When people make mistakes on their tax returns, they can file amended return status to correct the errors. This may result in a refund or a change in the amount they owe. However, they must remember that the IRS may take eight weeks or longer to process the amendment. Therefore, they should check the Where’s My Amended Return online daily to monitor its progress. Individuals often decide to file an amended return for various reasons, including changes in their filing status, incorrectly claimed credits or deductions, and additional income earned during the year. Depending on the reason, they can choose to use Form 1040-X or other forms to amend their original tax return.

Amended returns can be filed on paper or electronically and can include any new information or corrections that were overlooked on the original return. The IRS recommends tax software like TurboTax to prepare an amended return, which will help you find the right documents to include. However, some errors, such as mathematical mistakes, do not require an amended return. The IRS will usually rectify these errors when processing the original return.

Where is My Amended Return?

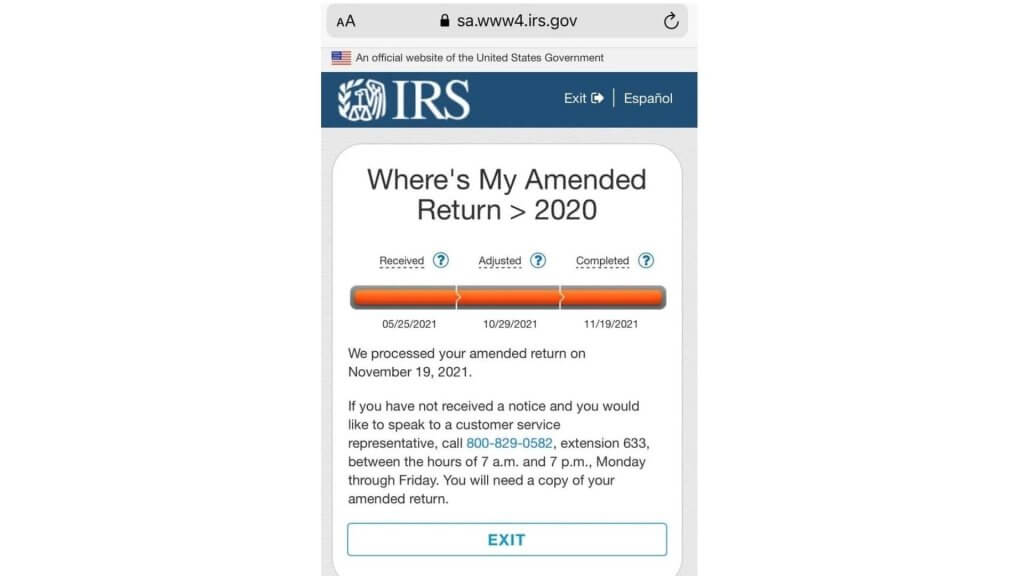

It is important to check the status of your amended return frequently. You can do this by visiting the IRS’s website and using its “Where’s My Amended Return?” tool. It’s easy to use, and you can get updates daily. It will provide you with information on the progress of your amended return, including whether it has been received, adjusted, or completed. Amended returns are used to correct mistakes made on your previous year’s tax return. Common errors include incorrect filing status, deductions, or credits. You can file an amended return by submitting Form 1040-X. This can be done online or by sending a paper version of the form to the IRS.

Generally, you should only file an amended return if necessary for your tax situation. Some errors, such as mathematical errors, do not require an amendment and can be corrected when the original return is being processed. However, other errors require an amended return, such as a filing status change or an income increase. If you are unsure whether or not your situation requires an amended return, consider speaking with a tax professional.

Amended Return Status not Showing up

Amended returns are usually processed slower than regular refunds because they require more manual work. It can also take longer if you filed a paper return or included direct deposit information on your amended tax return. You don’t need to file an amended return for small clerical errors or math mistakes you discover after filing. In this case, the IRS will correct the error on its own and issue your refund, if applicable. But, you can file an amended return if you discover that you missed out on a deduction or credit or if you have more income or taxes to report than you previously reported.

If you’ve filed an amended return, you can use the Where’s My Amended Return (WMAR) tool to check its status. The WMAR tool is updated every three weeks, in line with IRS processing cycles. However, it can take up to six months for the IRS to process an amended return that requires significant validation. This delay is due to backlogs and staffing issues. You can call the IRS or taxpayer advocate service to get more details about your amended return’s status.

Amended Return Status Says Take Action

If you see this message, your amended return is in the processing stage. This is a normal step that can take a few days to complete. It may also mean that the IRS needs more validation information from you to complete processing. In this case, they will send you a notice asking for the additional information. You can also call the IRS and speak to a taxpayer advocate, but they can’t do anything to expedite this process. They are currently working backlogs of COVID-19 credits, contributing to the delays in seeing your refund payment. This status will update on WMAR around 3 weeks after your mailed submission and can update more or less frequently depending on IRS actions. You can find more information about why your status says take action here.