The Alternative Minimum Tax (AMT) is a separate tax calculation method established by the U.S. government to prevent certain taxpayers from utilizing excessive deductions and credits to significantly reduce their tax liability. It operates alongside the regular income tax system, and taxpayers must calculate their liability under both systems, paying the higher of the two amounts. The AMT primarily affects individuals and corporations with relatively high incomes and substantial deductions. However, specific factors determine whether someone is subject to the Alternative Minimum Tax:

- Individuals with high levels of income, particularly those in the upper tax brackets, are more likely to be subject to the AMT.

- Taxpayers who claim significant deductions, such as large state and local tax deductions or numerous personal exemptions, increase their chances of triggering the AMT.

- Individuals who exercise incentive stock options or realize substantial capital gains may find themselves subject to the AMT.

- Business owners who receive income from pass-through entities, such as partnerships or S corporations, may also be subject to the AMT.

How Does the Alternative Minimum Tax Work?

The Alternative Minimum Tax functions by recalculating taxable income using different rules and rates. Here’s a brief overview of how the AMT works:

- Taxpayers start by calculating their regular income tax liability using the standard tax rules, taking into account applicable deductions and credits.

- Next, taxpayers determine their AMT liability by adding back certain deductions and making adjustments to their taxable income. The AMT rates are then applied to this adjusted amount.

- Taxpayers compare their regular tax liability and their AMT liability, paying the higher of the two amounts.

- If an individual pays the AMT in a particular year, they may be eligible to claim an AMT credit in future years when their regular tax liability exceeds the AMT liability.

How much AMT Do I Owe?

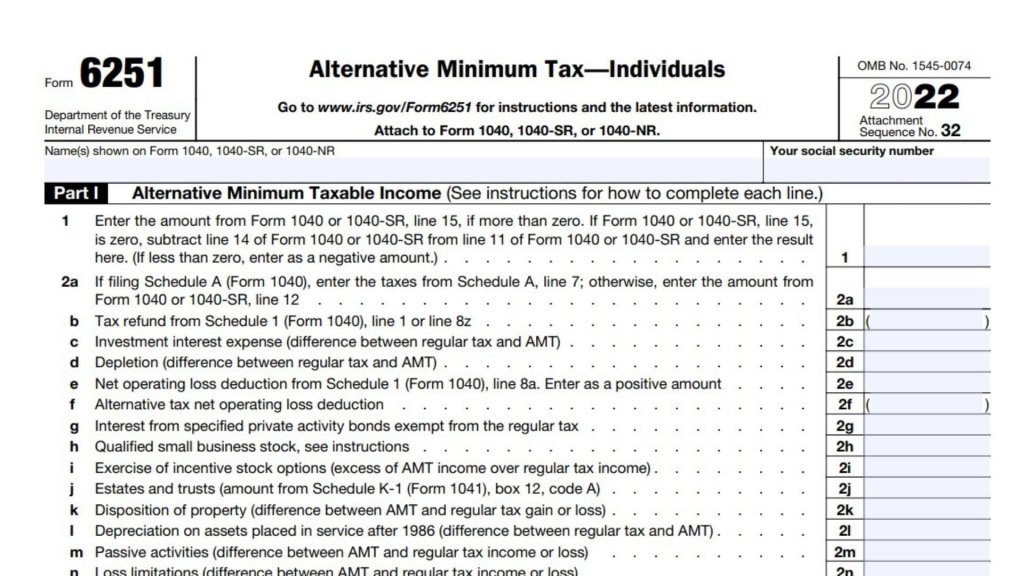

To figure the alternative minimum tax (AMT) amount, you need to use Form 6251, which is titled “Alternative Minimum Tax – Individuals.” This form is used to calculate your alternative minimum taxable income (AMTI) and determine the amount of AMT you owe.

Form 6251 guides you through the process of making various adjustments and additions to your regular taxable income to arrive at your AMTI. These adjustments include items such as tax preferences and adjustments, which are listed on the form. After determining your AMTI, you apply the appropriate alternative minimum tax rates to calculate the AMT amount.

When you complete Form 6251, you’ll compare the AMT amount to your regular income tax liability calculated on Form 1040 or 1040-SR. If the AMT amount is higher, you may be required to pay the difference as the alternative minimum tax.

The amount of Alternative Minimum Tax (AMT) an individual or corporation owes depends on various factors, including their taxable income, AMT exemption, and applicable AMT rates. The AMT operates under separate rules and rates compared to the regular income tax system. However, it’s important to note that specific figures and thresholds may change over time due to legislative updates and tax reforms. Here is a general overview of the AMT rates and exemptions:

For Individuals

AMT Exemption: The AMT exemption is an amount that individuals can deduct from their alternative minimum taxable income to determine their final AMT liability. The exemption is phased out for higher-income taxpayers.

- For Single or Head of Household filers: The AMT exemption for 2023 is $81,300, with a phaseout threshold of $578,150.

- For Married Filing Jointly or Qualifying Widow/Widower filers: The AMT exemption for 2023 is $126,500, with a phaseout threshold of $1,156,300.

AMT Rates: The AMT applies a different set of tax rates to alternative minimum taxable income after applying the exemption.

- For the first $199,900 of AMT income (for Single or Head of Household filers), the rate is 26%.

- For AMT income above $199,900, the rate is 28%.

For Corporations

AMT Exemption: Corporations also have an AMT exemption, which reduces their alternative minimum taxable income. The exemption amount varies based on the corporation’s filing status and is subject to phaseout for higher-income corporations.

- For tax years beginning in 2022, the AMT exemption for corporations is repealed. This means that corporations are subject to the regular corporate income tax rates without the AMT exemption.

AMT Rates: Prior to the repeal of the corporate AMT exemption, the AMT rate for corporations was a flat 20%.