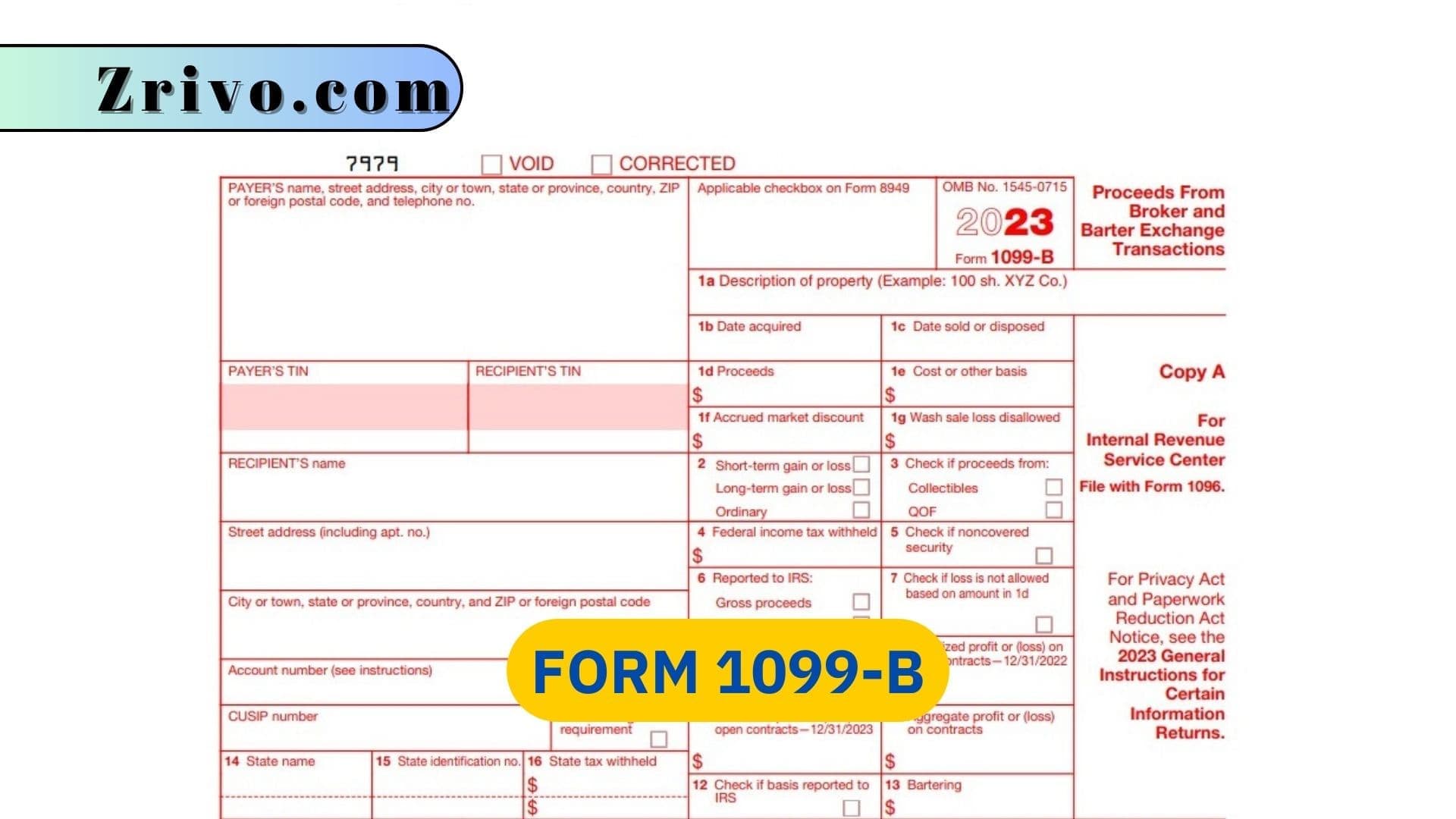

Brokers use Form 1099-B to report proceeds from stock transactions. It shows whether your gains were short-term or long-term and identifies the date of each transaction. It also shows the amount of your gain, including any capital losses you may have incurred. The IRS uses this information to calculate your tax liability.

Brokers must send you a 1099-B for every sale or exchange of stocks, bonds, commodities, and certain other property that they facilitate during the year. They must also file a copy with the IRS. In addition, some brokers and barter exchanges provide consolidated forms for all your sales on a single document. This is useful for those who sell precious metals, which do not typically generate a 1099-B.

How to File Form 1099-B?

When you receive your 1099-B, you must verify the accuracy of its information. You must check that the gross proceeds are correct and that your cost basis is accurate. You must contact your broker or barter exchange if the information is incorrect. Generally, you can expect to see your 1099-B by February 15, although some brokers may be late in filing them.

The purpose of Form 1099-B is to help taxpayers report their capital gains and losses. If you sell something for more than it cost to acquire, the difference is considered a capital gain and is taxable. Similarly, if you sell something for less than it cost to acquire, the loss is considered a capital loss and is deductible.

Taxpayers must compare their brokerage-provided cost basis with their records of purchases and sales to ensure that the amounts reported are accurate. This is especially important when a transaction involves multiple currencies and/or exchanges. If the cost basis information on your 1099-B is incorrect, you may be understating your taxes or overstating your gains.

Some brokerages also provide additional information in conjunction with the 1099-B reports they send to the IRS, such as realized gain/loss reporting or detailed wash sale adjustments. While this is a great convenience for active traders, it is important to remember that the burden of accurate reporting rests ultimately with the individual taxpayer.

Reporting Requirements for Brokers

The reporting requirements for brokers vary by tax year. Generally, brokers must report sales of covered securities with short-term or long-term gain or loss to the IRS on Form 1099-B. Brokers must also report sales of regulated futures, foreign currency, and Section 1256 option contracts to the IRS on Form 1099-B. However, brokers that trade precious metals do not have to report those sales on Form 1099-B if they are sold in an amount of less than $1000. For example, a broker that sells a single gold coin to a customer does not need to report the sale if the coin is of such form and quality as to be delivered to satisfy a CFTC-approved repurchase contract that currently calls for delivery of 25 coins or more.

If a broker opens a short sale in 2025 and does not close the short sale by the end of the year, the broker must still file Form 1099-B for that year. In box 4 of the form, report the gross proceeds from the short sale with the exception described above. The other numbered boxes must remain blank.

Brokers also must file Form 1099-B for persons who received cash, stock, or other property from a corporation that the broker knows or has reason to know had its stock acquired in an acquisition of control or had a substantial change in capital structure reportable on Form 8806. Lastly, brokers must report dispositions of interests in qualified opportunity funds (QOF) on Form 1099-B.