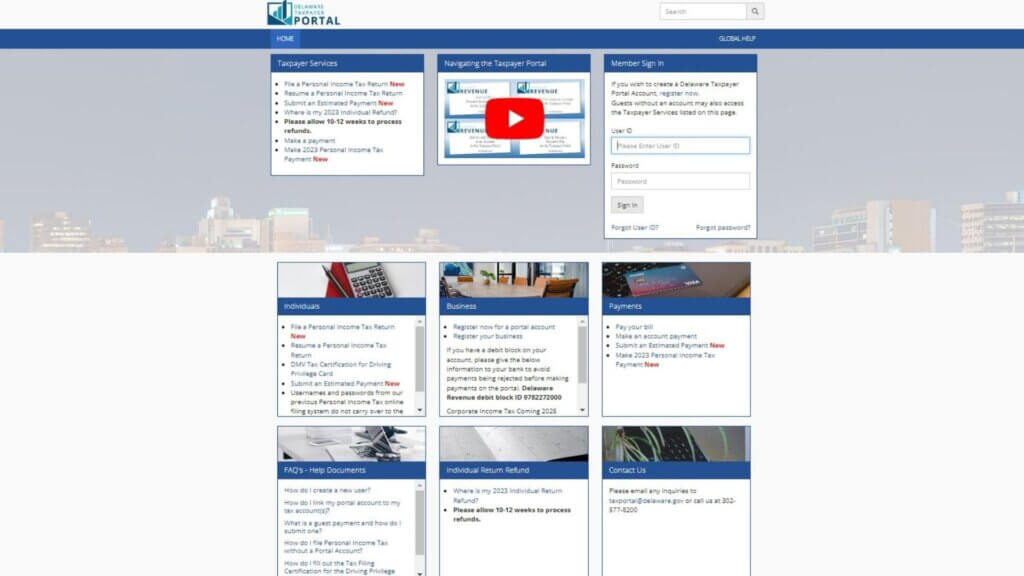

The Division of Revenue offers a variety of online services, including an online payment portal. In addition, the division also offers assistance for those who cannot afford to pay their tax debts. You can find information on these programs by visiting the Delaware Tax Portal website. The division is committed to protecting your privacy and keeping confidential any personal information you submit via the portal. It will not be disclosed to any third party unless required by law.

You can make a payment using either credit or ACH. You can also create an account to keep track of your payment history. To get started, click “Pay Taxes” and select the option to sign in or create an account. Once you’ve signed in, follow the instructions on the screen to complete your payment.

You can also use the website to pay your corporate or fiduciary taxes. However, you must file the appropriate tax return with the original due date to qualify for this service.

How to Use the Delaware Tax Payment Portal?

You must create an account to use the Delaware Tax Payment Portal. Enter an email address and a password to sign up. You’ll also need to provide a home address and a business office. Once you’ve created an account, you can log in and see your payment history.

The Delaware Division of Revenue (“DOR”) is committed to respecting Users’ privacy. Please read the DOR Privacy Policy for more information about browsing, security, E-mail use, and cookies. DOR may modify or discontinue this service and these Terms at any time. Users who do not agree to these Terms should not use this service.

You can pay your Delaware taxes online by logging into the Delaware State Tax Portal with your seven digit Business Entity File Number and Parcel number. The website also allows you to check your parcel’s valuation and tax amount. You can also find information about the Delaware property tax deduction. In addition to the online payment system, you can also download the state’s tax forms and filing instructions.

Make a Payment as a Guest in Delaware