It’s important to request a determination from the IRS if you aren’t sure whether a worker is an independent contractor or an employee. This ensures you aren’t misclassifying workers and risking financial penalties for your business. The worker can file Form SS-8 on their own, or your firm may decide to submit the form on behalf of the worker. In either case, both parties are asked to complete the form in as much detail as possible. Answers should include multiple ways to contact both the worker and your firm and information about the duration of the relationship. Providing this information for all years in which the worker performed services can help the IRS make a more accurate determination.

While this form can seem tedious, completing it can save your business time and money in the long run. It’s also a good idea to take the time to carefully review your worker classification policies before hiring new employees, as even minor misclassifications can lead to large back tax bills. As with all forms filed to the IRS, the SS-8 must be signed and dated by the individual submitting it. If you are filing on behalf of a corporation, partnership, trust, or LLC, the signature must be that of an officer with personal knowledge of the facts presented in the form.

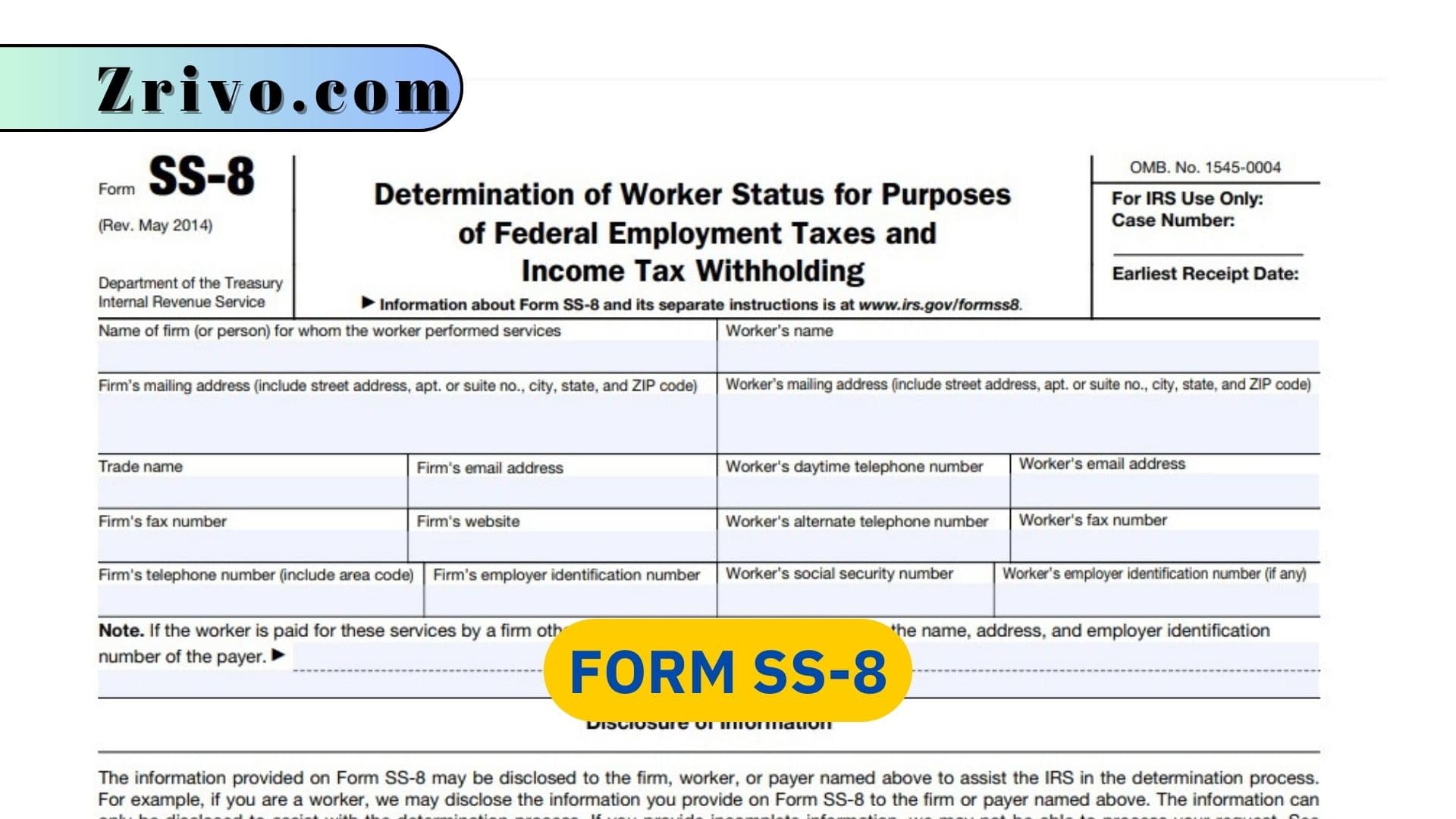

How to File Form SS-8?

Classifying workers as employees or contractors is a major concern for businesses. It can get you into trouble with the IRS if it isn’t done correctly. The IRS imposes significant penalties for misclassification. If you aren’t sure whether a worker is an employee or an independent contractor, you can request the IRS to make a determination for you by filing Form SS-8. You can file the form by yourself or with your worker. It must be filled out completely and accurately with multiple ways to contact both the firm and worker, as well as each party’s employer identification number and social security number. The form also requires information about all years the worker provided services and any significant changes in your relationship with them.

The IRS will examine the form to determine if the firm is withholding taxes properly. Depending on the outcome, you may need to provide additional documentation. You should consult with a tax attorney before submitting the form. If the IRS makes a determination that the firm incorrectly classified the worker, it will send the firm a letter with instructions to correct the situation. The firm must submit the correct information and a copy of the IRS Form SS-8. In addition, the firm must pay any back wages and tax liabilities owed by the worker.

How to Fill out Form SS-8?

- In Part I of the form, write the name of your business, the firm’s Employer Identification Number, and the worker’s social security number. You should also provide multiple ways to contact each party and include any contracts, invoices, or W-2 and 1099-MISC forms you have for the worker. You should also note any past litigation regarding the worker’s status. You must describe how the worker is paid, what services they provide, and how you handle finances concerning their work. If your business uses a trade name, you must list that as well.

- Then, move on to Part II, which consists of 10 to 13 questions about the nature of your worker’s relationship with your company. you must explain your reason for classifying the worker as a contractor instead of an employee. You must give specific examples of how you exercise control over the worker and why that control is insufficient to classify them as employees. You must also mention any other facts or circumstances that would lead you to believe the worker should be classified as an employee. The IRS will consider the totality of the situation when making a determination. If you’re unsure how to classify a worker, consult with an experienced tax lawyer.