Form D-400, NC State Income Tax Return is the state income tax return for NC residents and workers. The same as federal income taxes, you’ll file this tax form in 2024 for the income earned between January 1, 2025, and December 31, 2025.

While most other states tax their residents based on how much they earned, North Carolina has a flat tax rate of 5.25 percent. This rate is expected to remain the same in 2025 for the 2024 taxes. If the NC state income tax rate goes under changes, we’ll keep you updated. For the time being though, every taxpayer regardless of their taxable income is subject to a flat tax rate.

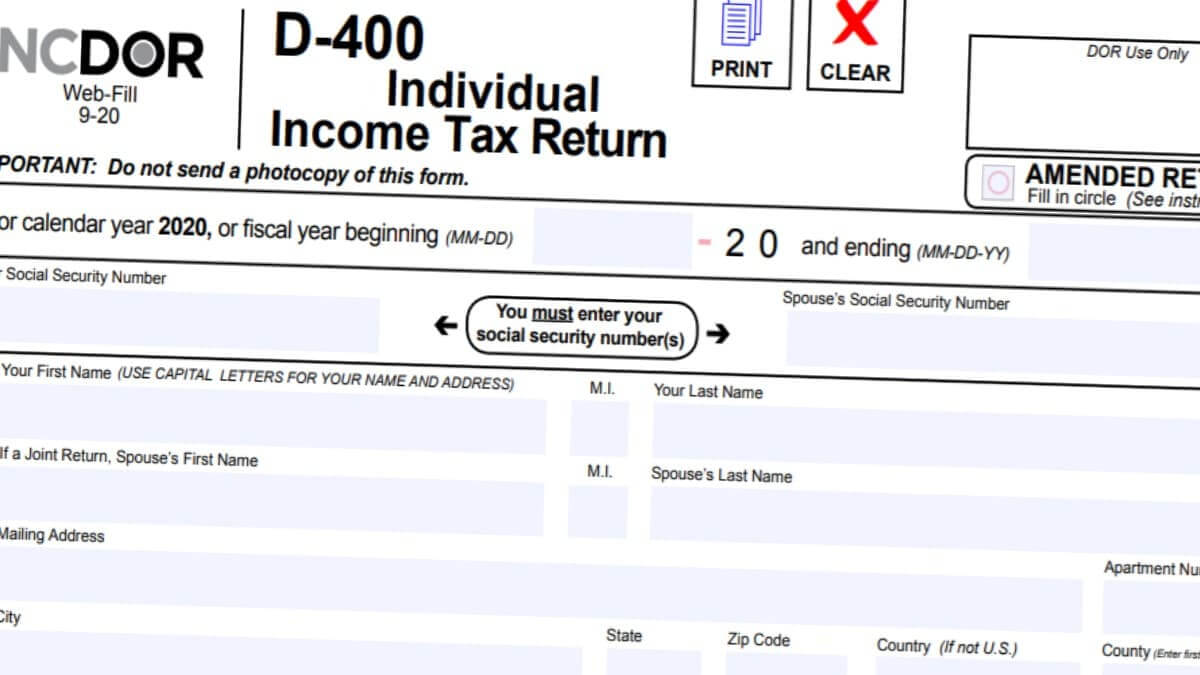

Printable D400 PDF

The above Form D400 is fillable online. You can enter text information, money amounts, and check boxes found on the form. Simply click where you want to enter information, and that’s it.

Fill out D400 online

The D400 Form coming out of the North Carolina Department of Revenue is fillable online where you can enter your information from your browser. Since the form is printable, you can then print out a paper copy to file with the Department of Revenue. However, you can only mail this form to the NCDOR. Filling out a PDF version of D400 doesn’t replace the electronic filing of this tax form or any other. You must file state tax forms through tax preparation services. Take note that you may be eligible for free e-filing. If your adjusted gross income is less than about $75,000, you’ll be able to file both federal and state income taxes without paying a dime. Although the requirements of tax preparation services differ, you’re more than likely to file taxes for free if your AGI doesn’t exceed the limit.