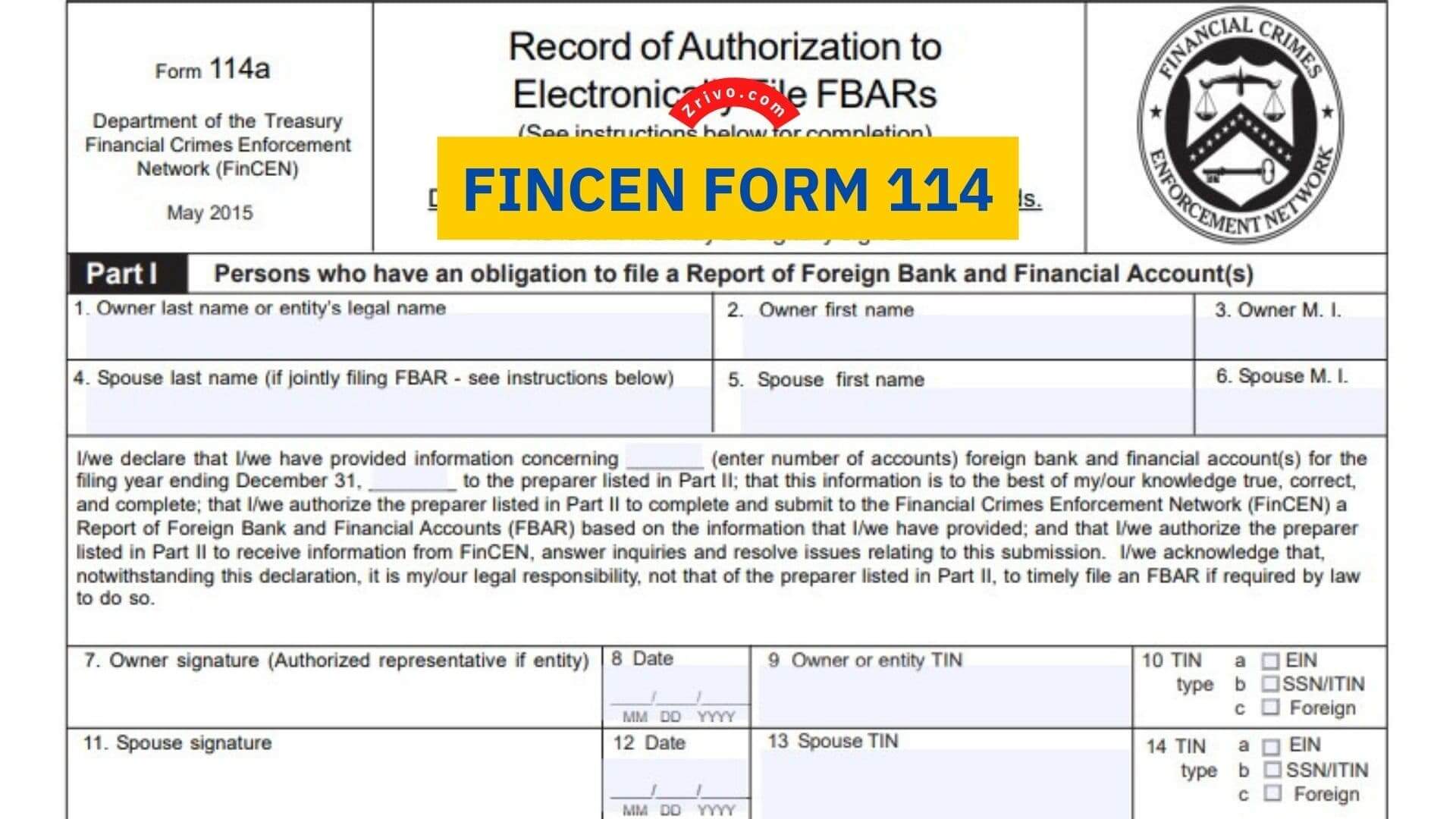

If you have a financial interest in or signature authority over one or more foreign financial accounts, you must report these accounts to FinCEN each year. The Bank Secrecy Act (BSA) requires citizens, green card holders, resident aliens, partnerships, corporations, estates, and trusts to report foreign financial accounts exceeding $10,000 in value at any time during the year. If the aggregate balance of your foreign financial accounts exceeds this threshold at any time during the year, you must file FinCEN Form 114, Report of Foreign Bank and Financial Accounts (FBAR). This form is separate from the federal tax return. It can be filed electronically through the government’s FBAR E-Filing website.

How to Fill Out FinCEN Form 114?

Whether you are required to file an FBAR depends on your income level, your personal circumstances, and your bank’s compliance with US FBAR requirements. For more detailed information about the FBAR filing requirements, visit the FinCEN website. The FBAR is due April 15 each year, but an automatic six-month extension is granted until October 15. This allows a taxpayer to extend the deadline if they are experiencing financial difficulties that are beyond their control.

You may choose to file your FBAR through the BSA E-Filing website electronically. However, if you do not have an internet connection or do not want to use your own computer to file, you can download the FBAR form and mail it to FRC @ fincen.gov instead. Once you have submitted your FBAR, it will be reviewed by FinCEN to determine if it is delinquent or not. If the FBAR is found to be delinquent, you will need to explain why you failed to file it on time in a section of the form that asks for a 750-character explanation.

If the FBAR is not filed on time because of a reasonable cause, you will not be assessed any penalty. If the FBAR is not filed on schedule because of willful neglect, a penalty can be applied. The IRS can also assess criminal penalties for willful violations of the FBAR requirement. This includes monetary fines, administrative penalties, and imprisonment.