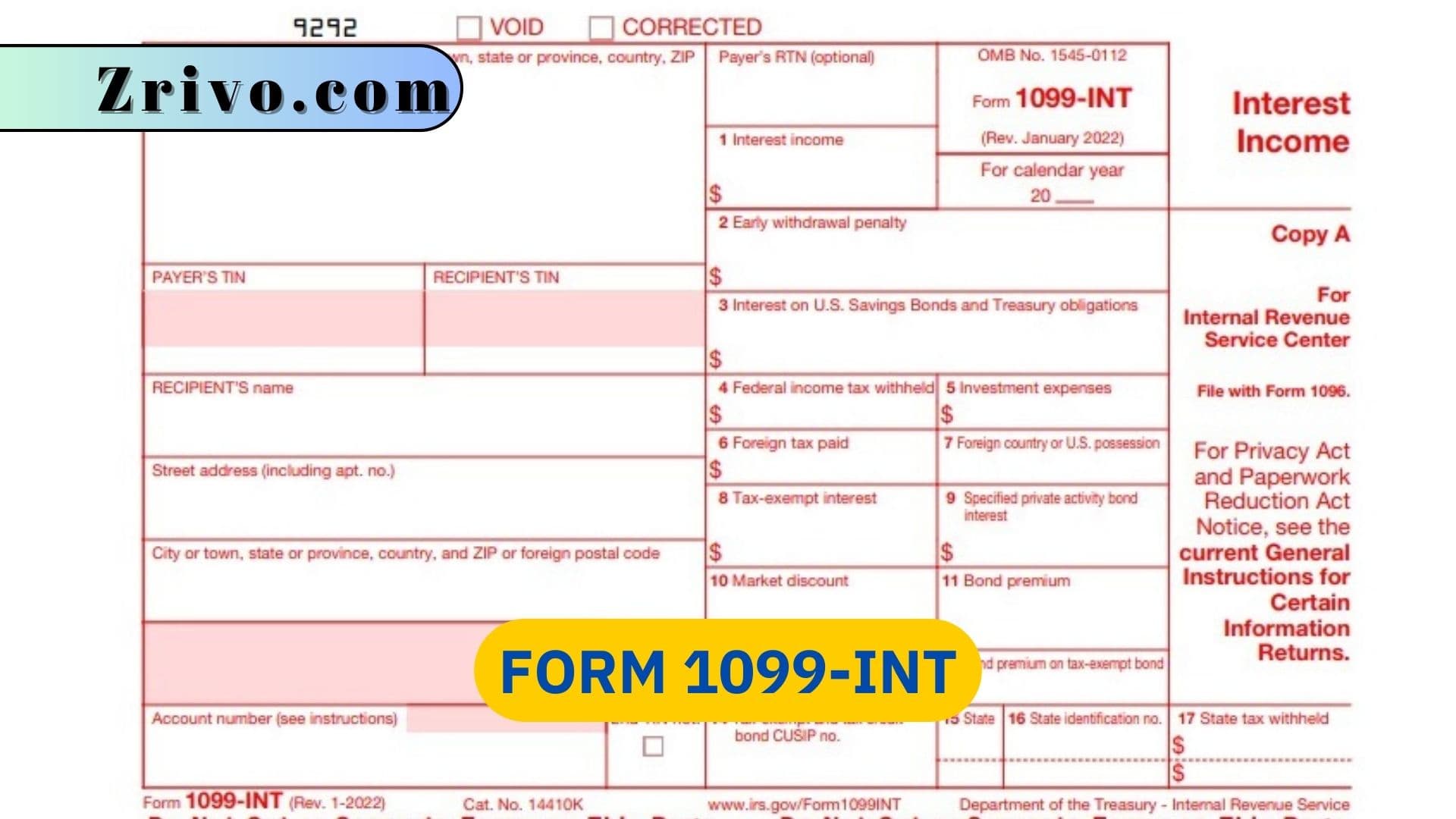

A 1099-INT is a tax form that reports interest income. It is usually issued by banks and other financial institutions that pay interest to their account holders. You can also receive one if you earn interest from investments such as bonds or money market accounts. The form is used to report taxable and tax-exempt interest to the IRS. It is also used to report any federal income tax that was withheld during the year.

Generally, you should expect to receive a Form 1099-INT late in January from the bank or institution that paid you interest. However, some entities and individuals are exempt from receiving a 1099-INT, such as corporations, tax-exempt organizations, certain individual retirement arrangements, and U.S. agencies. In addition, the form may not be required if the interest payment is made to an individual by a corporation that does not have a social security number and/or does not have a taxpayer identification number (TIN).

Who Must File Form 1099-INT?

Anyone who receives taxable interest income should expect to get Form 1099-INT in the mail from a financial institution. This includes banks, credit unions, and investment firms. It also includes companies that offer certificates of deposit, money market accounts, and treasury bonds. Generally, these institutions are required to issue a Form 1099-INT for any accounts that earn $10 or more in interest during the year. Some financial institutions may choose not to issue a Form 1099-INT if they don’t think the interest earned is significant enough to warrant it.

Most entities that pay interest will need to file Form 1099-INT, but the IRS lists several types of businesses and other organizations that are exempt from this requirement. These include mutual savings banks, building and loan associations without capital stock represented by shares, cooperative bank, homestead associations, and credit unions. In addition, the IRS notes that the reporting requirements don’t apply to corporations, tax-exempt organizations, IRAs, or certain other retirement accounts.

In addition to stating the amount of interest paid, the 1099-INT must report other items related to the payment. This information may include the amount of federal income tax withheld, any foreign taxes paid, and other applicable data. This information should be reported to both the recipient and the IRS.

How to File Form 1099-INT?

Filing Form 1099-INT can be a complicated process, but it’s important to understand the rules and requirements in order to make sure that you’re filing correctly. If you have any questions about filling out the form or need assistance, consult a qualified tax professional. They can help you ensure that your taxes are filed correctly and on time. And they can help you avoid penalties and interest charges for late or incorrect filings. A tax professional can also help you determine whether or not you need to file a Form 1099-INT and how much tax you may owe based on your interest income.