Cryptocurrency has captured the imagination of individuals and investors worldwide, offering new possibilities for decentralized transactions and financial innovation. However, as the popularity of cryptocurrencies like Bitcoin and Ethereum grows, so does the importance of understanding the complex realm of cryptocurrency taxation. This comprehensive guide will try to understand how cryptocurrency taxation works, covering various aspects such as taxable events, capital gains, reporting obligations, mining activities, foreign reporting requirements, and the importance of seeking professional guidance. By gaining a solid understanding of cryptocurrency taxation, individuals can ensure compliance with tax regulations and make informed decisions in this rapidly evolving landscape.

Cryptocurrency and Taxable Events

At the core of cryptocurrency taxation lies the concept of taxable events. These events trigger tax obligations and can take various forms, including selling or exchanging cryptocurrencies, using cryptocurrencies to purchase goods or services, receiving cryptocurrencies as income, and mining activities. Let’s explore each of these events and their tax implications.

Cryptocurrency Sales: One common taxable event is the sale or exchange of cryptocurrencies. You may realize a capital gain or loss when you sell or trade one cryptocurrency for another or convert cryptocurrencies into fiat currency. For example, if you bought Bitcoin for $5,000 and later sold it for $10,000, you would have a capital gain of $5,000.

Cryptocurrency Purchases: Using cryptocurrencies to buy goods, services, or other cryptocurrencies also triggers taxable events. When you make a purchase with cryptocurrencies, the fair market value of the cryptocurrency used at the time of the transaction is considered taxable income. For instance, if you used Bitcoin to purchase a laptop worth $1,000, you would need to report the fair market value of the Bitcoin used as income.

Cryptocurrency Mining: Cryptocurrency mining involves earning new tokens through computational processes. The IRS considers mined cryptocurrencies as taxable income, and their fair market value at the time of receipt must be reported. Mining expenses, such as electricity costs and equipment, may be deductible as business expenses.

Capital Gains and Mining Cryptocurrencies

Once taxable events occur, calculating capital gains or losses becomes crucial for tax reporting. Capital gains are determined by subtracting the cost basis from the proceeds of the taxable event. The cost basis refers to the original purchase price of the cryptocurrency and can be calculated using different methods such as FIFO or specific identification.

For example, suppose you purchased 1 Bitcoin for $10,000 and later sold it for $15,000. In this case, your capital gain would be $5,000. However, if you purchased another Bitcoin for $20,000 and sold it for $15,000, you would have a capital loss of $5,000. These gains or losses must be reported on your tax return.

Mining cryptocurrencies involves not only computational processes but also triggers taxable income. The fair market value of the mined cryptocurrencies at the time of receipt should be reported as income. Consider a scenario where you mine 10 Ethereum tokens, valued at $2,000 each at the time of mining. You would need to report $20,000 as income on your tax return.

Reporting Obligations and Forms

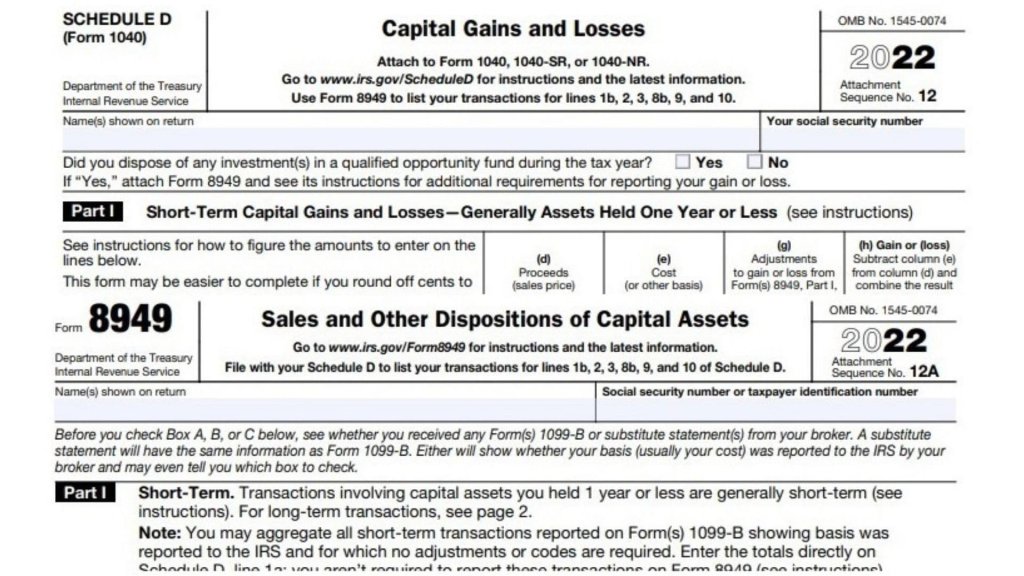

Accurate and detailed reporting is essential to fulfill tax obligations related to cryptocurrencies. Cryptocurrency transactions should be reported on IRS Form 8949 and Schedule D, providing comprehensive information for each transaction. Details to include are the date of acquisition, date of sale, proceeds, cost basis, and resulting gain or loss.

It’s important to note that the IRS has increased efforts to ensure cryptocurrency compliance. In recent years, the IRS has explicitly updated tax forms to include cryptocurrency-related questions, emphasizing the importance of accurately reporting these transactions.

How to Report Cryptocurrency Activities?

To report cryptocurrency profits to the IRS, you will typically use IRS Form 8949 and Schedule D when filing your tax return. Here’s a step-by-step guide on how to report cryptocurrency profits:

- Collect all the necessary information related to your cryptocurrency transactions, including dates of acquisition and sale, proceeds from sales, cost basis (original purchase price), and any relevant fees or expenses associated with the transactions.

- Calculate the capital gains or losses for each individual cryptocurrency transaction. This is done by subtracting the cost basis from the proceeds of the sale. You may need to calculate gains or losses for each transaction separately if you have multiple transactions.

- Transfer the information from your cryptocurrency transactions to IRS Form 8949. This form is used to report capital gains and losses from the sale or exchange of capital assets, including cryptocurrencies. You will need to provide details for each transaction, including the cryptocurrency’s name, date of acquisition, date of sale, proceeds, cost basis, and resulting gain or loss.

- After completing Form 8949, transfer the totals from the various sections of Form 8949 to Schedule D (1040). Schedule D is where you summarize your capital gains and losses for the tax year. Calculate the total gains and losses and enter them accordingly on Schedule D.

- Attach Schedule D to your tax return when filing. Make sure to include all other necessary forms and schedules required for your specific tax situation. The total capital gains or losses from Schedule D will ultimately flow into your main tax return.